Stock Market News, stock market, stock

The market managed to eke out moderate gains amid volatility and rangebound trade in the week ended July 1, continuing the uptrend for yet another week. Tepid global cues and caution ahead of June quarter earnings weighed on the sentiment.

On July 1, a hike in the export tax on oil producers pulled down the oil & gas space as well as the market but later the other sectors participated in the recovery.

The Sensex closed 180 points higher at 52,908 and the Nifty50 rose 53 points to 15,752, supported by auto, FMCG, technology, and metal stocks. In the broader space, the Nifty Midcap 100 index gained half a percent and the smallcap 100 index rose a percent higher.

Consolidation is expected to continue, with all eyes on corporate earnings and global cues, including the release of the Federal Reserve Open Market Committee (FOMC) meeting’s minutes, experts said.

“Participants will be closely eyeing its results for any change in the guidance amid the fear of a global slowdown. Besides, the performance of the global indices, crude movement and updates on the ongoing tussle between Russia-Ukraine will be in focus,” Ajit Mishra, VP-Research at Religare Broking said.

Here are 10 key factors that will keep traders busy during the week:

1) Focus on earnings

The June quarter corporate earnings season will be kicked off by Tata Consultancy Services, the country’s largest software services exporter on July 8 followed by Avenue Supermarts, the operator of the supermarket chain of D-Mart stores, the next day. Hence, there could be some stock-specific action in the market.

The IT sector is expected to see margin pressure, with an increase in attrition, while infrastructure and some cyclical segments may see early signs of a slowdown. Auto and FMCG names could see good numbers for the quarter ended June 2022, experts said.

“The first quarter of the fiscal year 2022-23 earnings season will drive market sentiment and stock-specific actions. Investors should pay careful attention to management commentary and select solid fundamental companies in order to focus on the long-term picture,” Yesha Shah, Head of Equity Research at Samco Securities said.

PTC India, Setco Automotive, GM Breweries, Mysore Paper Mills, Vakrangee, Kohinoor Foods, MMTC, and Scandent Imaging will also release their quarterly earnings scorecard during the week.

2) FOMC minutes

The Federal Reserve will release minutes of its June monetary policy meeting, which will be closely watched by investors globally for economic progress and rate-hike trajectory.

In the June meeting, FOMC raised interest rates by 75 bps, the biggest increase in three decades. Chairman Jerome Powell has hinted at another 50-75 bps increase in rates in the July meeting to control inflation back to its 2 percent target, without impacting economic growth.

3) Oil prices

Oil prices remained volatile, with international benchmark Brent crude futures rising up to $120 a barrel and declining up to $108 a barrel in the passing week before closing 1.4 percent down compared to the previous week. At above $100 a barrel, oil remains a risk for importing countries like India and is expected to cap the market upside till it falls way below that threshold, experts said.

The tight supply due to geopolitical tensions continues to support prices, though recession worries weighed on the sentiment and pulled down prices a bit on weekly basis.

“On last Thursday, the OPEC+ group of producers, including Russia, agreed to stick to its output strategy after two days of meetings. However, the producer club avoided discussing policy from September onwards,” said Tapan Patel, Senior Analyst (Commodities) at HDFC Securities who expects crude to trade sideways to down with resistance at $110 a barrel and support at $102.

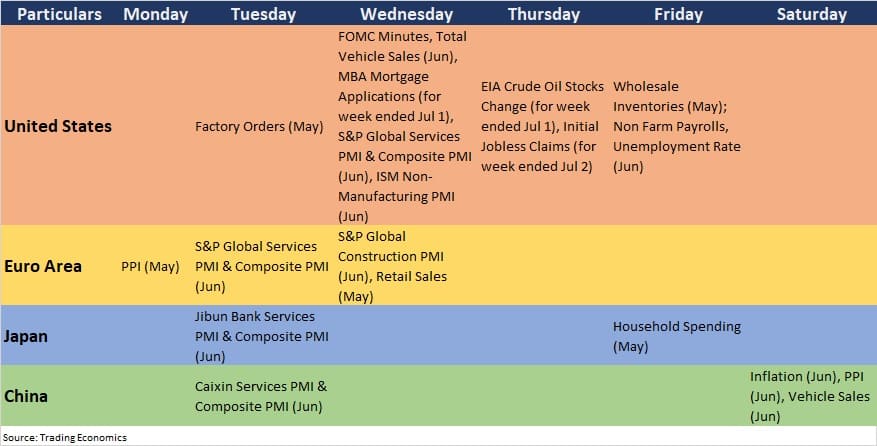

4) Global data points

Here are key global data points to watch out for during the week:

5) Indian rupee

The Indian rupee rebounded from its all-time closing low of 79.06 on June 30 and closed 12 paise higher the next day at 78.94 against the US dollar, snapping a five-day losing streak amid measures taken by the government to curb gold imports that is pressuring current account deficit.

The RBI, too, has been intervening intermittently to support the rupee since February, as the currency sank to its lowest at 79.11 in intraday trade on July 1.

The rupee is under pressure and is expected to remain negative in the coming days due to consistent FII outflow, elevated oil prices, inflation concerns, faster policy tightening by global central and the Ukraine-Russia war, experts said.

