Moneycontrol launches Analysts’ Call Tracker. A monthly special page that tells you which way analysts are leaning; the stock they are most bullish or bearish on, what they are upgrading or downgrades, and where they are betting against the market. Ignore this at your own risk!

Ajit Mishra, VP – Research, Religare Broking

Markets managed to gain half a percent amid volatility on a weekly expiry day. The benchmark remained range bound for most of the day and finally settled around the day’s high. Meanwhile, healthy buying in banks, metals, & FMCG pack and buoyancy on the broader front kept the participants busy. Consequently, the Nifty closed at 16,580 levels; up by 0.5%.

We maintain our cautiously optimistic stance and expect volatility to remain high, with more Nifty heavyweights like Reliance, UltraTech, and Infosys, announcing their earnings in the following sessions. Meanwhile, there’ll be no shortage of trading opportunities and participants should focus more on buying quality stocks from the sectors, which are trading in sync with the benchmark.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Investors traded with cautious optimism as gains in oil & gas, power, realty & banking stocks helped markets extend gain for the 5th straight session. The return of FIIs into domestic equity markets in the last few sessions coupled with receding commodity prices and hopes that US Fed may not go for aggressive rate hikes in its next meeting has somewhat tempered the fears of investors.

Technically, on daily charts, the Nifty has formed a bullish candle and closed above the 100-day SMA (Simple Moving Average), which is broadly positive.

For traders, 16500 would act as a key support level and above which the index could move up to 16700-16750. On the flip side, strong possibility of a quick short term correction is not ruled out, if the index trades below 16500. Below the same, the index could slip till 16450-16420.

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nifty index continued its upward momentum and remains in a buy-on-dip mode with strong support at the 35,800 level. The immediate upside resistance is placed at 36,500 and a breach of this lead accelerates the move towards the 37,000 level. The momentum oscillators are in the buy zone which confirms the strength.

Vinod Nair, Head of Research at Geojit Financial Services:

With support from FII buying, the domestic market was able to withstand the downward pressure from global markets to close on a positive note.

Global indices traded lower on rate hike worries as ECB in its meeting today, is expected to raise rates by 50bps, while the Fed is expected to increase rates by 75bps in upcoming meeting scheduled next week.

Even though a rate hike of this magnitude has already been factored in, the major market driver would be their commentary on future inflation and growth forecasts.

Rupee Close:

Indian rupee ended marginally higher at 79.95 per dollar against previous close of 79.98.

Market Close: Benchmark indices ended higher on the fifth day in a row with Nifty above 16600.

At close, the Sensex was up 284.42 points or 0.51% at 55,681.95, and the Nifty was up 84.50 points or 0.51% at 16,605.30. About 1950 shares have advanced, 1302 shares declined, and 155 shares are unchanged.

IndusInd Bank, Bajaj Finance, Tata Consumer Products, UPL and Bajaj Finserv were among the top Nifty gainers, while losers included Dr Reddy’s Laboratories, Kotak Mahindra Bank, SBI Life Insurance, Cipla and Tech Mahindra.

On the sectoral front, except pharma, all indices ended in the green, with PSU Bank, Oil & Gas, Power and Capital Goods indices rose 1-2 percent.

BSE midcap index added 1.2 percent and smallcap index jumped 0.9 percent

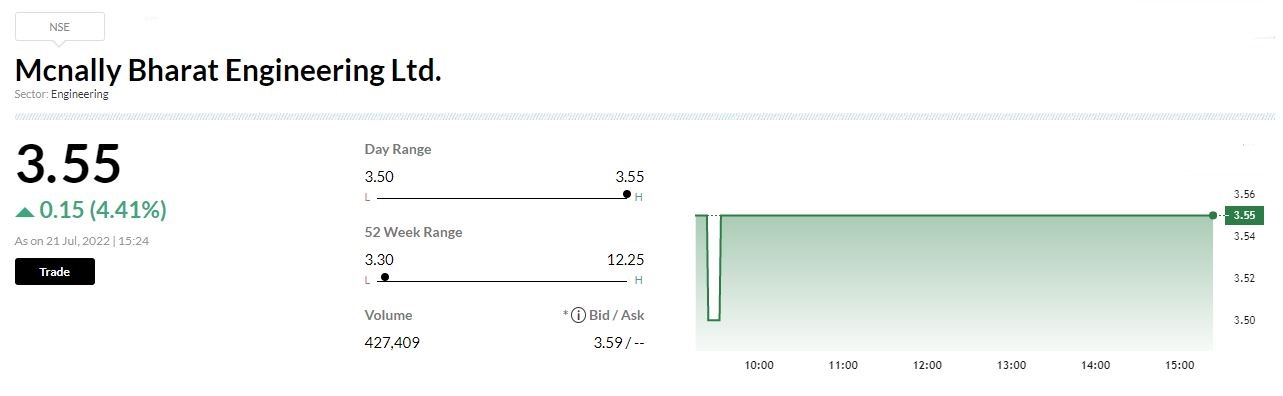

McNally Bharat to receive Rs 242 crore arbitration awardSingareni Collieries Company is directed by Arbitral Tribunal to pay Rs 242.07 crore within one month from the date of the Award. The Arbitral Tribunal has delivered matter of arbitration between McNally Bharat Engineering Company, and Singareni Collieries Company, and as per the Award, the Claimant (Singareni Collieries) is awarded a total sum of Rs 242.07 crore.

