Sunil Damania, Chief Investment Officer, MarketsMojo

In the first half of 2022, the Indian equity market had plunged. However, market sentiments have rekindled since July and remain bullish. Substantial GST collections were one of the reasons why equity markets became bullish, in addition to strong direct tax collections. These factors indicate healthy economic growth, despite global economies struggling.

Also, the rupee has begun moving in a very narrow range after touching Rs 80. Taking wind of these positive factors, FIIs returned strongly in July and August and are likely to continue investing in India’s growth story.

India Inc.’s earnings for the June quarter have also been reasonably admirable. Even though market pundits think otherwise, considering the environment under which India Inc. has operated — global uncertainty, high crude oil prices, rising interest rates, and other concerns, India Inc. delivered YoY growth both in topline and bottom line.

We also witnessed a growth in the topline for the June quarter-on-quarter. We believe there is great merit in India Inc’s growth story, and in that regard, we opine that Sensex could touch 65000 by Dec 2022.

Vinod Nair, Head of Research at Geojit Financial Services:

Profit booking amid weak global cues impacted domestic indices as concerns about interest rate hikes hung over the markets.

Additionally, the recent rally of the dollar index and FIIs turning net sellers has surprised bulls. Broad-based selling was witnessed with the index heavyweights dragging the index further down.

Amol Athawale, Deputy Vice President – Technical Research, Kotak Securities

Interest rate sensitives such as banking, auto & realty stocks witnessed heavy profit-taking and halted benchmark indices’ 7-day winning streak. Investors pressed the sell button after the recent US FOMC minutes indicated that the Federal Reserve may go for rate hikes in its next meeting, which prompted local investors to prune their holdings after the recent run-up.

Technically, the Nifty witnessed profit booking near 18000 level, while on daily charts, the index has formed a long bearish candle and also broke the important support level of 17850 which is broadly negative.

In addition, it has also formed Hammer candlestick formation indicating further weakness in the near future. Below 17900, the correction formation is likely to continue and could retest the level of 17600-17500. On the flip side, 17900 – 17950 would act as an immediate hurdle for the bulls. Fresh uptrend is possible only if the index clears the resistance of 17950, which could then take it further to 18050-18150 levels.

Market Close: Indian equity market snapped 8-day gaining streak and ended lower with Nifty below 17,800.

At Close, the Sensex was down 651.85 points or 1.08% at 59,646.15, and the Nifty was down 198 points or 1.10% at 17,758.50. About 1387 shares have advanced, 1927 shares declined, and 122 shares are unchanged.

IndusInd Bank, Apollo Hospitals, Bajaj Finserv, Tata Motors and Hindalco Industries were among the major Nifty losers. The gainers were Adani Ports, L&T, Infosys, Eicher Motors and Bajaj Auto.

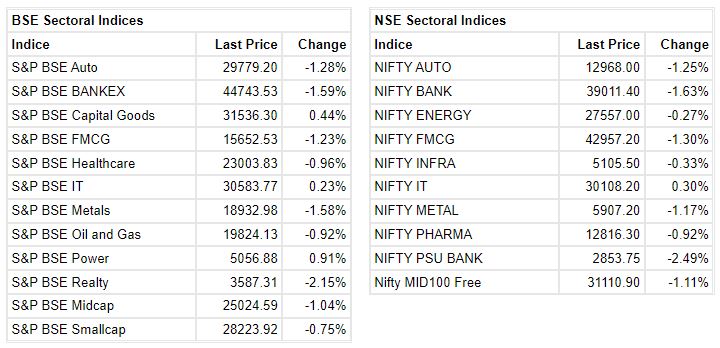

Except capital goods, and Power all other sectoral indices ended in the red.

BSE midcap and smallcap indices shed 1 percent each.

Rupee Close:

Indian rupee ended 10 paise lower at 79.78 per dollar against previous close of 79.68.

JUST IN | Adani Group is said to get SEBI nod for USD 3.8 billion Ambuja, ACC open offer: From Bloomberg.

Adani Group to offer Rs 385 per share for Ambuja and Rs 2,300 per share for ACC, it added

Metropolis Healthcare CEO resignsVijender Singh has resigned as the Chief Executive Officer of Metropolis Healthcare. The company has agreed to release him from the position of CEO from the closing of business hours of August 17.

BSE Healthcare index shed nearly 1 percent dragged by the Shalby, Granules India, Glenmark Pharmaceuticals

Buzzing:

Talbros Engineering has commenced construction on land acquired admeasuring 2.2 acre in Faridabad for setting up of new production unit.

Talbros Engineering was quoting at Rs 575.00, up Rs 5.35, or 0.94 percent on the BSE.

Market at 3 PMBenchmark indices erased some of the intraday losses but still trading lower with Nifty below 17800.The Sensex was down 588.99 points or 0.98% at 59709.01, and the Nifty was down 178.20 points or 0.99% at 17778.30. About 1276 shares have advanced, 1891 shares declined, and 103 shares are unchanged.

BSE Capital Goods index rose 0.5 percent led by the Thermax, L&T, Graphite India

Future Enterprises defaults on Rs 12.68 crore interest payment for NCDs:

Debt-ridden Future Enterprises Ltd (FEL) said it has defaulted on payments of interest of two non-convertible debentures totalling Rs 12.68 crore. The due date for payment was August 17, 2022, FEL said in a regulatory filing.

“The company is unable to service its obligations in respect of the interest on Non-Convertible Debentures (NCDs) due on August 17, 2022,” it said on Thursday. The debentures are secured with a coupon rate of 9.60 per cent per annum.