Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Market Close: Benchmark indices ended higher for the second consecutive day on June 25 supported by metal and financials.

The Sensex was up 226.04 points or 0.43% at 52925.04, and the Nifty was up 69.90 points or 0.44% at 15860.40. About 1737 shares have advanced, 1393 shares declined, and 142 shares are unchanged.

Tata Steel, Axis Bank, SBI, ICICI Bank and Hindalco Industries were among major gainers on the Nifty, while top losers included Reliance Industries, Titan Company, NTPC, HUL and Asian Paints.

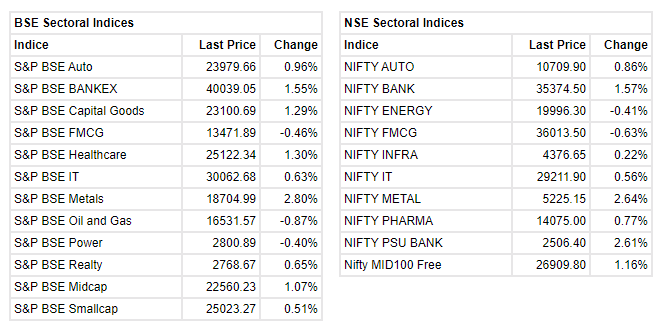

On the sectoral front, Nifty Bank, metal and PSU Bank indices added 1-2.5 percent, while BSE midcap index added 1 percent.

Hemant Kanawala, Head – Equity, Kotak Mahindra Life Insurance:

Last 2 months have been very challenging for India due to wave 2 of covid infection and lockdowns announced by state governments to control the spread of infection. On the positive note, Covid infection in India in terms of new cases, active cases and mortality has come down sharply over last 1 month. There has been dramatic improvement in the vaccination rate lately and till date, India has administered 30 crore doses of covid vaccination.

As the pace of vaccination improves over the next quarter, there is an increased probability of complete opening up of the economy into the festive season. Another positive news for the economy is the prediction of normal monsoon by Indian Met department, which should greatly help rural India where the impact of wave 2 of covid infection has been more than wave 1. Increase in vaccination rate and normal monsoon should support strong economic growth in 2nd half of FY22.

Nifty 50 is trading at more than 20 times 1 year forward earnings, which is close to historic high and supported by low interest rates in India and globally. Last week, US Fed has started discussing path for reducing liquidity support, which it has been providing for last 1 year to stimulate growth. As and when they announce their roadmap, it can bring volatility in risk assets including emerging markets and India.

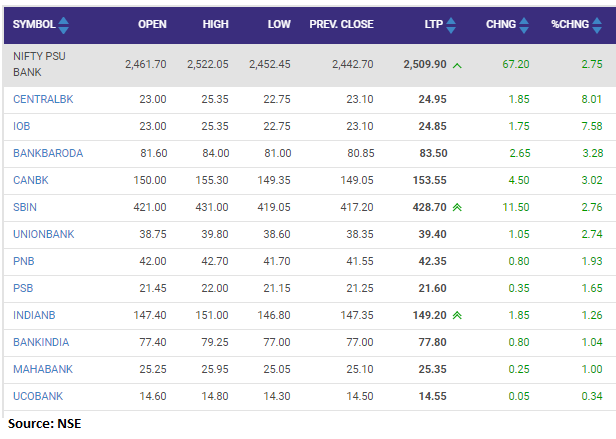

Nifty PSU Bank index added nearly 3 percent led by the Central Bank of India, IOB, Bank of Baroda

Abhishek Bansal, Founder Chairman, Abans Group

Silver is currently trading near $26.285, sharply high from Monday’s low of $25.580. Weakness in the US dollar index is likely to support precious metals prices. The dollar index is currently trading near 91.74 which is sharply lower from a high of 92.395 registered on June 18.

However, weaker than expected US economic data is likely to keep a cap on Silver prices.

Silver prices are likely to find immediate support near $25.67 and $25.10 while immediate resistance is seen around 20 days EMA at $26.87 and 50 days EMA at $27.017

Parag Milk Foods Q4:

The company has posted net loss at Rs 9.6 crore in Q4FY21 versus Rs 10.1 crore in a year ago period. Revenue was down 18.8% at Rs 434.3 crore versus Rs 535.2 crore.

Parag Milk Foods was quoting at Rs 135.75, down Rs 1.80, or 1.31 percent on the BSE.

Market at 3 PMBenchmark indices extended the gains in the final hour of the trading with Nifty around 15850.The Sensex was up 254.41 points or 0.48% at 52953.41, and the Nifty was up 76.00 points or 0.48% at 15866.50. About 1644 shares have advanced, 1284 shares declined, and 108 shares are unchangedTata Steel, Axis Bank, SBI, ICICI Bank and Hindalco Industries were among major gainers on the Nifty, while top losers included Reliance Industries, Titan Company, NTPC, HUL and Asian Paints.

Rupee Updates:

Indian rupee is trading marginally lower at 74.21 per dollar, amid buying seen in the domestic equity market.

It opened flat at 74.14 per dollar against Thursday’s close of 74.16.

D-Street Buzz: Nifty Metal Outperforms As Tata Steel, SAIL, Vedanta Jump 4% Each

The metal index jumped close to 3 percent led by Tata Steel and SAIL which jumped over 4 percent each followed by NALCO, JSW Steel, Vedanta, Hindustan Copper and Hindalco Industries among others.

Yash Gupta Equity Research Associate, Angel Broking

India Pesticides Limited’s IPO is getting good response from investors. Company has already received good response from anchor investors, raising Rs 240 crores from anchor investors.

If we look at the listing gain opportunity in this IPO, we expect a gains of around 10%-20% as the company is fundamentally strong and available at better valuation than its peers. We have assigned a “Subscribe” rating to India Pesticides Limited’s IPO.

KCP Q4: Net profit came in at Rs 89.6 crore against Rs 34.7 crore (YoY). Revenue jumped 51.3 percent at Rs 531.5 crore against Rs 351.3 crore (YoY). EBITDA rose 98.3 percent at Rs 137.4 crore against Rs 69.3 crore (YoY). EBITDA margin at 25.9 percent against 19.7 percent (YoY).

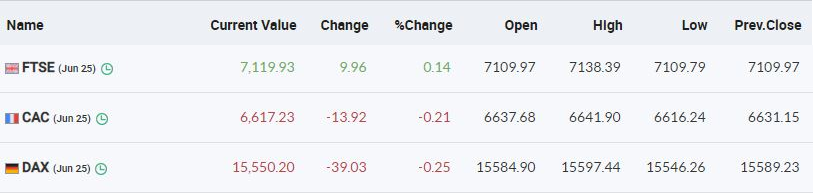

European markets are trading flat with FTSE up marginally in the green