6) FII outflow continues

The consistent FII outflow has been wrecking the equity market. Until the Federal Reserve’s policy tightening stabilises and geopolitical tensions ease, the outflow will continue, experts said.

June reported the second biggest monthly FII outflow at Rs 58,112 crore after Rs 65,817 crore in March 2020. The total outflow since October 2021 is around Rs 3.85 lakh crore, though domestic institutional investors managed to compensate to a great extent by buying nearly Rs 3 lakh crore worth of shares in the same period.

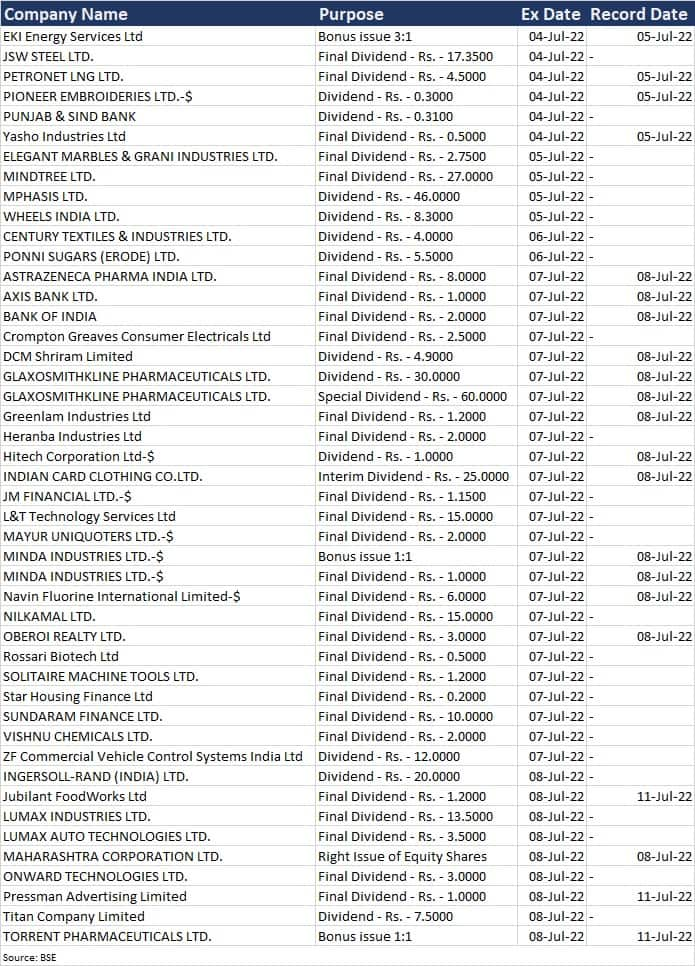

7) Corporate action

Here are key corporate actions taking place in the week:

8) Technical View

The Nifty formed a bullish Hammer pattern on the daily charts on July 1 and a bearish candle, which, too, resembled a bearish Hammer pattern, on the weekly scale.

These are signs of trend reversal and hence there could be a bit of recovery in the coming sessions but the overall trend is expected to be rangebound. Immediate support is at 15,700 followed by 15,500, while 15,900 is likely to be a crucial hurdle followed by 16,170-16,200, which can bring strong bullish bias, experts said.

“A small negative candle was formed on the daily chart with a long lower shadow. Technically, this pattern indicates the formation of the hammer-type pattern (not a classical one). Such market action signals a short-term bottom reversal pattern for the market,” Nagaraj Shetti, Technical Research Analyst, HDFC Securities, said.

This could also indicate a false downside breakout of the small range at 15,700. This is a positive indication, and a further upside can be expected in the short term.

Overall, the short-term trend continues to be rangebound. “But Friday’s sharp upside recovery from the lows hints at the possibility of more upside for the market ahead. A sustainable upmove only above 15,900-15950 levels could bring bulls back into the market and that could possibly pull the Nifty towards the next upside levels of 16,200-16,300 levels quickly,” the market expert said.

9) F&O cues

The options data indicates that the Nifty may see a bit of short-covering towards 15,900-16,000 due to the beginning of the quarterly earnings season but overall, it is expected to be in a broader trading range of 15,300 to 16,300, experts said.

The maximum Call open interest was at 16,500 strike, followed by 15,800, 16,000 and 16,200 strikes, with Call writing at 16,500 strike then 16,200 and 16,100 strikes.

The maximum Put was at 15,500 strike followed by 15,000, 15,600 & 15,400 strikes, with Put writing at 14,700 strike, then 15,400, 15,000 & 15,600 strikes.

“From the data perspective, the Call open interest for the coming weekly settlement is visible at 16,000 strike, while the Put base is placed at ATM 15,600 strike. Hence, positive bias should continue till the Nifty sustains above 15,600. It may witness a move towards 15,900, 16,000 levels in coming sessions,” ICICI Direct said.

10) India VIX

Volatility cooled down by 2.7 percent to 21.25 on Juky 1 but was on the higher side for the week, rising 3.41 percent on week on week.

India VIX, which indicates expected volatility, has to fall and hold below the level of 20 for the markets to stabilise, experts said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.