Market Close: Indian benchmark indices ended lower for the second consecutive session on May 19 with Nifty finishing near 15,800 level.

At close, the Sensex was down 1,416.30 points or 2.61% at 52,792.23, and the Nifty was down 430.90 points or 2.65% at 15,809.40. About 838 shares have advanced, 2413 shares declined, and 122 shares are unchanged.

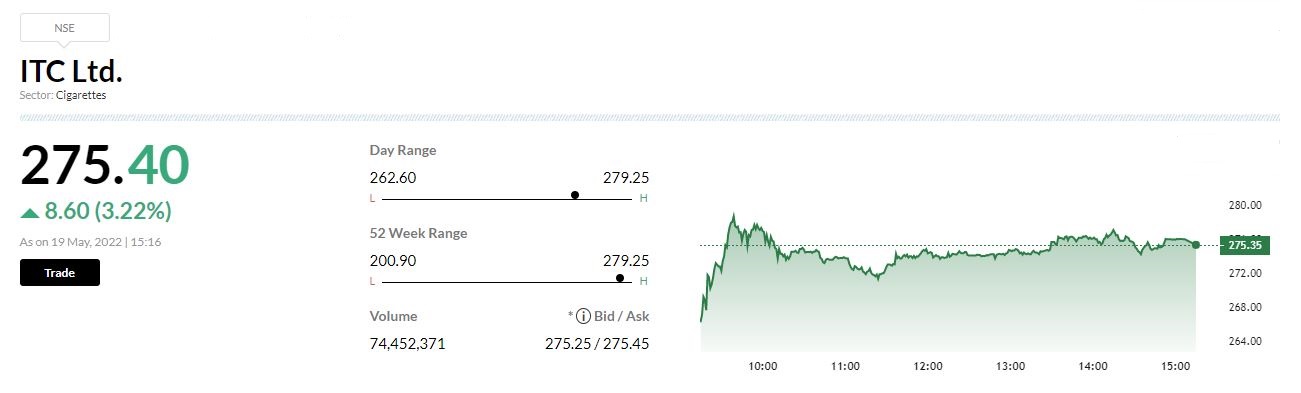

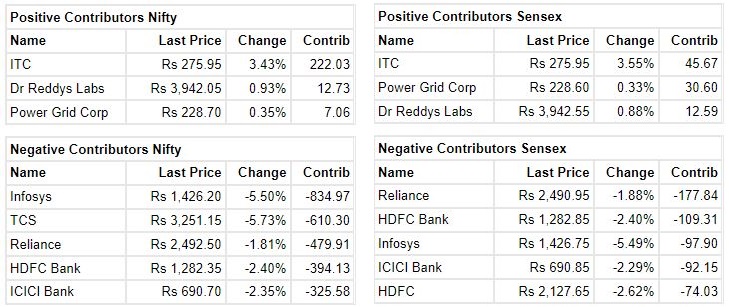

Wipro, HCL Technologies, TCS, Tech Mahindra and Infosys were among the top Nifty losers, while gainers included ITC, Dr Reddy’s Laboratories and Power Grid Corporation.

All the sectoral indices ended in the red with metal, IT indices fell 4-5 percent.

The BSE midcap and smallcap indices lost over 2 percent each.

Rupee Close:

Indian rupee ended 14 paise lower at 77.72 per dollar versus Wednesday’s closing of 77.58.

BSE Oil & Gas index slipped 2 percent dragged by the Indraprastha Gas, Adani Total Gas, Gujarat Gas

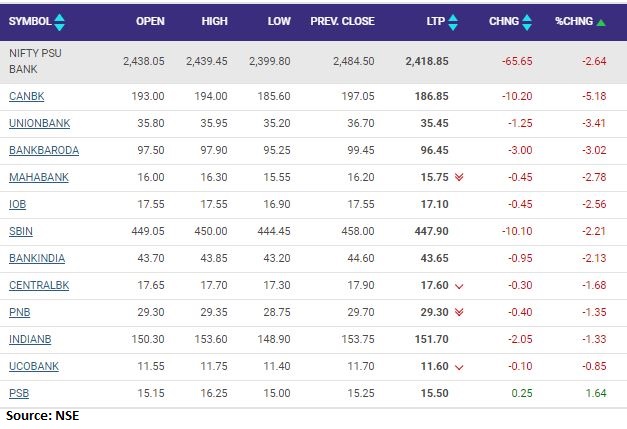

Nifty PSU Bank index lost 2 percent dragged by the Canara Bank, Union Bank of India, Bank of Baroda

Jefferies View on ITCJefferies maintained a buy rating on ITC with a target price of Rs 305.ITC has seen expanding margin, with smart gains in cigarettes and FMCG.More than 20 percent growth in operating profit is a key positive for FMCG.The improvement in dividend pay-out drives up return on equity to seven-year high of 25 percent, CNBC-TV18 reported.

UK announced new sanctions against the Russian airline sector. The Russian airlines won’t be able to sell unused landing slots at UK airports, reported CNBC-TV18.

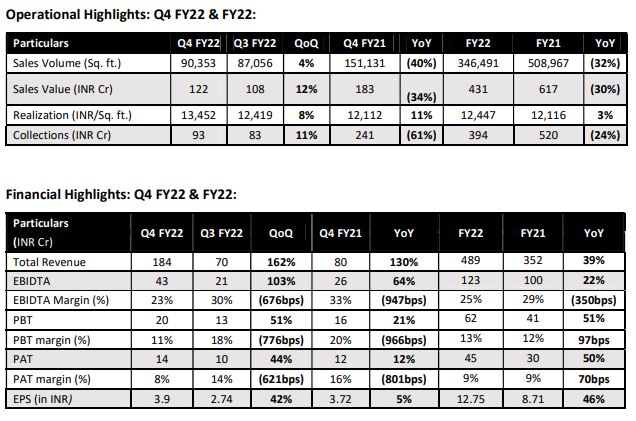

Ajmera Realty and Infra India Q4 Earnings:Ajmera Realty and Infra India was quoting at Rs 294.65, up Rs 8.45, or 2.95 percent on the BSE.