Credit Suisse View on Wipro

Brokerage house Credit Suisse has kept ‘neutral’ call on the stock and cut the target price to Rs 415 per share from Rs 530.

The earnings were miss on a weak operating margin with strong Q2 revenue guidance, mainly on acquisitions.

Credit Suisse cut FY23-25E EPS by 11-13 percent and believe Q2 growth guidance includes Rizing & Convergence acquisition impact of 1.3-1.5 percent.

Wipro won 18 large deals in Q1, TCV of $1.1 billion. The macro headwinds should impact growth beyond FY23, reported CNBC-TV18.

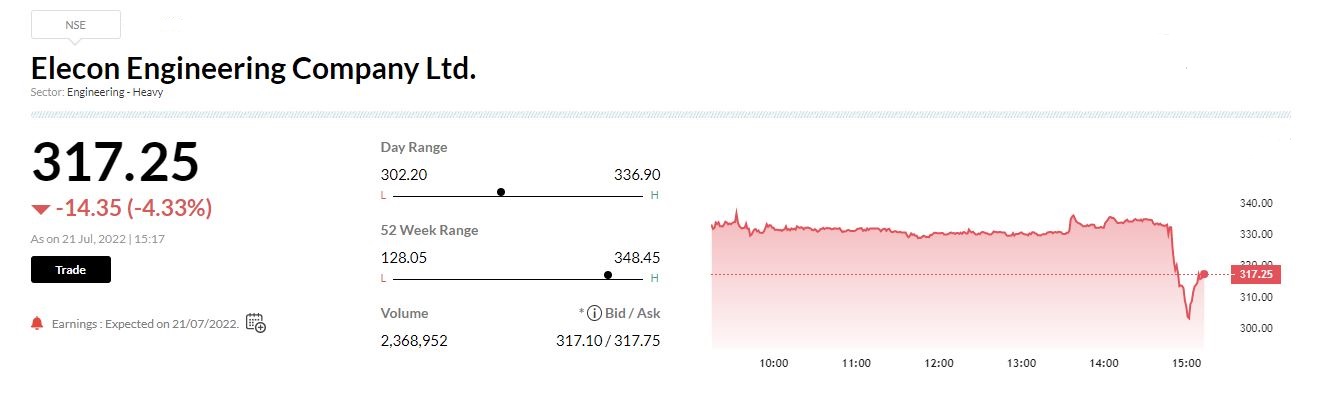

Elecon Engineering Q1:

Elecon Engineering has posted 42.4 percent jump in its Q1 net profit at Rs 32.94 crore versus Rs 23.12 crore and revenue was up 16.4% at Rs 257.2 crore versus Rs 220.9 crore, YoY.

Jefferies View on Wipro

Brokerage house Jefferies has kept ‘underperform’ rating on the stock with a target price Rs 360 per share

The 1QFY23 missed the estimates, with 200 bps QoQ margin decline being the key disappointment.

The deal TCV was at $1.1 billion, strong net hiring and healthy Q2 guidance of 3-5 percent QoQ were encouraging.

The lower estimate by 1-6 percent and expect Wipro to deliver a 6 percent EPS CAGR in FY22-25.

The weak EPS growth is a high risk of cuts to consensus estimates, while heavy reliance on acquisitions should weigh on stock, reported CNBC-TV18.

Wipro was quoting at Rs 414, up Rs 1.80, or 0.44 percent on the BSE.

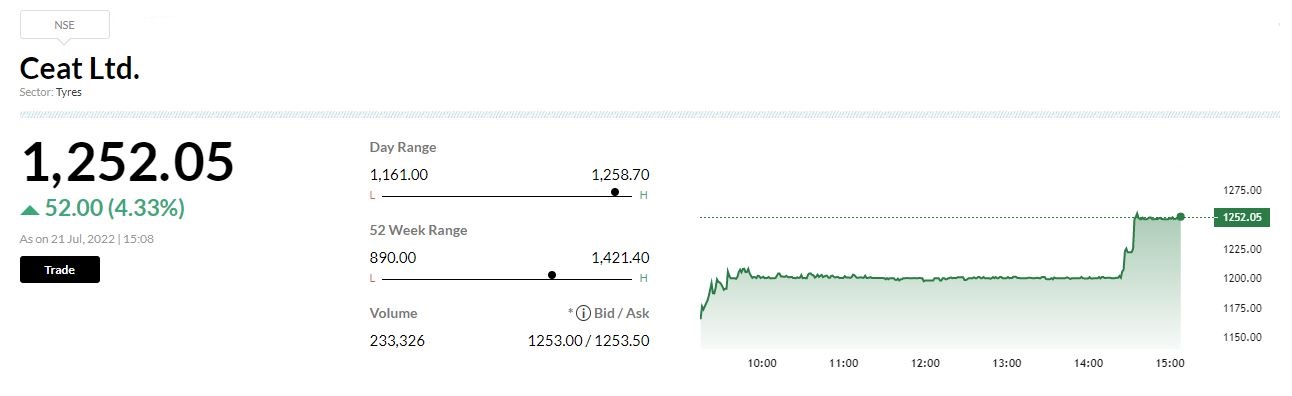

Buzzing:Ceat reported a 62.3% year-on-year decline in consolidated profit at Rs 8.68 crore for the quarter ended June 2022, dented by higher input cost. Revenue jumped 48% YoY to Rs 2,818.4 crore during the same period.