Vinod Nair, Head of Research at Geojit Financial Services:

Domestic equities clawed its way out of the recent downslide boosted by metal, PSU bank and pharma stocks with mid and small caps outperforming the benchmark indices.

US markets witnessed a late sell-off yesterday despite the re-nomination of Jerome Powell as the Fed chair. Oil and gas indices remained under pressure amid reports of the US releasing its emergency oil reserves to keep the rising crude oil prices under control.

The telecom sector was in focus today as the sector majors initiated rate hike which will enhance profitability.

Market Close: Benchmark indices ended on positive note in the highly volatile session on November 23 with Nifty closing above 17500.

At Close, the Sensex was up 198.44 points or 0.34% at 58,664.33, and the Nifty was up 86.80 points or 0.50% at 17,503.30. About 2346 shares have advanced, 829 shares declined, and 153 shares are unchanged.

JSW Steel, Coal India, Power Grid Corp, NTPC and Tata Steel were among major gainers on the Nifty. Losers included IndusInd Bank,

Asian Paints, Infosys, Bajaj Auto and Wipro.

Except IT, all other sectoral indices ended in the green, with power, metal, realty, pharma, capital goods, oil & gas, PSU bank indices up 1-3 percent. BSE midcap and smallcap indices rose over 1 percent each.

India to release 5 mn barrels of crude oil from strategic reserve

India plans to release about 5 million barrels of crude oil from its emergency stockpile in tandem with the US, Japan and other major economies to cool prices, a top government official said on Tuesday.

India stores about 38 million barrels of crude oil in underground caverns at three locations on the east and west coast.

Mahesh Kumar, EVP & Head Capital & Commodities Market at Abans Group:

WTI Crude oil fell dramatically ahead of the United States’ expected announcement of a coordinated release of reserves. After hitting a low of $74.76 per barrel, WTI crude oil is now trading near $75.91 per barrel, continuing its downward trend from a recent high of $85.41 per barrel in October.

Crude oil prices are projected to remain in a downward trend due to concerns about increased supplies and weaker demand as a result of a new covid-related worldwide lockdown.

WTI oil prices are likely to confront severe resistance around the 50-day and 20-day exponential moving averages (EMAs) of 78.40 and 79.30, respectively, while immediate support could be found around $72.80 and 68.30.

TVS Motor signs MOU with Tamil Nadu Government

TVS Motor Company signed a Memorandum of Understanding (MOU) with the Government of Tamil Nadu for investment in Future Technologies and Electric Vehicle, as per the company press release.

Under the MOU, TVS Motor Company will invest Rs. 1200 crores in Future Technologies and Electric Vehicles (EV) in the next four years.

The investment will be mainly for the design, development and manufacturing of new products and capacity expansion in the EV space, it added.

TVS Motor Company was quoting at Rs 712.20, up Rs 2.25, or 0.32 percent.

Fitch affirms Punjab National Bank at BBB‐:

Fitch Ratings has affirmed Punjab National Bank’s (PNB) Long‐Term Issuer Default Rating (IDR) at ‘BBB‐’. The outlook is negative.

This reflects the outlook on India’s sovereign rating (BBB‐/Negative).

The agency has also affirmed PNB’s Viability Rating (VR) at ‘b’.

Punjab National Bank was quoting at Rs 40.60, up Rs 0.70, or 1.75 percent.

Jefferies view on SRF:

Foreign research house Jefferies has maintained underperform rating on the SRF with a target price of Rs 1,890 per share.

See strong demand & alleviating margin pressure in specialty chemical segment in H2, however packaging film margin could see continued weakness.

It sees a slowdown in earnings growth over FY21-24.

SRF was quoting at Rs 2,189.15, up Rs 94.05, or 4.49 percent on the BSE.

Greaves Cotton opens EV production facility in Ranipet, Tamil Nadu

Greaves Electric Mobility, the E-Mobility arm of Greaves Cotton Limited and one of the market leaders in the E-2W and E-3W segments, inaugurated its largest EV production facility in Ranipet, Tamil Nadu.

The 35-acre plant built to preserve the green terrain surrounding the site is located in the Industrial Centre of Tamil Nadu and will serve as an electric mobility hub for both domestic and export markets, company said in its press release.

Greaves Cotton was quoting at Rs 155.00, up Rs 9.60, or 6.60 percent.

Market at 3 PMBenchmark indices were trading higher in the final hour of trading supported by the metal, pharma, PSU bank, power and realty stocks.The Sensex was up 244.71 points or 0.42% at 58710.60, and the Nifty was up 101.80 points or 0.58% at 17518.30. About 2286 shares have advanced, 745 shares declined, and 108 shares are unchanged.

BSE Oil & Gas index gained 1 percent supported by the Indraprastha Gas, Gujarat Gas, IOC

SpiceJet brings back Boeing 737 MAX aircraft onboard: SpiceJet has brought back Boeing 737 MAX aircraft into operation after a gap of around two-and-a-half years, Ajay Singh, Chairman, and Managing Director, SpiceJet said at an event on November 23.

This comes almost a week after the domestic carrier said it has entered into an agreement with the US-based aerospace company Boeing to settle outstanding claims related to the grounding of 737 Max aircraft and its return to service. SpiceJet brought back 737 MAX to service with a special flight from New Delhi to Gwalior on November 23.

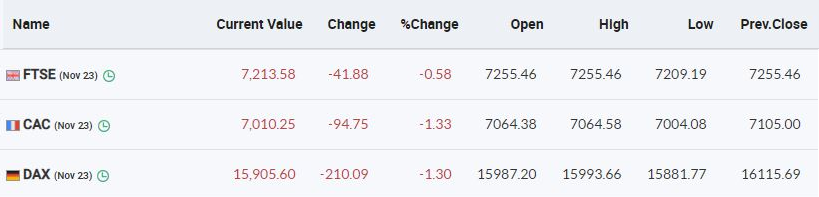

European markets are trading in the red with CAC and DAX down over a percent each