Market ended higher in yet another week of volatility mirroring global market trends amid reopening of China and hawkish Fed comments with likely rate hikes. Mixed earnings from India Inc also added to the volatility.

The BSE Sensex added 360.59 points or 0.59 percent to close at 60,621.77 and Nifty50 added 71.1 points or 0.39 percent to end at 18,027.7 levels this week.

For the month, Sensex and Nifty lost 0.36 percent and 0.43 percent, respectively.

“The Nifty continued to consolidate just above the 20 WMA for yet another week. On the weekly chart, it has formed a Doji pattern for the second consecutive week. This shows indecision in the minds of the market participants,” said Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas.

“The daily chart reveals that the index has moved out of a base triangle formation. Post the breakout, however, the Nifty is witnessing a brief consolidation before it embarks on a larger up move,” he said.

Ratnaparkhi sees immediate support at 18,000 where fresh buying interest can be seen. The short term bullish stance holds true as long as the Nifty trades above the swing low of 17760. On the higher side, the Nifty is expected to surpass the key hurdle zone of 18,260-18,300 and head towards 18,500, according to him.

Among sectors, BSE capital goods and power indices added 2 percent each and oil and gas and information technology indices gained nearly 2 percent each. On the other hand, BSE telecom and auto indices lost 1-2 percent.

During this week, the BSE Mid-Cap and Small-cap indices fell 0.66 percent and 0.8 percent, while the Large-cap index added 0.29 percent.

“Subdued Q3 results, soft budget expectations, a slowing economy, FII selling, and concerns over global interest rate hikes defined the market in the past week. While economic optimism stemming from China’s reopening aided gains, weak US consumer data and hawkish comments from the Fed’s policy makers wounded investor risk appetite,” said Vinod Nair, Head of Research at Geojit Financial services.

“Although we started the third quarter on a shaky note, the latest set of financial announcements from IT and banking blue chips are encouraging. Given the mixed undercurrents, the second line of Q3 and global market cues will determine the trend going forward,” he said.

Also Read – RIL Q3: Net profit comes in at Rs 17,806 crore, revenue rises 15% YoY

Foreign Institutional Investors (FIIs) continued with their selling spree this week too as they offloaded equities worth Rs 2,461.03 crore, while domestic institutional investors (DIIs) picked up equities worth Rs 3,383.72 crore.

Foreign institutions sold equities worth Rs 19,880.11 crore and DIIs bought equities worth Rs 16,182.38 crore in this month so far.

“Markets ended an uninspiring week on a lower note as the upside momentum has been losing traction. The benchmark Nifty traded with a negative bias taking over the negative baton from weak overnight Wall Street cues,” said Prashanth Tapse – Research Analyst, Senior VP (Research), Mehta Equities.

“Technically, the bias will shift to bullish only above the 18,265 mark. Until then, the downside risk will be at Nifty’s make-or-break support at 17,853 mark,” he added.

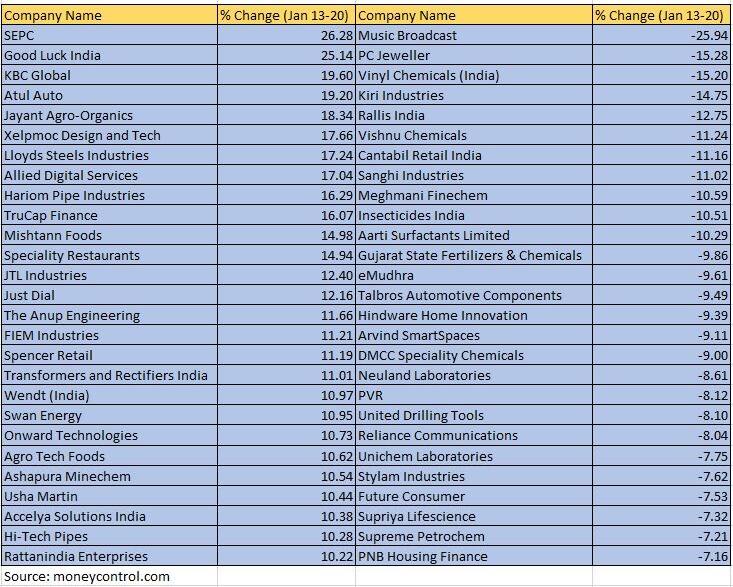

The BSE Small-cap index shed 0.8 percent. Music Broadcast, PC Jeweller, Vinyl Chemicals (India), Kiri Industries, Rallis India, Vishnu Chemicals, Cantabil Retail India, Sanghi Industries, Meghmani Finechem, Insecticides India and Aarti Surfactants fell 10-26 percent.

However, SEPC, Good Luck India, KBC Global, Atul Auto, Jayant Agro-Organics, Xelpmoc Design and Tech, Lloyds Steels Industries, Allied Digital Services, Hariom Pipe Industries, TruCap Finance, Mishtann Foods and Speciality Restaurants added 15-26 percent.

Also Read – Fed set to slow down on rate hikes again and debate how much further to go

Where is Nifty50 headed?

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services

The market is likely to remain in a consolidative range with stock specific action on Q3FY23 results and the upcoming Budget.

Metals, IT and capital goods are likely to remain in momentum. The banking sector would be in focus next week after results of ICICI Bank, Kotak Bank and IDFC First Bank over the weekend.

Amol Athawale, Deputy Vice President – Technical Analyst, Kotak Securities

Technically, on weekly charts, the Nifty has formed a long-legged Doji Candlestick which is indicating non directional activity. For the index, 18,000 or 20-day SMA would act as a sacrosanct support zone in the near future. And above the same, the index could retest the level of 18,150-18,200.

On the flip side, below 18,000 a bearish sentiment is likely to accelerate and below the same the index could slip to 17,850.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.