DRE. Reddy, CEO and Managing Partner at CRCL LLP:

The Indian Government’s decision of limiting the export of sugar to 10 MT is not very surprising. The move comes on the backdrop of rising inflation and is made to keep on the rising domestic food prices.

This decision is in line with the centre’s decision of limiting the export of wheat. This decision will impact the global sugar supply as India is the second-largest exporter of sugar after Brazil. However, it is too soon to say if this restriction will have an impact on the pricing in India.

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty remained directionless during the day leading to volatility in the market. On the higher end, 16400 is likely to remain a resistance over the near term. Support on the lower end remains at 16000-16020.

Going ahead, the volatility may continue over the near term. Any decisive breakout above 16400 may induce a strong directional move in the market.

Vinod Nair, Head of Research at Geojit Financial Services:

Anxiety of slowing economy & rising interest rates underpinned by soaring inflation continued to haunt the global market.

The UK and Eurozone composite PMI registered the slowest rise in business activity in the month of May, worsening global investor risk sentiment.

On the domestic front, while all major sectors succumbed to the pressure, the auto sector bucked the market trend this month gaining on fuel price cut and rise in steel custom duty.

Market Close: Benchmark indices ended lower in the volatile session on May 24, with Nifty below 16,150.

At close, the Sensex was down 236.00 points or 0.43% at 54,052.61, and the Nifty was down 89.50 points or 0.55% at 16,125.20. About 1005 shares have advanced, 2220 shares declined, and 121 shares are unchanged.

Dr Reddy’s Labs, Kotak Mahindra Bank, HDFC, Nestle India and HDFC Bank were among the top Nifty gainers, while losers included Divis Labs, Tech Mahindra, Grasim Industries, Hindalco Industries and HUL.

Among sectors, IT, pharma, metal, FMCG, power and realty indices down 1 percent each.

BSE midcap index fell 0.8 percent and smallcap index shed 1 percent.

JSW Steel to consider fund raising on May 27

The company board would considering raising of long term funds, including but not limited to, Qualified Institutions Placement of permissible securities, subject to such regulatory/statutory approvals as may be required, in May 27 board meeting.

JSW Steel has touched a 52-week low of Rs 538 and was quoting at Rs 538.10, down Rs 9.50, or 1.73 percent.

Maruti Suzuki buys 12% stake in Sciograph Solutions

Maruti Suzuki India said it will acquire an equity stake of 12.09 percent in Sociograph Solutions Pvt Ltd (SSPL) for about Rs 2 crore.

SSPL is an artificial intelligence (AI) software company that specialises in visual AI platforms predominantly used to help enterprises improve sales experiences and improve efficiency in their business.

Maruti Suzuki India was quoting at Rs 7,800.00, down Rs 96.20, or 1.22 percent on the BSE.

Marwadi Financial Services view on Aether Industries Limited IPO

Considering the TTM (Dec-21) EPS of Rs 8.50 on a post issue basis, the company is going to list at a P/E of 75.6x with a market cap of Rs 79,918 Mn whereas its peers namely Clean Science & Technology Ltd and Fine Organic Ltd. are trading at PE of 82.7x and 80.2x.

We assign the “Subscribe (With Caution)” rating to this IPO as the company is the sole manufacturer of chemicals namely 4MEP, MMBC, T2E, OTBN, and others, in India.

However, the company has low and declining Operating Cash Flow to EBITDA ratio which keeps us cautious from a long-term perspective.

Yash Gupta- Equity Research Analyst, Angel One:

We suggest short-term investors book profit in Delhivery IPO and long-term investors remain invested. Currently, the company is trading at EV/sales of 4.8x and price to book value of 5.2x on annualized number of FY2022. We have given a neutral rating to Delhivery IPO.

Delhivery is the largest and fastest growing fully integrated logistics services player in India. The company has a reach of 17,488 pin codes and has an infrastructure of 14.2 million rupee square feet with more than 3,836 delivery points.

The company offers five types of transportation services- Express Parcel services, Part Truck Load services, Truck Load services, Supply chain services, and Cross Border services.

Aether Industries IPO is open: Should you subscribe?

Brokerages are confident about the company’s prospects, given its inherent strengths and the growth likely in the Indian chemical industry. They have assigned a “subscribe” or “subscribe with caution”…

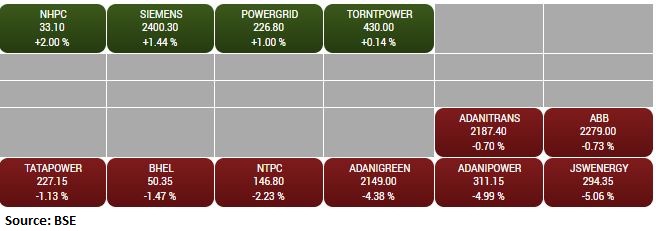

BSE Power index fell 1 percent dragged by the Adani Power, JSW Energy, Adani Green

Va Tech Wabag signs concession agreement with Ghaziabad Nagar Nigam

Va Tech Wabag has signed through its wholly owned subsidiary M/s. Ghaziabad Water Solutions Private Limited (SPV), a concession agreement with Ghaziabad Nagar Nigam (GNN) towards Design, Build, Finance and Operation of a new 40 MLD Recycle and Re-use Tertiary Treatment Reverse Osmosis (TTRO) plant along with associated infrastructure under Hybrid Annuity Model (HAM).

Va Tech Wabag was quoting at Rs 236.25, down Rs 5.95, or 2.46 percent on the BSE.

Market at 3 PMBenchmark indices were trading lower in the final hour of the trade.The Sensex was down 237.49 points or 0.44% at 54051.12, and the Nifty was down 88.50 points or 0.55% at 16126.20. About 951 shares have advanced, 2167 shares declined, and 94 shares are unchanged.