The benchmark indices rose more than 1 percent in the week ended August 5 and also continued the winning streak for third straight week. Except Monday, the market remained highly volatile. While the market went bullish on monthly auto sales numbers, earnings from India Inc, and return of foreign investors into equities, geopolitical tension and anticipation over RBI monetary policy review countered the spikes.

For the week, the BSE Sensex added 817.68 points (1.42 percent) to end at 58,387.93, while the Nifty50 rose 239.25 points (1.39 percent) to close at 17,397.5 levels.

Among sectors, BSE Information Technology rose 3 percent, BSE Power index added 2.87 percent and BSE Auto index added 2.22 percent. However, BSE Realty index shed 3 percent.

In the last week, the Midcap index rose 1.7 percent, Smallcap index added 2 percent and Largecap index rose 1.4 percent

“Our market started the session with a decent bump up on Monday, carrying last week’s strong optimism. Globally, things continued on a brighter side and that was providing the much-needed impetus to the rally across the globe. As the week progressed, we extended our gains towards yet another psychological junction of 17,500. However, if we dive deep into it, we can realise, this week’s up move (barring Monday) was not as smooth as the previous one,” said Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel One.

“We did observe some profit booking at higher levels and in fact, on Thursday, the profit booking was severe at one point. But fortunately, all these intraday declines were successfully getting bought into. Eventually, the benchmark index ended the session at 17400 by adding more than a percent to the previous week’s close.”

After a long time, the foreign institutional investors (FIIs) remained net buyers for the full week as they bought Rs 6,991.54 crore of equities, while domestic institutional investors (DIIs) turned net sellers as they sold equities worth of Rs 1,765.59 crore.

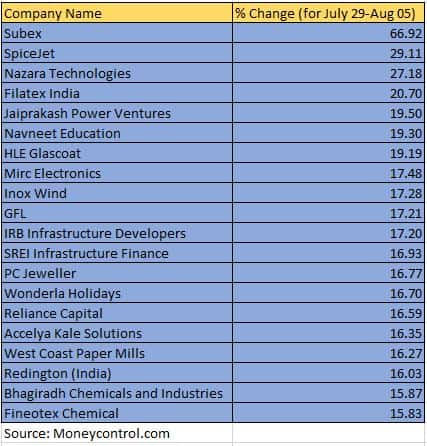

More than 60 small-cap stocks rose 10-66 percent in the last week, including Subex, SpiceJet, Nazara Technologies, Filatex India, Jaiprakash Power Ventures, Navneet Education, HLE Glascoat, Mirc Electronics and Inox Wind.

On the other hand, losers included Birla Tyres, Future Enterprises, Brightcom Group, Future Retail, KBC Global, Neuland Laboratories, Gulshan Polyols and Balrampur Chini Mills.

“After reclaiming the 17,000 mark, the Nifty traded with a positive bias in the week gone by and crept higher to end the week around 17,400 with gains of over a percent. However, a lot of uncertainty was seen in the last couple of trading sessions as the Nifty resisted around 17500 and saw stock specific profit booking,” said Ruchit Jain, Lead Research, 5paisa.com.

Among mid-caps, Kansai Nerolac Paints, JSW Energy, IDFC First Bank, IDBI Bank, Cholamandalam Investment and Finance Company and Natco Pharma rose 10-24 percent. However, losers included Godrej Properties, Balkrishna Industries, Crompton Greaves Consumer Electrical, Max Financial Services, Cummins India and Bharat Heavy Electricals.

The BSE 500 index added 1.6 percent supported by the SpiceJet, Kansai Nerolac Paints, PB Fintech, JSW Energy, HLE Glascoat, IRB Infrastructure Developers and Zomato.

Where is Nifty50 headed?

Apurva Sheth, Head of Market Perspectives, Samco Securities.

On a macroeconomic front, the upcoming week is expected to be jam-packed for investors. The global markets are likely to dance to the tune of the Inflation figures to be released by the United States and China. Back home, market players will turn to the Indian CPI print for hints about the economy’s trajectory.

After a remarkable comeback from the bottom of the 15,200 mark in June, it appears like the bulls are running out of steam. On the hourly charts, the Nifty is forming a bearish divergence with the RSI, indicating that the upward momentum is slowing.

Throughout the week, the index encountered resistance around 17,500. This level is also expected to act as a resistance in the next week too. On the downside, 17,000 is anticipated to provide significant support for the index.

Amol Athawale, Deputy Vice President – Technical Research, Kotak Securities:

With the overhang of monetary policy now behind us, the geo-political tension between China & Taiwan will be in focus, as any flare up in the region may lead to panic situations across the globe. Technically, on weekly charts, the index has formed a bullish candle. Further, daily and intraday charts are indicating the continuation of a non-directional activity in the near future.

The short texture of the market is still on the bullish side but a fresh uptrend rally is possible only after the 17,500 breakout level. Above the same, the index could rally up to 17,600-17,750. On the flip side, below 17,500, the index would retest the level of 17,250-17,200 and if the downside continues, it may correct up to 17,050-17,000.

Ajit Mishra, VP – Research, Religare Broking Ltd

With no major event lined up ahead, the focus would be on earnings and global cues for direction. On the index front, we’re currently seeing time-wise correction as it’s somehow holding around the upper band of the consolidation range.

A decisive break above 17,400 would help resume the trend ahead else consolidation may continue. Since we’re seeing rotational buying across sectors, focus more on stock selection and overnight risk management.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.