Vinod Nair, Head of Research at Geojit Financial Services:

The market has struggled for a firm direction today as global markets were largely under selling pressure ahead of the release of US job data, which could provide insight into upcoming Fed actions.

Oil prices rose ahead of the OPEC+ meeting on the expectation of a reduction in output, despite the fact that weak global growth prospects remain a concern.

A surging dollar index and rising US bond yields could be reflected in the elevated volatility of the domestic market in the near term.

Market Close: In the highly volatile session, Indian benchmark indices ended on flat note on September 2.

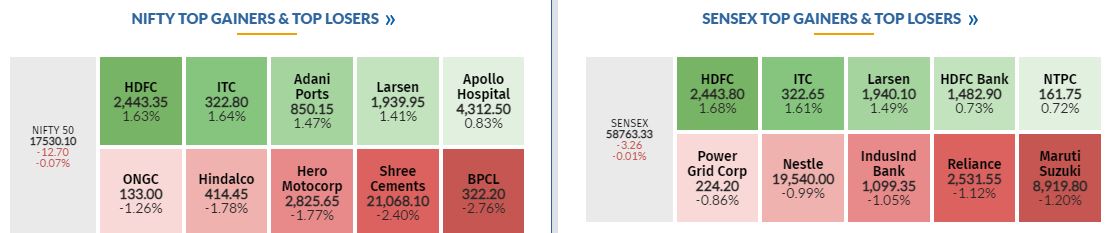

At Close, the Sensex was up 36.74 points or 0.06% at 58,803.33, and the Nifty was down 3.30 points or 0.02% at 17,539.50. About 1726 shares have advanced, 1612 shares declined, and 137 shares are unchanged.

BPCL, Shree Cements, Hero MotoCorp, Hindalco Industries, ONGC were among major losers on the Nifty, while gainers were HDFC, ITC, Adani Ports, Larsen and Toubro and HDFC Bank.

On the sectoral front, capital goods index rose 1 percent and Oil & gas index shed 1 percent. However, selling was also seen in the IT, metal, oil & gas, pharma and PSU banks.

BSE midcap and smallcap indices ended on flat note.

Rupee Close:

Indian rupee ended 25 paise lower at 79.80 per dollar against previous close of 79.55.

European Markets Update:

Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities:

Domestic market remained volatile during the week. While BSE-30 and Nifty-50 returns were flat, the midcap and smallcap space saw interest from market participants. Both, BSE-Midcap and BSE-Smallcap index outperformed the larger peers this week. BSE Capital Goods and BSE Realty indices were key gainers, whereas the BSE IT index remained under pressure.

Auto stock gave positive returns this week amid reporting of August 2022 sales volumes by auto companies. India’s Q1FY23 real GDP grew by 13.5%, aided by private consumption growth.

For August 2022, GST collections remained buoyant and manufacturing PMI was healthy. While the crude oil prices has been volatile, the US 10-year bond yield has gradually moved up to 3.25%. In the near term, Indian markets are likely to continue tracking global peers.

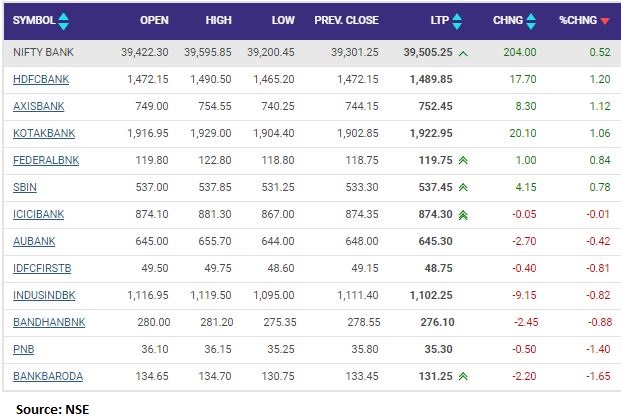

Nifty Bank index rose 0.5 percent led by the HDFC Bank, Kotak Mahindra Bank, Axis Bank

Tamilnad Mercantile Bank IPO:

Tamilnad Mercantile Bank has set a price band of Rs 500-525 a share for its initial public offering. Earlier, the firm said its IPO will open for subscription on September 5 and close on September 7.

The IPO is a fresh issue of 1.58 crore shares. On the upper end of the price band, the firm will raise around Rs 831.60 crore from the issue. Axis Capital, Motilal Oswal, SBI Capital Markets are the lead managers to the issue.

The anchor book bidding will start on September 2. Shares will be allotted to dematerialised accounts of successful investors on September 14 and stock will make its market debut on September 15.

JUST IN | Securities Appellate Tribunal (SAT) dismisses shareholder petitions seeking a stay on the IPO of Tamilnad Mercantile Bank.