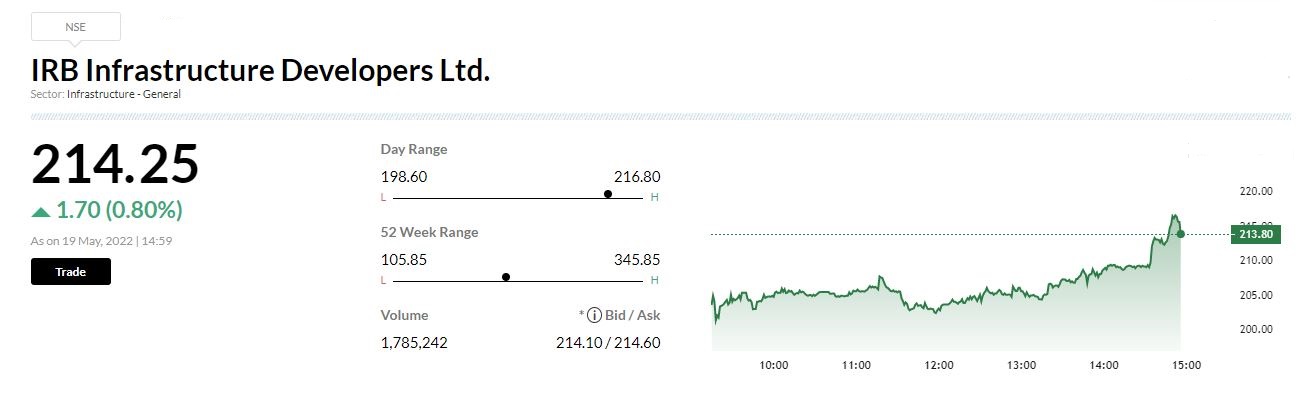

YES Securities maintains buy on IRB Infrastructure Developers:IRB’s 4QFY22 results were a mixed bag with revenues missing estimates due to degrowth in construction segment of 17% YoY, while margins surprised positively. In 4Q, toll revenues in 11 projects (across IRB and private InVIT) saw 5% sequential growth in revenue. With revision in tariff rates from April’22 onward toll collection is expected to witness strong growth in FY23. On the construction side, management expects revenue in the range of Rs 50‐55 billion for FY23 with EBITDA margins in the range of 22‐24%.We maintain with a buy with a revised SOTP of Rs 328/shares, implying an upside potential of 54% from the current levels

Market at 3 PMBenchmark indices extended the losses and trading at day’s low levels with Nifty around 15800.The Sensex was down 1,437.33 points or 2.65% at 52771.20, and the Nifty was down 437.00 points or 2.69% at 15803.30. About 707 shares have advanced, 2430 shares declined, and 92 shares are unchanged.

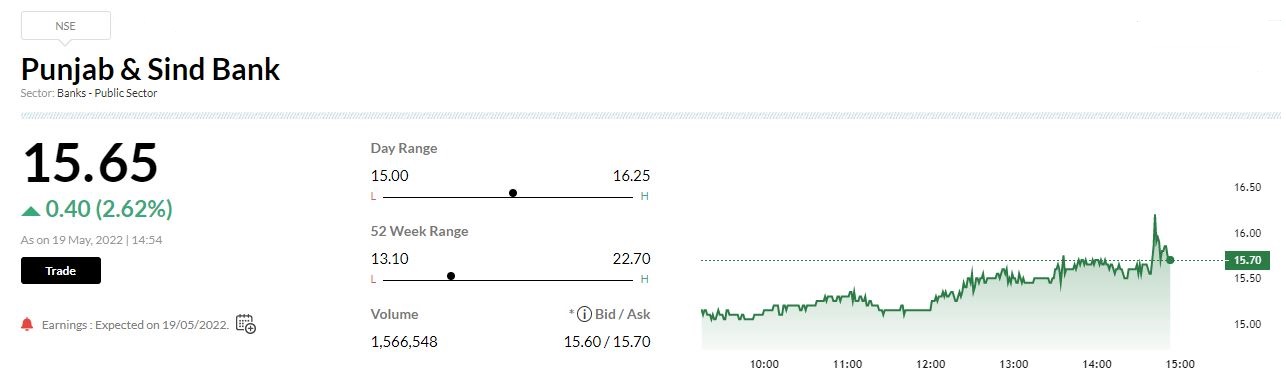

Punjab & Sind Bank Q4 Earnings:Punjab & Sind Bank has reported net profit of Rs 346 crore in the quarter ended March 2022 against Rs 160.8 crore and net interest income (NII) was up 40.9% at Rs 697.6 crore against Rs 495 crore, YoY.Gross NPA was at Rs 8564.8 crore against Rs 9635.8 crore and net NPA was at Rs 1742.3 crore versus Rs 1773.1 crore, QoQ.

As eMudhra IPO opens tomorrow, here are 10 things to know before subscribing

The IPO, sized at Rs 413 crore, comprises fresh shares of Rs 161 crore and an offer for sale worth Rs 252 crore by shareholders and promoters.

BSE Power index fell 2 percent dragged by the Tata Power, Torrent Power, Adani Green Energy: