Taking Stock | Market Bounces Back; Nifty Closes Above 18,100, Sensex Gains 767 Points

For the week, BSE Sensex and Nifty50 indices rose 1 percent each.

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The ‘RBI Direct Sheme’ enabling retail investors to directly invest in government bonds, announced by the RBI in its February Monetary policy and launched by PM Modi today, is an innovative scheme which is pro-retail investors.

The scheme, which is simple to operate, allows retail investors to invest in the safe G- Secs. This provides retail investors an opportunity to diversify their portfolios with risk-free fixed income assets. Also, this move will demystify the govt bond market which was hitherto an area of experts and professionals.

Ajit Mishra, VP – Research, Religare Broking:

Markets recovered sharply and posted gains of over a percent, taking a breather after the recent dip. Positive global cues led to a gap up but profit taking trimmed the gains in the initial hours. The tone gradually changed with healthy buying in index heavyweights from the sectors such as IT, realty and energy which supported the market to inch higher till the end.

Consequently, the Nifty ended with healthy gains of 1.3% at 18,103 levels. All the sectoral indices ended in the green. The broader markets closed with positive bias in the range of 0.2-0.5%.

Markets will first react to macro data in early trade on Monday. As the result season is almost behind us, the focus will shift back to global markets for cues.

At the same time, traction in primary markets will keep investors busy. There are mixed sentiments in the markets, so we reiterate our cautious view on markets and let Nifty stabilise above 18,100 to change the bias.

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

We respected the gap opening and the index moved up further to close above 18100. Next week would be crucial for the Nifty. If we can keep above 18,150 for a couple of sessions, the markets can scale up higher to 18,400 and then 18,600.

This will also take out the upper end of the current range which will add further momentum to the index.

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index opened a day with good gap and managed its bullish stream throughout day & closed a day at 18103 with gains of more than one percent forming a bullish candle on daily chart.

The index has moved above its strong hurdle zone of 18k mark which hints if prices managed to hold above 18k mark then one can expect a current pullback to extend further towards 18200-18300 zone which are an immediate hurdle zone on the higher side also any dip near 18k mark will be again fresh buying opportunity.

Palak Kothari, Research Analyst at Choice Broking:

On the last day of the week, the index opened on a positive note and traded higher as it managed to cross 18000 marks and closed at 18102.75 level with a gain of 229.15 points. While Bank Nifty closed at level 38733.35 with a gain of 173.15 points.

On the sectoral front, IT, power, capital goods and realty indices were up 1 percent each while media ended in red.

Technically, the index has formed a bullish candle on the daily time frame with the support of 50 DMA, which suggests strength in the counter.

The Index has given a breakout of the falling trendline, which points out strength in the counter. Also, the Stochastic indicator bounced and showed positive crossover, which points out strength in the counter for the next trading session. At present, the index has a support level of 17,900, while resistance is at 18,250 levels.

Vinod Nair, Head of Research at Geojit Financial Services:

The momentum which was lost during the week was regained as inflation worries started fading with investors shifting their focus to good quarterly earnings, economic recovery and strong domestic macro data points.

Today’s market rally was led by IT, energy and realty stocks while global peers traded mixed.

Market Close: Benchmark indices broke the three day losing streak and ended higher with Nifty above 18000 led by IT, power, realty stocks

At close, the Sensex was up 767.00 points or 1.28% at 60,686.69, and the Nifty was up 229.20 points or 1.28% at 18,102.80. About 1556 shares have advanced, 1628 shares declined, and 143 shares are unchanged.

Tech Mahindra, Hindalco Industries, Wipro, HDFC and Infosys were among the major Nifty gainers, while losers included Bajaj Auto, Tata Steel, Hero MotoCorp, Axis Bank and IOC.

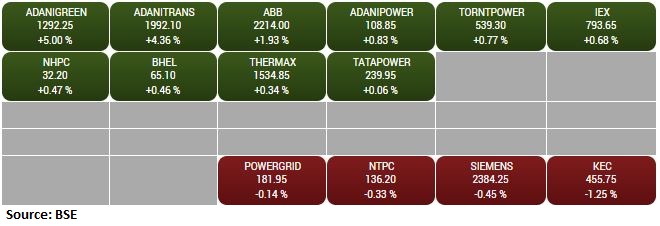

On the sectoral front, IT, power, capital goods and realty rose 1 percent each. The BSE midcap and smallcap indices ended in the green.

BSE Power index gained 1 percent supported by the Adani Green, Adani Transmission, ABB:

Vodafone Idea Q2 earnings

Vodafone Idea has posted consolidated net loss at Rs 7,132.3 crore in the quarter ended September 2021 against loss of Rs 7,319.1 crore in the quarter ended June 2021.

Its consolidated revenue was up 2.8% at Rs 9,406.4 crore versus Rs 9,152.3 crore, QoQ.

Vodafone Idea Limited was quoting at Rs 10.28, up Rs 0.40, or 4.05 percent on the BSE.

Latent View Analytics IPO subscribed 288 times on final day

The public issue of Latent View Analytics has seen overwhelming response from investors as it received bids for 505 crore equity shares against IPO size of 1.75 crore equity shares, resulting into a 288 times subscription on November 12, the final day of bidding.

Investors showed strong interest in the offer as retail investors bought shares 112 times their reserved portion and employees put in bids 3.67 times the portion set aside for them.

The part reserved for qualified institutional buyers was subscribed 115 times, and that of non-institutional investors saw 774 times subscription.

Nitin Shanbhag, Sr. Executive group VP- Motilal Oswal Private wealth management:

The G-sec market is dominated by institutional investors like Banks, Insurance companies, Mutual Funds, etc. with lot sizes of Rs 5 crores & higher. Hence this segment was largely inaccessible to retail participants.

G-secs witnesses highest volumes within the fixed income market since they offer a risk-free rate, hence no credit risk. Retail investors could thus far participate in G-secs only through Debt Mutual Funds, although with limited options.

Further, in debt funds, investors have to invest with a minimum 3 year investment horizon through the growth option to qualify for long term capital gains at 20% with indexation benefit.

The RBI Retail Direct Scheme will enable retail investors to participate into G-secs across various tenors with flexible investment horizons and with the ability to get regular cash flows through risk-free coupons.