S Ranganathan, Head of Research at LKP Securities: In a highly volatile trading day, the street began on a very positive note on expectations of record GST numbers for November in line with the trends shown by e-way bills. However, post the views of the Moderna CEO on the Omicron Variant, markets witnessed selling pressure. While key data points for November like the Auto numbers were seen playing out, profit-booking by FPI kept investors watchful. The smallcap 100 index however was seen buzzing around through the day on the back of the MSCI semi-annual review.

Market at close: Sensex ended 195.71 points lower or 0.34% at 57064.87, and the Nifty shed 81.40 points or 0.48% at 16972.60. About 1675 shares have advanced, 1383 shares declined, and 112 shares are unchanged. Power Grid Corporation, Shree Cements adn Bajaj Finserv are the top gainers while Tata Steel, Kotak Mahindra Bank, Reliance Industries and Bajaj Auto are the top losers.

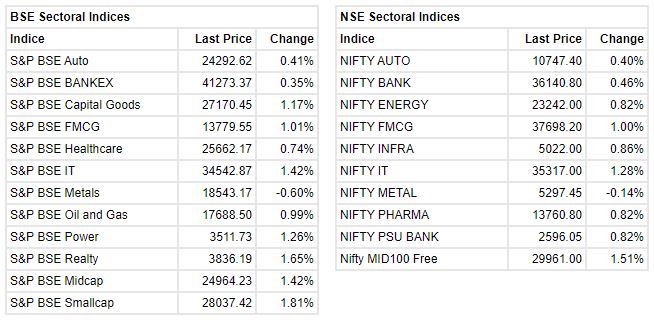

Among the sectors, the metal index fell over 2 percent followed by banks, auto and power while IT, Realty and FMCG closed in the green. The midcap and smallcap indices ended in the green.

“India VIX in the domestic market was around 17-18 levels during most of November, indicating limited market downside. However, volatility spiked by 25% on Friday, 26th Nov, led by rising concerns on the new Covid-19 variant, making investors cautious. Further, an increase in the new variant cases will be a short-term negative for the equity market. Currently, VIX trading around 21 levels signifies an increase in cautiousness, as compared to the previous week. Volatility is likely to continue for some more time, as the direction of the new variant, Oil prices, and Dollar index will further drive the market fundamentals. FIIs are the net sellers in the equity market, especially from the last two weeks, and DIIs are consistently providing support. With every FIIs selling, here onwards, DIIs support will be critical for the market. Investors should stick to the fundamentals where the earnings visibility is high, and we believe sector rotation with a focus on quality and momentum will deliver superior returns moving forward”

Naveen Kulkarni, Chief Investment Officer, Axis Securities

Market update at 3 PM: Sensex is down 113.01 points or 0.20% at 57147.57, and the Nifty is down 43.1 points or 0.25% at 17010.9

Source: BSE

Tariff hikes, moratorium on govt dues to help telecom companies invest more aggressively in 5G tech: Report

The announced tariff hikes by the telcos could boost their operating profits by at least 40 percent and coupled with the moratorium on government dues, will help them invest more aggressively into 5G technology, says a report.

Tariff hikes to lift the EBITDA, or earnings before interest, taxes, depreciation, and amortization, of telcos by 40 percent and along with the moratorium on government dues, this will support 5G investments and credit profiles, Crisil said in a note on Tuesday.

Airtel and Vodafone Idea have announced up to 25 percent hike in their prepaid plans tariffs to improve financials, While Reliance Jio has announced up to 21 percent hike in mobile services tariffs from December 1.

Most active stocks on NSE in terms of volumes

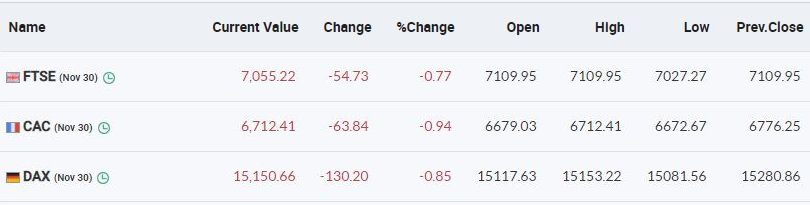

European markets are trading in the red with FTSE, CAC and DAX down 0.5-1 percent each

Maruti announces price increase: Auto major Maruti Suzuki has announced price increase of Rs 8000 for ECCO (Non-cargo variants) due to introduction of passenger air bag. The stock was trading at Rs 7,173.40, up Rs 26.70, or 0.37 percent. It has touched an intraday high of Rs 7,251.85 and an intraday low of Rs 7,100.

NielsenIQ on Q2 FMCG data: FMCG industry growth at 12.6% YoY in Q2 against 36.9% in Q1. FMCG industry sees urban-led growth while rural consumption slips. Price-led growth at 11.3% YoY in Q2 against 15.5% in Q1. Volume-led growth at 1.2% YoY in Q2 against 18.5% in Q1. Rural consumption declines 2.9% in Q2 against 14.9% growth in Q1. Modern trade revives, up 17% in Q2, doubles grom 8% in Q1.

Market update at 2 PM: Sensex is up 403.34 points or 0.70% at 57663.92, and the Nifty gained 113 points or 0.66% at 17167.

Star Health IPO updates: The public issue of Rakesh Jhunjhunwala-promoted Star Health and Allied Insurance Company was subscribed 9 percent on the debut on November 30. It received bids for 39.38 lakh equity shares against an IPO size of 4.49 crore equity shares.

Retail investors bid for 49 percent of their reserved portion, while the portion set aside for employees was subscribed for 5,552 shares.

Vinod Nair, Head of Research at Geojit Financial Services:

We like Go Fashion (India) Ltd considering, being the first company to launch exclusive brand dedicated to women’s bottom wear, investment in digital & omnichannel engagement, focus on E-retail, distributive growth strategy to tap customers from tier 1 to tier 3 cities and expansions plans for existing and newer geographies.

A growing number of working women, rise in disposable income, consumer shift towards buying from safe & hygienic facilities triggered by COVID-19 augurs well for the company.

The opening-up of markets will support revenue growth going forward. With strong appreciation over the offer price, it appears the current positives are largely factored in. Given the solid listing, profit booking is expected, long-term investors can accumulate the stock in the dip.