Stocks to Watch: Check out the companies making headlines before the opening bell today.

Britannia Industries: The company has reported a 156 percent year-on-year growth in consolidated profit at Rs 932.4 crore for December FY23 quarter led by strong operating performance and exceptional income of Rs 359 crore. Revenue from operations at Rs 4,197 crore grew by 17.4 percent over a year-ago period. EBITDA jumped 51.5 percent to Rs 817.6 crore for the quarter YoY.

Results on February 2: HDFC, Tata Consumer Products, Titan Company, Aditya Birla Capital, Aegis Logistics, Apollo Tyres, Bajaj Electricals, Berger Paints India, Birlasoft, Cera Sanitaryware, Coromandel International, Crompton Greaves Consumer Electricals, Dabur India, Deepak Fertilisers, Godrej Properties, Karnataka Bank, Max India, SIS, Ujjivan Small Finance Bank, and Welspun Corp will be in focus ahead of quarterly earnings on February 2.

Ashok Leyland: The commercial vehicle maker has sold 17,200 units in the month of January 2023, growing 23 percent over a year-ago period with healthy growth across segments. Medium & heavy commercial vehicle sales increased by 28 percent to 11,050 units in the same period, and light commercial vehicle segment registered 17 percent YoY growth at 6,150 units for January.

Eicher Motors: Royal Enfield has sold 74,746 motorcycles in January 2023, rising 27 percent over 58,838 units sold in same month last year. But exports dropped by 23 percent to 7,044 motorcycles in the same period. The company has registered a 45 percent YoY growth by selling 6.91 lakh motorcycles in April 2022-January 2023 period.

Coal India: The country’s largest coal mining company has announced production of 71.9 million tonnes of coal for January 2023, growing 11.5 percent over a year-ago month, while offtake rose by 6.1 percent to 64.5 million tonnes in the same period. These are provisional numbers.

Syngene International: Promoter Biocon has offloaded 4 crore shares of the company via open market transactions on February 1. As a result, its shareholding in Syngene reduced by 9.96 percent to 54.6 percent, from 64.56 percent earlier. Government of Singapore bought 1.57 crore shares of Syngene at Rs 560 per share.

Craftsman Automation: The auto ancillary company has completed acquisition of 76 percent stake in DR Axion India. In December 2022, it had signed a definitive agreement for acquiring 8.57 crore shares of DR Axion India.

Alembic Pharmaceuticals: The pharma company has registered a 29 percent year-on-year decline in consolidated profit at Rs 122 crore for quarter ended December FY23, impacted by weak operating performance and lower other income. However, revenue from operations at Rs 1,509 crore increased by 19 percent YoY in the same period with growth across verticals as US business grew by 10 percent to Rs 432 crore and India segment reported a 12 percent growth at Rs 545 crore.

Lakshmi Machine Works: The textile machinery manufacturer has reported a massive 76 percent year-on-year growth in profit at Rs 113 crore for quarter ended December FY23, backed by healthy operating performance and topline. Revenue from operations at Rs 1,222 crore increased by 34 percent compared to year-ago period.

Gillette India: The FMCG company has recorded a 5.6% year-on-year growth in profit at Rs 74.45 crore for quarter ended December FY23, backed by strategic productivity interventions. Revenue for the quarter jumped 10% to Rs 618.62 crore compared to year-ago period, with support by strength of brands and product portfolio, superior innovation, and improved retail execution. At the operating level, EBITDA grew by 10.4% YoY to Rs 126 crore and margin increased by 12 bps to 20.37% impacted by higher input cost.

UTI AMC: The asset management company has registered a 53% year-on-year decline in consolidated profit at Rs 60 crore for December FY23 quarter, impacted by lower topline and net loss on fair value changes. Revenue from operations at Rs 295 crore for the quarter fell by 4.3% compared to year-ago period as net gain on fair value changes nil in Q3FY23 against Rs 20.5 crore in Q3FY22.

