Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Firm global market cues triggered an upsurge in local benchmark indices as Sensex closed above the crucial 60,000 mark on back of buying in IT and realty stocks. In recent sessions, falling global crude oil prices and sliding US Dollar index have encouraged domestic investors to increase their equity exposure. Technically, Nifty has formed a shooting star kind of candle formation near the important resistance level. A trend reversal is possible only after the dismissal of 17850. Above the same, the index could touch the level of 18000-18100. On the flip side, below 17850 selling pressure is likely to increase and could retest the level of 17,750-17,700.

Vinod Nair, Head of Research, Geojit Financial Services

Domestic economy is witnessing strong vigour and the same is assisting a steady growth in Indian equities. A 15.5 percent YoY increase in bank credits during August suggests that the economy is recovering rapidly. Due to rising food prices, domestic inflation figures are predicted to show a gradual rise from 6.7 percent in July which could add volatility in the short-term. Meanwhile, the world equity market is ignoring the fact that the Fed will retain its aggressive rate hike strategy given high levels of inflation assuming that much is factored in.

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty rose for the third consecutive session on September 12 aided by positive global cues. Among sectors, realty, consumer durables and IT indices rose the most. Advance decline ratio was positive at 1.64:1.

Broader market continues to do well, while the largecaps are seeing rotational buying and profit taking; thus leading the Nifty to a slow crawl up. Nifty could continue to face resistance at 17,992 while 17,807 could act as a support in the near term.

Titan, Adani Ports, Tech Mahindra were the top Nifty gainers

Rupee At Close | Rupee ends at 79.52/$ versus Friday’s close of 79.58/$

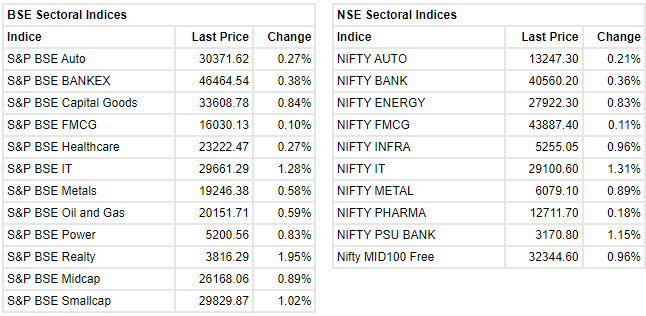

Markets At CloseSensex ended the day 312.26 points higher or 0.52 percent at 60,105.40. Nifty added 97.50 points or 0.55 percent to close at 17,930.80. About 2013 shares advanced, 1326 shares declined, and 143 shares remained unchanged.Among sectors, Nifty IT led the market rally. Tech Mahindra, Infosys and Wipro surged between 1.5-3 percent, and were among the top gainers on the BSE. Nifty Realty Index added 2 percent, led by Oberoi Realty, Godrej Properties, DLF and Brigade Enterprises

Tapan Patel, Senior Analyst (Commodities), HDFC Securities

On Gold: Gold prices extended gains as dollar index declined ahead of US CPI data. The dollar index was trading more than 1 percent down near 107.61 during the day. US inflation is expected to have eased further from highs hit this year, a trend which may encourage the Federal Reserve to eventually bring down its pace of interest rate hikes. We expect gold prices to trade sideways to up for the day with COMEX spot gold support at $1710 and resistance at $1740 per ounce. MCX Gold October support lies at Rs 50,300 and resistance at Rs 50,900 per 10 grams.

On Crude Oil: Global oil prices may rebound towards the end of the year as supply is expected to tighten further when a European Union embargo on Russian oil takes effect on Dec 5. We expect crude oil prices to trade sideways to up with resistance at $89 per barrel with support at $85 per barrel.

Ashwin Patil, Senior Research Analyst at LKP Securities

Defense sector is buzzing currently on the back of a strong order book, orders from GOI under the Ministry of Defense, technological advancements and requirements according to the geopolitical environment and export orders. This gives us a visibility of upto 4-5 years as the country needs to match the international standards. Furthermore, profitability led by higher indigenisation theme, better operating leverage and higher contribution from non government orders should augur well for the margins. Valuations too seem comfortable to us for the entire sector. Therefore we are bullish on the sector, particularly on BEL due to additional positives like a lean balance sheet, better working capital management and emphasis on some non profitable non defense sectors.

IDBI Bank cuts lending rates on Overnight to 3-month tenures by 5-15 bps. Meanwhile, the bank has hiked lending rates on 6-month, 2-year tenures by 5 bps

UK Data Watch | UK economy grew 0.2 percent in July MoM vs estimate of 0.3 percent

Santosh Meena, Head of Research, Swastika Investmart

IT stocks are seeing some bargain buying after a healthy correction. Indian markets are near their all-time high however IT stocks are trading much below their 52-week highs. Thus, we are seeing some buying at lower levels. The leadership is in the hand of the domestic economy facing sectors like financials, auto, and industrials but there is some sectoral rotation, ahead of new highs in the market. FIIs are in buying mood and they are showing some interest in beaten-down IT names as global cues are also improving.

Why equity inflows are at a 10-month low? NS Venkatesh, CEO, AMFI says

“A lot of people are booking profits. It is the season of people going abroad for higher education. People need money to pay for fees, travel expenses, etc.”

Meanwhile, the total amount invested into funds is going up. There are indications of fresh funds coming in for NFOs, he adds.