Vinod Nair, Head of Research at Geojit Financial Services

Investors welcomed the new year on a high note with data showing strengthening domestic business conditions. India’s manufacturing PMI rose to 57.8 in December from 55.7 in the previous month, with new orders rising at the fastest pace since February 2021.

Metal stocks led the surge following reports of China raising export duties to support their domestic demand, which is positive for India.

We expect 2023 to be a year to buy equities in anticipation that a large part of the global recession has already been factored in the market.

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty has been witnessing short term consolidation for the last few sessions. On the higher side, a rising trendline & the key daily moving averages are acting as resistances whereas the 20-week moving average & the 50% retracement of the Sept – Dec 2022 rally are providing support on the downside.

The overall structure shows that the index can continue with the short term consolidation in the range of 17,800-18,400. Within this range, the Nifty is attempting a move towards 18,400. The level of 18,000 is acting as an intermediate support.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Markets gained confidence in the afternoon trades after European indices advanced sharply in their early trades. Local traders lapped up metals, realty and banking shares, which had faced relentless selling in the last week’s sell-off.

However, markets may face strong bouts of volatility as investors brace for earnings season and the upcoming Union Budget.

Technically, the Nifty is consolidating between 18,050 and 18,250 levels. For the bulls 18,250 would be the fresh breakout level to watch out for, and above the same it could move up to 18,350-18,400.

On the flip side, below 18,100, there is a strong possibility of a quick intraday correction. Below the same, the index could slip till 18,050-18,000.

Rupee Close:

Indian rupee closed flat at 82.74 per dollar against previous close of 82.73.

Market Close: Benchmark indices ended higher on January 2, the first trading session of 2023, with Nifty around 18,200.

At Close, the Sensex was up 327.05 points or 0.54% at 61,167.79, and the Nifty was up 92.20 points or 0.51% at 18,197.50. About 2254 shares have advanced, 1245 shares declined, and 177 shares are unchanged.

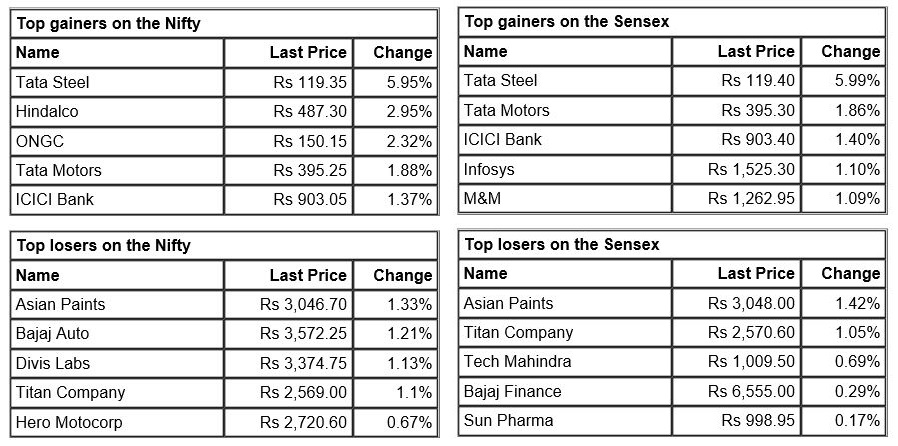

Tata Steel, Hindalco Industries, ONGC, Tata Motors and ICICI Bank were among the biggest Nifty gainers. However, losers included Titan Company, Asian Paints, Divis Labs, Bajaj Auto and Hero MotoCorp.

On the sectoral front, metal index added nearly 3 percent and realty index rose 1 percent.

BSE midcap and smallcap indices rose 0.5 percent each.

Dollar edges up at start of new year but sentiment frail

The dollar edged up on Monday, pulling away from recent six-month lows against a basket of major currencies, for now.

It has weakened recently as markets bet a U.S. Federal Reserve tightening cycle may be nearing an end and sentiment remained fragile.

And the first trading day of the year was subdued, with many countries including big trading centres such as Britain and Japan closed for a holiday.

