Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

Nifty tested the daily lower Bollinger Band post the recent decline. The index witnessed buying support emerging thereon, which led to the swift recovery on August 30. On the way up, the index has crossed the swing high of 17726. In terms of the Fibonacci retracement, the Nifty is approaching 78.6% retracement of the entire recent decline i.e. 17815, which is the immediate resistance.

The index is likely to witness selling pressure again near 17815-17900. However, the overall structure suggests that a sharp decline in the short term is unlikely. What we can expect is a short term consolidation in the broad range of 17200-18000.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Strong bounce back in local benchmark indices came on the back of recovery in Asian and European indices. Focus seemed to have shifted from hawkish Fed stance to expectations of a strong Q1 GDP numbers. Despite volatility and uncertain global macro environment, the rally shows that India would remain a good long-term bet. We are of the view that the short-term market structure has changed from negative to positive due to a strong pullback from lower levels. But due to temporarily overbought conditions, we may see range-bound activity in the near future.

For traders 17550 or the 20-day SMA could be an important level to notice. Above the same, the index could accelerate to the level of 17800-17850. On the other hand, an uptrend below 17500 would be weak. If the Nifty crosses the 18000 level then, the index could surge to 18300-18350.

Ajit Mishra, VP – Research, Religare Broking:

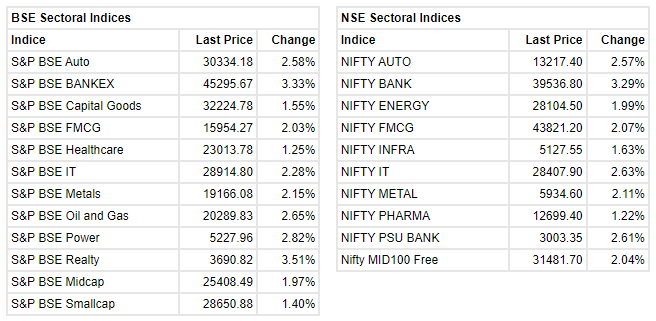

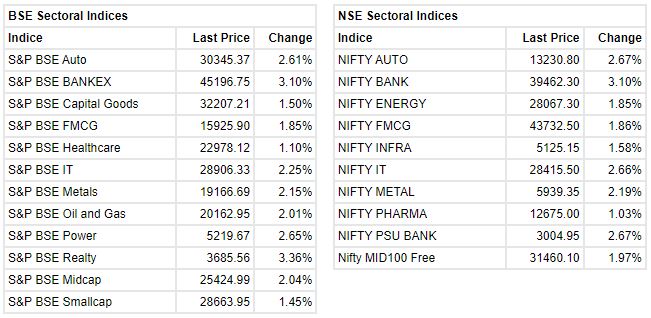

Markets made a remarkable recovery and gained over two and a half percent amid mixed global cues. After the gap-up start, the benchmark moved from strength to strength till the end and settled around the day’s high. All the sectoral indices participated in the move wherein banking and financials contributed the maximum. In line with the trend, the market breadth was also inclined strongly on the advancing side.

Markets have completely engulfed the recent decline with a decisive up move however sustainability would be critical for a further uptick. While the global cues are still mixed, upcoming domestic data like core sector and auto sales numbers will be on the radar for cues. We recommend maintaining a positive yet cautious stance and suggest preferring top-performing sectors like banking, financials, auto, FMCG and realty for long positions.

Rupak De, Senior Technical Analyst at LKP Securities:

Bulls had a grand return as the benchmark index clocked a 2.5% rally on Tuesday following a gap-down closing in the previous session. A strong rally took the index above the recent consolidation sending the 50-EMA above 200 DMA. The RSI on the other hand is still in a bearish crossover. The trend after today’s massive movement looks positive. Over the short term, the index may move towards 18000-18100. On the lower end, support is visible at 17500.

Infosys divests its entire holding in Trifacta for $12 million:

Rupee at close: Rupee ends at 79.45 per US dollar against August 29 close of 79.96 per US dollar.