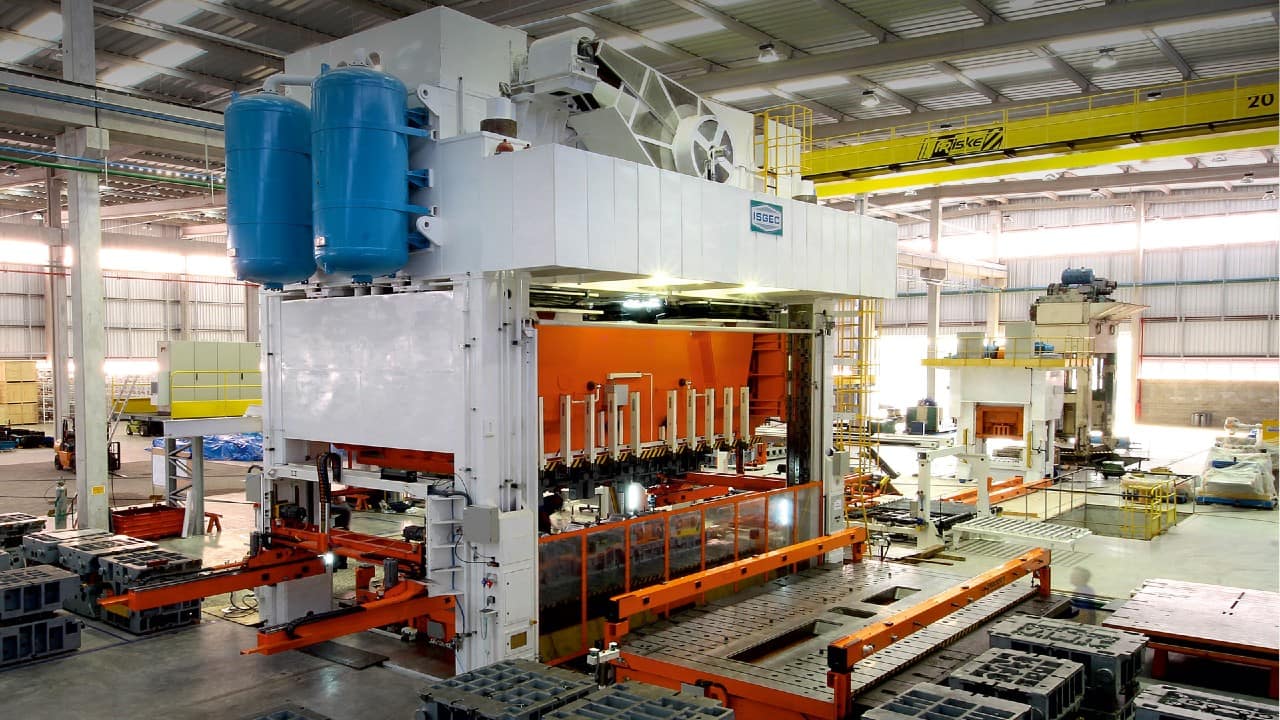

Isgec Heavy Engineering: The company has received an order for 500 KLPD ethanol plant on syrup, and 100 KLPD ethanol/extra neutral alcohol (ENA) plant on grain on turnkey basis from Panchganga Sugar and Power, Maharashtra.

RPG Life Sciences: The pharmaceutical products manufacturer has recorded a 31% year-on-year growth in profit at Rs 19.11 crore for quarter ended December FY23, with maintaining the upward trajectory in EBITDA margins, which improved from 20.85% to 22.36% YoY. Revenue from operations grew by 13% YoY to Rs 130.6 crore for the quarter.

Tata Chemicals: The Tata Group company has recorded a 27% year-on-year growth in profit at Rs 432 crore for December FY23 quarter led by healthy topline and operating performance. Revenue jumped 32% to Rs 4,148 crore for the quarter YoY.

Ajanta Pharma: The specialty pharmaceutical formulation company reported a 30% year-on-year decline in profit at Rs 135 crore impacted by weak operating performance. Revenue from operations grew by 16% YoY to Rs 972 crore, with India business growing 13%, Asia showing 17% rise, and US business growing 61%. However, EBITDA fell 29% to Rs 170 crore in the same period.