Amit Pamnani, DGM, Swastika Investmart

The Capital market regulator Sebi came out with the exciting amendment in lock in period rules. This is a welcome move of Sebi at perfect time for the companies looking to list on the stock exchange.

The markets regulator has made it easier for companies to launch initial public offers (IPOs). Also it can be presumed that the Sebi has undertaken the various measures to boost up the economy slowdown due to pandemic.

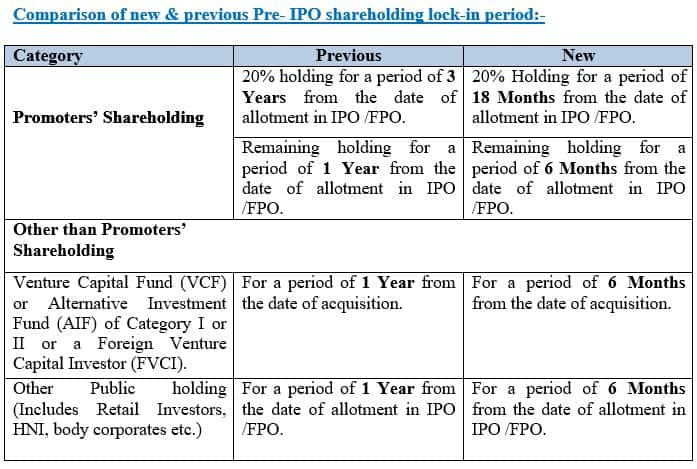

Generally, during lock-in period promoters & investors cannot liquidate the pre-IPO securities held by them. Hence, investors were not able to unlock the value of their funds by liquidating on the stock exchange for the longer period. To ease out this issue, now Sebi has reduced the lock in period for the promoters and all the categories of investors.

Further, in case the majority of the issue proceeds excluding the portion of offer for sale (OFS) is proposed to be utilized for capital expenditure, then the promoter pre – IPO shareholding lock-in period shall be 3 years from the date of allotment in the IPO.

This proposal will also be welcomed by issuer companies which are already funded by Alternative Investment Fund (AIF) of Category I or II or a Foreign Venture Capital Investor (FVCI), private equity firms who earlier were not having the exit or liquidation option before one year. Now they have option to liquidate their holdings after six months from the date of their acquisition.

PayTM, Policybazaar, Nykaa, Mobikwik are coming up with their IPOs on the perfect time as their existing investors will now have the opportunity to get liquidated with this exit route after 6 months from the date of allotment to public in the IPO. Sebi has resolved regulatory hurdles, provide investment flexibility and streamline regulatory processes in the interest of all categories of Investors.

In last 3 months, stock market is experiencing record subscriptions on the back of influx of investors.

The current phase of security market is also attracting the retail Investors and their participation in the IPOs as compared to last few years.

In order to bolster the companies, investors & other stakeholders, Sebi has also made amendments in few other rules & regulations including business responsibility and sustainability reporting, delisting of equity shares, minimum public offer requirements and re-classification of promoters/ promoter groups., SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018, which shall come into force on the date of their publication in the Official Gazette.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.