Devang Mehta,Head – Equity Advisory ,Centrum Wealth:

Indian markets bounced back with renewed vigor after a sharp fall led by the inflation & interest rate rhetoric from the US, a day before. Though India cant decouple with the rest of developed & emerging markets, there is a strong expectation of relative outperformance on the back of improved macros, robust trend in most of the high frequency indicators, progress & coverage of monsoon, lower commodity prices, improvement in credit growth, expectation of big festive demand after a long covid induced slowdown, capex roadmap by public & private sector & improvement in corporate profitability.

Add to it, the growing domestic investor community which has started to believe in the long term equity cult plus the return of Foreign Institutional Investors, make India clearly a market to invest in. There will be days of heightened volatility due to a number of moving parts, but it has to be utilized as an opportunity to buy in adversity.

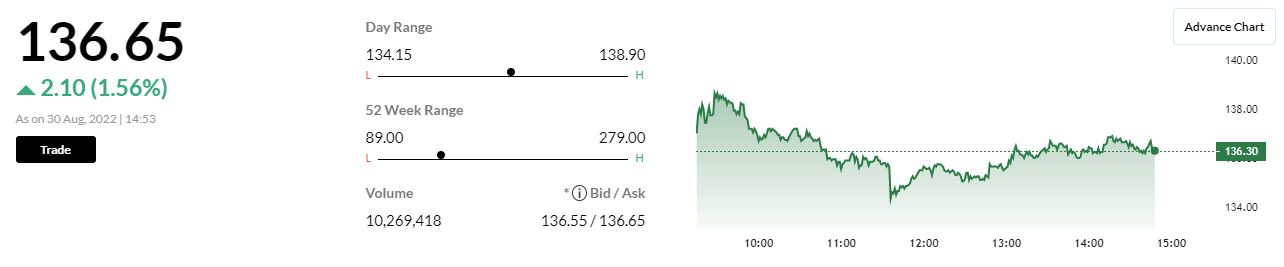

Market at close: Benchmark indices ended the session on August 30 on a robust note with Sensex surging 1,564.45 points or 2.70% at 59537.07, and the Nifty jumping 446.40 points or 2.58% at 17759.30. About 2323 shares have advanced, 1007 shares declined, and 123 shares are unchanged.All the sectoral indices ended in the green led by financials, auto, realty and power. The BSE midcap and smallcap indices added over a percent each.

#CNBCTV18Market | #Market extends gains

Market surges to the high point of the day, #Nifty above 17,750#Sensex adds over 1,500 points, Nifty Bank rises more than 3.3% pic.twitter.com/KaSqkfNa4K

— CNBC-TV18 (@CNBCTV18Live) August 30, 2022

Hitesh Jain, Lead Analyst – Institutional Equities, Yes Securities on Indian Rupee

Indian Rupee is flirting around 80 levels against the US dollar and is likely to scale further lower as Federal Reserve has proclaimed that the US monetary policy probably needs more tightening until inflation is under control. Although the central bank did not provide cues on the size of rate hikes in September and ensuing policy meetings, investors are paring back expectations that the Fed could tilt to a slower pace of rate hikes. For what it’s worth, the Fed funds futures market is now assigning a 70% probability to a 75-basis point rate increase in September. On the INR outlook, it seems the path of least resistance is on the downside. Having said that, USD/INR will likely inch towards the 81 mark but we do not see a major downside as RBI remains committed to preserving the INR in a confined range. Needless to mention, RBI’s war chest in terms of adequate FX reserves to counter the volatility in INR. Also, FII flows into Equities remain positive, while markets will derive courage from an imminent possibility of the inclusion of Indian Bonds in Global Indices.

Market update at 3 PM: Sensex is up 1,429.29 points or 2.47% at 59401.91, and the Nifty added 413.30 points or 2.39% at 17726.20.

Indiabulls Housing Finance approves issue of NCDs for as much as Rs 1,000 crore