Tirthankar Das, Technical & Derivative Analyst, Retail, Ashika Stock Broking:

On the technical front, Nifty formed a small positive candle with long upper shadow with a long upper shadow which indicates of an upcoming consolidation in the market with volatile trade. However, higher low formation on daily chart indicates of a pause in downward pressure and possibility remains of an upside bounce towards 17750-17800.

On the oscillator front, the 14-period RSI has gained a bullish momentum sustaining above the trend deciding level of 60. Though one need to avoid trading aggressively amid global nervousness.

Considering the present situation, a bare minimum correction of 38.6% of the entire rally from 15,183 to 17,992 comes around 16900 followed by 50% correction at 16600.

On the upside present setup indicates that Nifty can move towards 17,992 followed by 18,114 in the coming days with immediate support stands at 17,350 and index need to sustain above the said level with some authority for the bulls to strengthen their stance. Hence during the day intraday decline towards 17430-17470 can be used for creating long position for the target of 17750.

Market at 3 PMBenchmark indices erased all the intraday gains and trading flat in the highly volatile market.The Sensex was up 2.89 points or 0.00% at 58769.48, and the Nifty was down 12.40 points or 0.07% at 17530.40. About 1648 shares have advanced, 1537 shares declined, and 121 shares are unchanged.

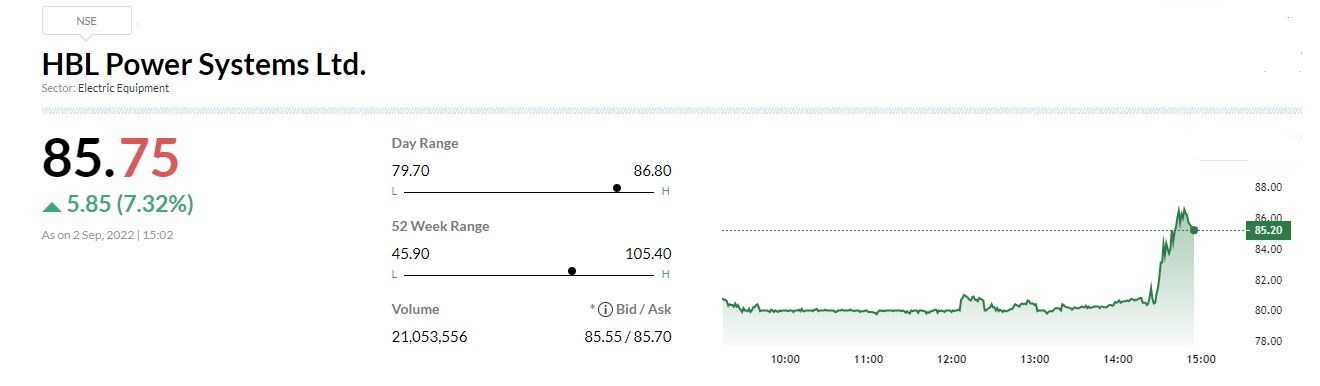

HBL Power bags orders worth Rs 673 croreHBL as the lead member of a consortium with Siemens, signed the first contract under Mission Raftar project, with Eastern Railway for deployment of Kavach (TCAS — Train Collision Avoidance System) over 260 kms of track and 120 locomotives, from Howrah to Pradhankhanta. The contract price is Rs 286.69 crore including taxes of which HBL’s work share is Rs 205.88 crore; the contract is scheduled to be completed in 700 days.Integral Coach Factory (ICF) is manufacturing the Vande Bharat trainsets, designed to run at 160 kmph. HBL received a purchase order from ICF for the supply of 46 sets of Kavach, to be installed at the time of manufacture of the trainsets, at a total price of Rs 31.66 crore including taxes. Deliveries begin in November 2022 and is scheduled to be completed by July 2023. HBL, as the lead member of a consortium with Shivakriti International, is also declared as the lowest bidder in two other tenders in West Central Railway and Western Railway, on the Delhi-Mumbai route. The tender in West Central Railway is for deployment of Kavach over 549 kms of track and 87 locomotives, for a bid price of Rs 353.84 crore including taxes. The tender in Western Railway is for deployment of Kavach over 96 kms of track, for a bid price of Rs 81.67 crore including taxes. The contracts for these tenders are expected to be awarded shortly.

Morgan Stanley View On SBI Card

Foreign broking house Morgan Stanley has kept overweight rating on the stock with a target at Rs 1,100 per share.

The new cashback card could have a wide customer appeal, while cashback costs could be recouped by saving certain costs.

The cashback is a strong tactical move to reduce dependence on partners, reported CNBC-TV18.

SBI Cards & Payment Services was quoting at Rs 932.05, up Rs 3.60, or 0.39 percent.