The dollar index, which measures the value of the greenback against a basket of other major currencies, was trading up around 0.16% at 103.65 – off roughly six-month lows hit last week at around 103.38.

The euro was down about a third of a percent at $1.0680, but not far off its highest levels since June.

Against the yen, the dollar was a touch softer at 130.94, having hit its lowest levels since August last month.

Macquarie keeps ‘Outperform’ rating on IndusInd Bank, target Rs 1,400

-Outperform rating, target at Rs 1,400 per share

-Falling credit costs could drive RoA to 1.8 percent

-Faster growth in MFI/CV books could offset higher funding costs

-See implied upside of 32 percent if fair value is based on FY25E BVPS

IndusInd Bank was quoting at Rs 1,226.15, up Rs 4.65, or 0.38 percent.

Supreme Petrochem gets consent from Maharashtra Pollution Control Board

Supreme Petrochem has received consent to operate (CTO) from Maharashtra Pollution Control Board, for polystyrene (PS) and expandable polystyrene (EPS) capacity expansion projects at Amdoshi plant in Raigad, Maharashtra.

With this, company’s effective manufacturing capacity of polystyrene increased from existing 2,20,000 MTA to 3,00,000 MTA and expandable polystyrene from existing 50,000 MTA to 85,000 MTA.

Supreme Petrochem was quoting at Rs 788.55, down Rs 2.05, or 0.26 percent on the BSE.

Texmo Pipes & Products reappoints Sanjay Kumar Agrawal as Managing Director

Texmo Pipes & Products has reappointed Rashmi Agrawal as Whole Time Director and Chairperson, Sanjay Kumar Agrawal as Managing Director, and Vijay Prasad Pappu as Whole Time Director cum Chief Financial Officer for five years with effect from September 1, 2023 till August 31, 2028.

Texmo Pipes and Products was quoting at Rs 59.05, up Rs 1.35, or 2.34 percent.

Macquarie keeps ‘Underperform’ rating on Jubilant FoodWorks; target Rs 445-Underperform rating, target at Rs 445 per share

-Sales per store likely to remain under pressure

-Peers city count makes company more reliant on smaller cities

-Input inflation-linked headwinds, elevated capex plans pose risk to near-term margin

-Competitive pressures pose risks to return ratios

-At 57x FY24e EPS, valuation remains elevated versus historical trading range

-Margin risks underappreciated

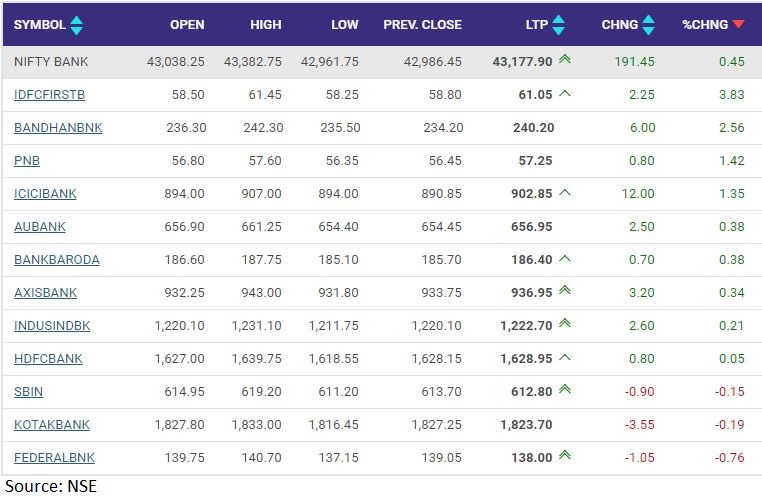

Nifty Bank index gained 0.5 percent led by IDFC First Bank, Bandhan Bank, PNB

Market at 3 PMThe Sensex was up 286.82 points or 0.47% at 61127.56, and the Nifty was up 81.40 points or 0.45% at 18186.70. About 2136 shares have advanced, 1222 shares declined, and 141 shares are unchanged.