Taking Stock | Market snaps 2-day losing streak, Sensex gains 319 points, Nifty above 18,100

HUL, Sun Pharma, Tech Mahindra, Eicher Motors and UPL were among the biggest Nifty gainers. The losers included UltraTech Cement, Grasim Industries, NTPC, JSW Steel and Tata Steel… Read More

Kunal Shah, Senior Technical Analyst at LKP Securities

The Bank Nifty index witnessed a breakout above the resistance level of 42700, and the index managed to hold the level on a closing basis. The index remains in buy-on-dip mode with immediate support at 42400 levels, which should act as a cushion for the bulls.

The immediate upside hurdle is visible at 43000, where call writing is observed, and once cleared, we will see a sharp short covering on the upside.

Ajit Mishra, VP – Technical Research, Religare Broking

Markets started the week with an uptick and ended marginally higher. Upbeat global cues combined with favourable earnings announcements triggered a gap-up start which further strengthened with renewed buying in the IT majors. However, profit taking in energy, banking and cement heavyweights trimmed the gains as the day progressed.

Finally, the Nifty index settled at 18118.55%; up by 0.5%. Meanwhile, the broader indices traded mixed wherein select buying in the midcap space helped the index to end higher while smallcap closed unchanged.

Markets have been facing pressure on every uptick however rotational buying in select index majors is helping in establishing a higher base. Amid all, we reiterate our view to focus on the selection of stocks and prefer hedged positions until we see a decisive close above 18250 in Nifty.

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty traded in a range bound manner on January 23; however the overall structure shows that the index is preparing to start the next leg on the upside. On the daily chart, it has started forming higher top higher bottom & once the swing high of 18,184 is crossed then one can initiate a fresh long position.

The daily upper Bollinger Band is set for an expansion, which will create room for the price action on the higher side.

In the short term, the Nifty is expected to surpass the key hurdle zone of 18,260-18,300 & head towards 18,500. On the other hand, the level of 18,000 will provide cushion on the downside.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Markets maintained the upward momentum through the trading session on positive cues from Asian and European indices. IT stocks emerged as the star performers after getting hammered in recent sessions on worries global IT spending may moderate this year due to likely slowdown in key economies.

If the optimism continues, we may see some pre-budget rally in the truncated week.

On the technical front, despite the strong momentum Nifty failed to clear the 18,180 resistance mark.

Currently, the index is trading above the 20-day SMA and also holding a higher bottom formation on intraday charts which is largely positive.

For the traders, 18,000 would be the trend decider level, above which the index could move up to 18,200-18,250. On the flip side, below 18,000, selling pressure is likely to intensify, which could see the index slip till 17,950-17,900.

Vinod Nair, Head of Research at Geojit Financial Services

Market breadth tilted in favour of bulls lifted by financial stocks, amid positive cues from global peers. Strong corporate earnings reported by banks boosted appetite for financial stocks. Positive global markets owing to possibility of a less aggressive rate hike, further added colour.

Rupee Close:

Indian rupee closed 27 paise lower at 81.39 per dollar against previous close of 81.12.

Market Close: benchmark indices ended on positive note with Nifty above 18100.

At Close, the Sensex was up 319.90 points or 0.53% at 60,941.67, and the Nifty was up 90.80 points or 0.50% at 18,118.50. About 1595 shares have advanced, 1947 shares declined, and 180 shares are unchanged.

HUL, Sun Pharma, Tech Mahindra, Eicher Motors and UPL were among the biggest gainers on the Nifty. The losers included UltraTech Cement, Grasim Industries, NTPC, JSW Steel and Tata Steel.

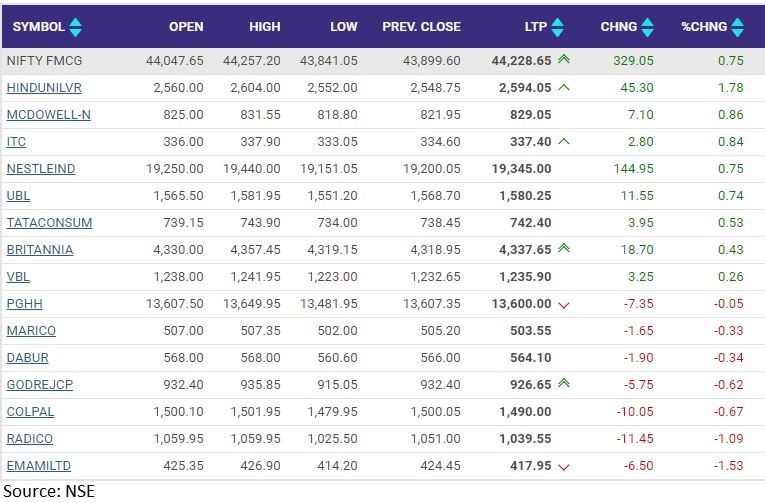

Among sectors, auto, bank, FMCG, healthcare, oil & gas and information technology indices up 0.5-1 percent, while realty, and power down 0.4-0.7 percent.

BSE midcap index added 0.4 percent, while smallcap index down 0.3 percent.

Morgan Stanley View On SBI Life Insurance Company

-Overweight rating, target at Rs 1,700 per share

-VNB margin moderated QoQ as product mix shifted towards ULIP

-Solid fundamentals continue with well rounded delivery of top-line growth

-Valuations look attractive, reported CNBC-TV18

SBI Life Insurance Company was quoting at Rs 1,296.50, up Rs 1.05, or 0.08 percent on the BSE.

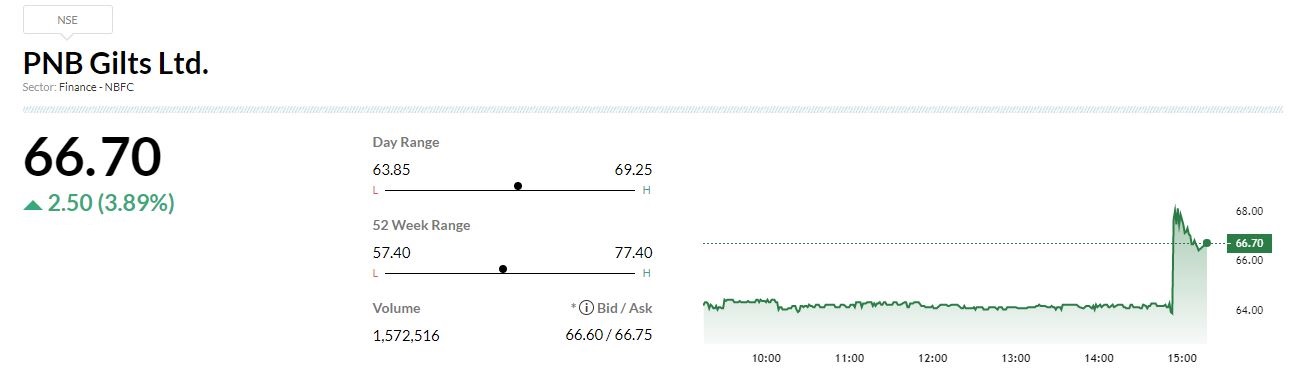

Punjab Gilts Q3Punjab Gilts has posted profit of Rs 6.1 crore in the quarter ended December 2022 versus loss of Rs 6.14 crore, year ago period.Revenue was up 13% at Rs 296.6 crore versus Rs 262.5 crore, YoY.

Nomura View On LTIMindtree

-Reduce rating, target cut to Rs 3,840 per share

-Q3 results miss consensus as furloughs and holidays impair growth

-Margin miss sharper than expected, to recover partly in Q4 & rest slowly in FY24

-Aims for synergies of USD 1 billion in revenue & 200-300 bps in margin over next 5 years

-Remain watchful of smooth merger; stock is currently trading at 22x FY25 EPS, reported CNBC-TV18.

LTIMindtree was quoting at Rs 4,374.45, up Rs 104.60, or 2.45 percent.

Nifty FMCG index rose 0.7 percent led by Hindustan Unilever, ITC, United Spirits