Emkay Global Financial Services:

There are no fresh triggers in the fx market and the USDINR spot is stuck with in a tight range of 74.20-74.55. It is a truncated week, with inflation playing a major hindrance to the risk appetite.

So the only focus remains on whether Fed members’ express their worry over inflation, supporting the uptrend in DXY. But overall we expect the spot to continue trading in between 74-74.65.

Rohit Singre, Senior Technical Analyst at LKP Securities:

One more round of selling witnessed in today’s session and the index closed a day at 17900 with loss of more than half percent forming a bearish candle for the third consecutive day.

The index managed to breach its rising trend line support of 17900 zone which hints we may see more pressure if the index continued to trade below 17900 zone towards 17800-17700 zone which are next supports for Nifty and resistance is coming near 17950-18000 zone and above 18k mark only we may see good strength.

Market Close: Benchmark indices ended on negative note for the second consecutive session on November 17 amid selling seen in the realty, oil & gas, pharma names.

At close, the Sensex was down 314.04 points or 0.52% at 60,008.33, and the Nifty was down 100.50 points or 0.56% at 17,898.70. About 1382 shares have advanced, 1758 shares declined, and 95 shares are unchanged.

UPL, Reliance Industries, Axis Bank, Britannia Industries and IOC were among the major Nifty losers. Gainers included SBI Life Insurance, Asian Paints, Maruti Suzuki, Tata Motors and Power Grid.

The realty, oil & gas, pharma indices lost 1 percent each, while selling was also seen in the metal, capital goods, and banking names. The BSE midcap index was down 0.2 percent, while the smallcap index ended on flat note.

SCI board approves demerger of ‘Non-Core Assets’

The board of directors of Shipping Corporation of India Land and Assets Limited in its meeting held on November 16, 2021, has considered and approved the Scheme of Arrangement for Demerger of ‘Non-Core Assets’ between The Shipping Corporation of India and Shipping Corporation of India Land and Assets.

The company is taking necessary actions to obtain all necessary approvals from the competent authority/ies to bring this scheme into effect.

Shipping Corporation of India was quoting at Rs 129.35, up Rs 0.30, or 0.23 percent.

JSW Steel selects in the S&P Dow Jones Sustainability Index

JSW Steel announced today that it has been selected in the S&P Dow Jones Sustainability Index (DJSI) for the Emerging Markets for 2021.

JSW Steel is one of the 15 companies from India and one amongst only three steel companies from Emerging Markets that have made it to the DJSI EM Index which comprises 108 companies globally.

JSW Steel was quoting at Rs 662.40, down Rs 2.25, or 0.34 percent.

Nucleus Software gets shareholders nod for Rs 159 crore share buyback:

Nucleus Software has announced the postal ballot results of their proposed buyback of 22,67,400 equity shares, for an aggregate amount not exceeding Rs 159 crore. The total buyback shares represent 7.81% of the total paid-up equity capital of the company, as per the company press release.

Nucleus Software Exports was quoting at Rs 590.10, up Rs 10.80, or 1.86 percent.

Bharat Dynamics bags order worth Rs 171 crore

Bharat Dynamics has signed a contract for design, development, manufacture, supply and support of CMDS worth Rs 171 crore approximately.

The order book position of the company as on November 17, 2021 is Rs 8,991 crore. The company has received new orders of worth Rs 1331 crore during the current financial year.

Bharat Dynamics Ltd. was quoting at Rs 427.25, up Rs 10.35, or 2.48 percent on the BSE.

Tarsons Products IPO sees 33.4 times subscription on final day of bidding

The initial share sale of Tarsons Products, a manufacturer of labware items, has seen 33.4 times subscription on the final day of bidding on November 17 as it garnered bids for 36.24 crore equity shares against an offer size of 1.08 crore units.

The reserved portion for retail investors was subscribed 8.61 times and that of employees 1.35 times. The company has reserved 60,000 equity shares for its employees.

Qualified institutional investors have bought shares 31.79 times the portion set aside for them and non-institutional investors have put in bids 94 times the portion reserved for them.

Market at 3 PMBenchmark indices extended the losses and trading near the day’s low point with Nifty below 17950 dragged by the oil & gas, pharma, metal, bank and realty stocks.The Sensex was down 221.66 points or 0.37% at 60100.71, and the Nifty was down 70.40 points or 0.39% at 17928.80. About 1428 shares have advanced, 1664 shares declined, and 106 shares are unchanged.

Go Fashion IPO subscribed 1.56 times on Day 1

The initial public offering (IPO) of Go Fashion, one of India’s largest women’s bottom-wear brands, was subscribed 1.56 percent on November 17. Bids were received for 1.26 crore equity shares against an IPO size of 80.79 lakh units on the first day.

The company raised Rs 456.12 crore through the anchor book on November 16. The offer size has been reduced to 80.79 lakh equity shares from 1.46 crore earlier.

Retail investors had put in bid 8.25 times the shares reserved for them, while the part set aside for non-institutional investors was subscribed 22 percent. Qualified institutional buyers have bought 14,679 equity shares of the reserved portion.

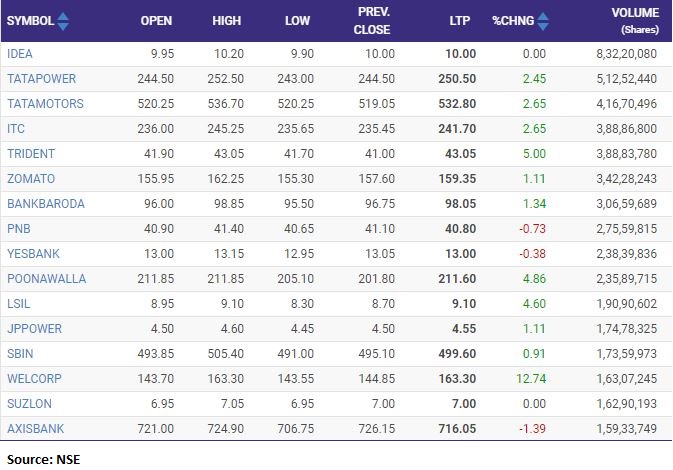

Most active shares on NSE in terms of volumes

JM Financial Suggests ‘hold’ On PB Fintech, Sets Target At Rs 2,200 By December 24 Despite Risks. Here’s Why

JM Financial values PB Fintech at 8x EV/Revenue and 35x EV/EBITDA multiple to ideally factor-in long term growth as well as dilute the impact of near-term one-offs.