Vinod Nair, Head of Research at Geojit Financial Services

The response by Adani had a mixed effect on the stock group and market. The saga is likely to continue as a hanging risk in the minds of the investors in the medium-term. To expect a scientific assessment report either by a strong independent third party or government is dim in the short-term. Now the focus of the market will be on budget and fed policy.

Rupee Close:

Indian rupee closed flat at 81.50 per dollar against previous close of 81.52.

Market Close: Benchmark indices ended on positive note in the highly volatile session on January 30.

At Close, the Sensex was up 169.51 points or 0.29% at 59,500.41, and the Nifty was up 44.70 points or 0.25% at 17,649. About 1531 shares have advanced, 1965 shares declined, and 162 shares are unchanged.

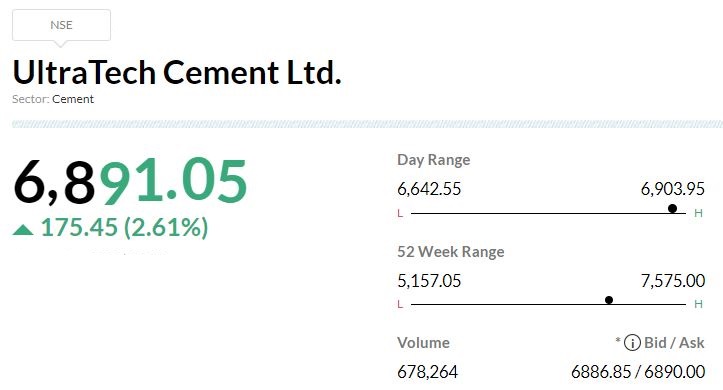

Adani Enterprises, Bajaj Finance, UltraTech Cement, Bajaj Finserv and HCL Technologies were among the biggest gainers on the Nifty, while losers included Power Grid Corporation, JSW Steel, Bajaj Auto, Larsen and Toubro and IndusInd Bank.

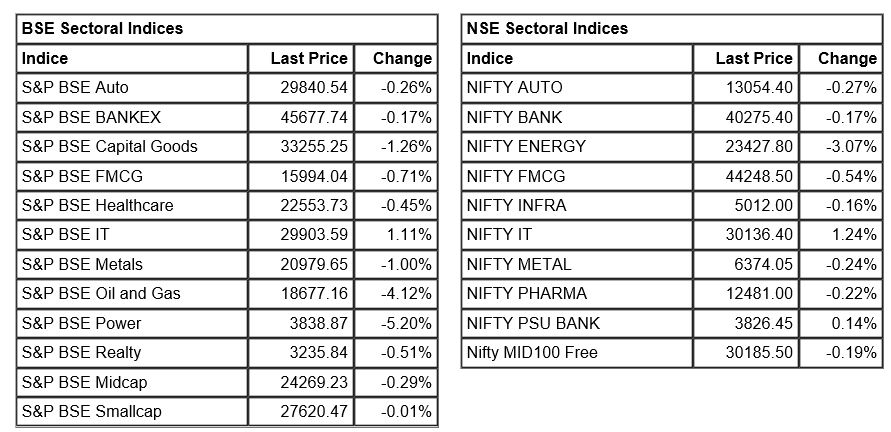

On the sectoral front, capital goods, metal, power and oil & gas down 1-5 percent, while information technology index up 1 percent.

The BSE midcap and the smallcap indices ended marginally lower.

Gold slips as investors await central bank meetings

Gold prices edged lower on Monday as investor attention moved to several central bank meetings this week for more clarity on their rate hike strategies, with key focus on the U.S. Federal Reserve.

Spot gold was 0.2% lower at $1,923.35 per ounce, as of 0924 GMT. U.S. gold futures fell 0.3% to $1,922.90.

Dollar seesaws ahead of busy central bank week, euro higher after Spain CPI

The dollar languished near an eight-month low on Monday ahead of a slew of central bank meetings this week, while higher Spanish inflation data supported the euro ahead of euro area readings on Wednesday.

The U.S. dollar index, which measures the currency against a basket of its peers including the euro, was flat at 101.88, having hit an eight-month low of 101.50 last week.

Mazagon Dock Shipbuilders Q3 Results:Mazagon Dock Shipbuilders has posted 68.7 percent jump in its Q3 net profit at Rs 337.3 crore against Rs 199.9 crore, YoY.

CLSA On UltraTech Cement -Outperform rating, target at Rs 7,800 per share

-Even on a muted pricing increase outlook, assume company’s FY24 EBITDA/t to rise

-Attractive risk-reward despite assuming much lower profitability growth & valuation multiple

Oil falls as rate hikes loom, Russian flows stay strong

Oil fell on Monday, giving up earlier gains, as looming interest rate hikes by major central banks and signs of strong Russian exports offset rising Middle East tension over a drone attack in Iran and hopes of higher Chinese demand.

Investors expect the Federal Reserve to raise rates by 25 basis points on Wednesday, followed the day after by half-point hikes from the Bank of England and European Central Bank, and any deviation from that script would be a shock.

Brent crude fell 29 cents, or 0.3%, to $86.37 a barrel by 0910 GMT while U.S. West Texas Intermediate crude dropped 52 cents, or 0.7%, to $79.16.

SRF Q3 Earnings:

SRF has posted a net profit of Rs 511 crore in the quarter ended December 2022 versus Rs 505.5 crore in a year ago period.

SRF was quoting at Rs 2,152.45, up Rs 22.05, or 1.04 percent.

Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian Rupee depreciated by 0.07% on weak domestic markets and huge FII outflows. However, weak Dollar index and decline in crude oil prices cushioned the downside. FPO related foreign inflows also supported Rupee at lower levels.

We expect Rupee to trade with a slight negative bias amid a weak tone in the domestic markets and expectations that US Dollar may rise on safe haven appeal.

Month-end Dollar demand from importers and selling pressure from FIIs may also put downside pressure on Rupee. Traders may remain cautious ahead of India’s union budget and US FOMC meeting later this week. USDINR spot price is expected to trade in a range of Rs 81 to Rs 82.20.

Welspun India Q3 resultsWelspun India has recorded 68 percent declined in net profit for the quarter ended December 2022 at Rs 42.4 crore versus Rs 132.4 crore and revenue was down 22.7% at Rs 1,869 crore versus Rs 2,418.2 crore, YoY.

Market at 3 PmBenchmark indices erased all the intraday losses and trading higher with Nifty above 17600.The Sensex was up 137.21 points or 0.23% at 59468.11, and the Nifty was up 30.60 points or 0.17% at 17634.90. About 1318 shares have advanced, 2036 shares declined, and 143 shares are unchanged.