Taking Stock | Sensex rises 224 points, Nifty ends flat in a volatile session

The selloff in Adani group companies intensified as most of the stocks hit the lower circuit. ITC, Britannia Industries, IndusInd Bank, HUL and Infosys were among the biggest gainers on the Nifty… Read More

Manish Shah, Independent Technical Analyst

Nifty is in a steady decline since the high of Dec 01 2022. It is 42 days since the decline and Nifty has lost about 7.5 percent from the highs. If we draw a channel, Nifty is now at lower end of the channel and there we see a “tweezers bottom” at the low of the channel. Nifty is taking a breather at the support zone.

The top end of the channel is at 18,015-18,050 and there is a chance that Nifty may see a bounce to the channel in coming days. Nifty needs to move above 17,680-17,700 for the rally to trigger a move towards 18,015-18,050.

Support in Nifty is at 17,450 a break below 17,450 will trigger a drop to 17,000-17050. Traders should brace for extreme volatility in coming days.

Kunal Shah, Senior Technical Analyst at LKP Securities

The Bank Nifty index witnessed extreme volatility throughout the day, but the index managed to hold the support level of 40,000 on the downside.

The index immediate hurdle on the upside stands at 41,000, and if breached decisively, we will witness a short covering towards 41,500. The index remains in “buy on dip” mode as long as the mentioned support levels are held.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

The rout in Adani group stocks continued to play havoc as benchmark indices gyrated sharply intra-day before recouping lost ground on buying in IT and banking stocks. However, power, energy, oil & gas, and utility stocks were plundered as investors continued to exit in view of dampening sentiment. More than external factors, investors’ sentiments have been hurt by the domestic mood.

Technically, the Nifty hovered between 17,450 to 17,650 range and also formed an inside body candle on daily charts which indicates the continuation of a range bound activity in the near future.

However, a pullback rally is possible if the index trades above 17,500. Above the same, it could move up to 17,700-17,750. On the flip side, a fresh selloff is possible only after the dismissal of 17,500 and below the same the index could retest the level of 17,380-17,350.

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty witnessed swings in both the directions on February 02 & ultimately posted a minor negative close. Despite multiple attempts, the index couldn’t sustain in the positive territory.

The hourly chart shows that the 20 HMA acted as a cap on the higher side, whereas the hourly lower Bollinger Band offered support to the index.

Thus, 17,650 – 17,450 is the tight range within the overall short term range of 17,350-18,000. The bulls can get some relief if the index crosses 17,650-17,700 area on the higher side.

Mohit Ralhan – Chief Executive Officer, TIW Capital

It’s a forward-thinking budget with a focus on creating a blueprint to make India the third-largest economy. This budget has kept all constituents of the economy in mind, be it infrastructure building, creating manufacturing jobs, marching towards green energy, middle-class taxpayers, rural welfare and poor citizens.

Bridging the infrastructure deficit is the top priority for this decade and the increase in capital expenditure by 33% along with the highest-ever allocation to railways is a big step in this direction.

The announcement of several favourable indirect tax proposals, such as a reduction in the highest surcharge rate to 25% from 37%, a reduction in customs duties, etc. should boost domestic manufacturing creating much-needed employment opportunities.

The government continues to emphasize on the transition to green and India’s commitment to reach a zero net carbon emission status. The 66% increase in allocation to PM Awas Yojna and the increase in tax exemption limit to Rs 7 lakhs should result in an increase in consumption spending.

The government has skilfully walked the tightrope between job creation and controlling the fiscal deficit, with the target of getting it below 6% of GDP. Overall, I believe this budget has hit all the right notes and provided the right impetus to propel India as a leading economic powerhouse.

Vinod Nair, Head of Research at Geojit Financial Services

Despite a growth oriented budget, drop in crude prices and upside in the global market, the domestic market is not able to gain because of the Adani saga having a ripple impact on the investors.

In addition, the premium valuation of India continues to weigh down the performance compared to other emerging markets which are expecting upside in the economy. The global markets are positive in assumption of being in the last phase of the rate hikes.

Rupee Close:

Indian rupee closed 25 paise lower at 82.18 per dollar against previous close of 81.93.

Market Close: Benchmark indices ended higher in the volatile session on February 2.

At Close, the Sensex was up 224.16 points or 0.38% at 59,932.24, and the Nifty was down 5.90 points or 0.03% at 17,610.40. About 1637 shares have advanced, 1759 shares declined, and 122 shares are unchanged.

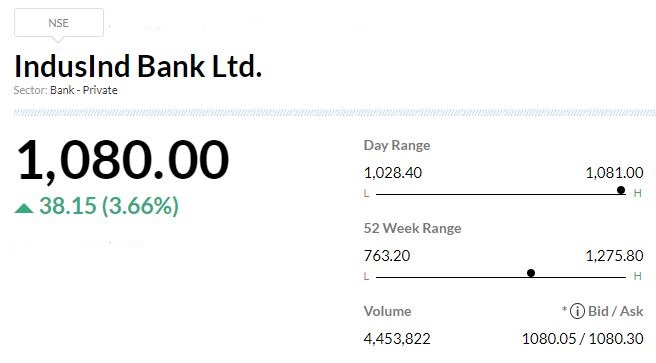

ITC, Britannia Industries, IndusInd Bank, HUL and Infosys were among the biggest gainers on the Nifty, while losers included Adani Enterprises, Adani Ports, UPL, HDFC Life and Divis Labs.

Among sectors, FMCG and Information Technology indices gained 1-2 percent, while power, oil & gas, metal indices fell 1-4 percent.

The BSE midcap and the smallcap indices ended marginally higher.

Euro hits 10 month-high

The euro sat at a 10-month high against the dollar on Thursday, ahead of a European Central Bank meeting at which markets expect a half-percentage point rate increase, a day after the U.S. Federal Reserve slowed the pace of its rises to 25 basis points.

Morgan Stanley On IndusInd Bank-Overweight rating, target at Rs 1,525 per share

-Bank has clarified its exposure to a conglomerate group is 1.5 percent of loans

-Would closely track debt related development in group, do not see risk to investment thesis

-Valuation looks attractive

-Key catalyst is RBI’s approval for reappointment of MD & CEO

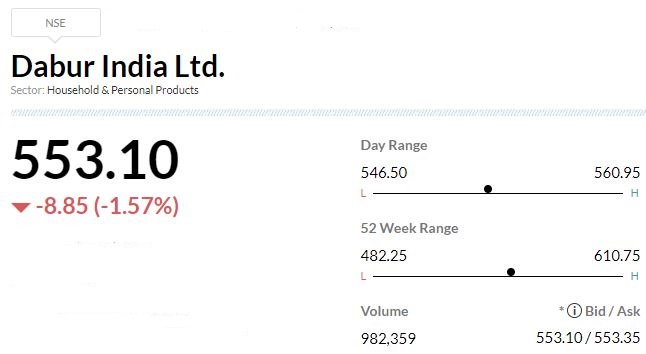

Dabur India Q3 Earnings:The company’s Q3 net profit was down 5.5% at Rs 476.7 crore against Rs 504.4 crore and revenue was up 3.5% at Rs 3,043.7 crore versus Rs 2,941.8 crore, YoY.