M&M, Bajaj Finance, SBI Life Insurance, Adani Ports and HUL were among major gainers on the Nifty, while losers included Tata Steel, Tata Motors, Britannia Industries, Power Grid Corporation and ICICI Bank

Indian benchmark indices broke a three-day losing streak to close higher on September 19 ,helped by buying in FMCG and PSU bank names. At close, the Sensex was up 300.44 points, or 0.51%, at 59,141.23, and the Nifty was up 91.50 points, or 0.52%, at 17,622.30.

Granules India | CMP: Rs 321.95 | The company’s share price rose 2 percent after it decided to open its share buyback offer on September 27. The offer will close on October 11. The company will buy shares worth up to Rs 250 crore and the buyback price has been fixed at Rs 400 a share.

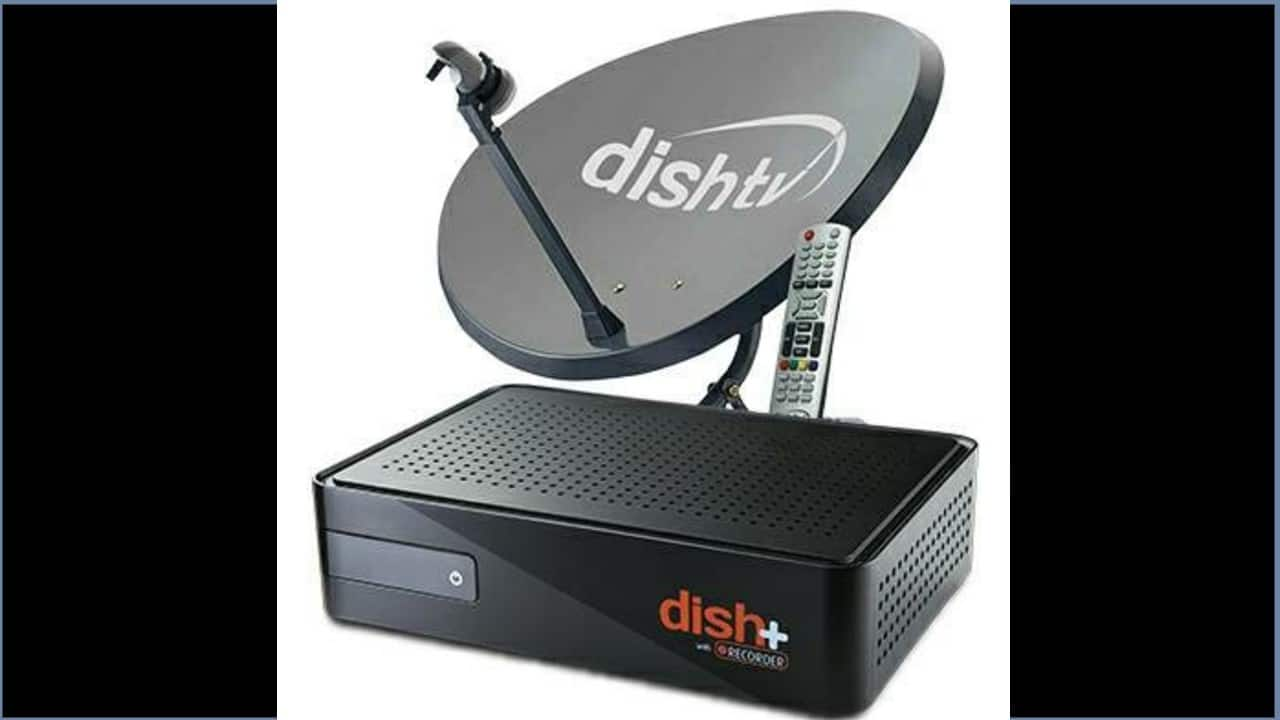

Dish TV India | CMP: Rs 16.77 | Shares of Dish TV India rose 10 percent after the company said its chairman has resigned from his position as promised. “We wish to inform you that Jawahar Lal Goel, Director of the Company, vide his letter dated September 19, 2022, has tendered his resignation from the Board of Directors of the Company and committee(s) thereof with effect from the close of business hours of September 19, 2022,” the company said in a regulatory filing.

Ambuja Cements | CMP: Rs 564.95 | The share price touched a 52-week high of Rs 572.25, gaining 9 percent after Adani Group, through its special purpose vehicle Endeavour Trade and Investment, completed the acquisition of Ambuja Cements and ACC. The transaction involved the acquisition of Holcim’s stake in Ambuja and ACC along with an open offer in both entities. The value of the Holcim stake and open offer consideration for Ambuja Cements and ACC is $6.50 billion. Soon after Adani’s takeover, the two cement firms announced the resignation of their board of directors, including the CEOs and CFOs. The board of Ambuja Cements approved an infusion of Rs 20,000 crore into Ambuja by way of preferential allotment of warrants. Research house Jefferies raised consolidated EBITDA estimate for Ambuja by ~20%/30% for FY24/FY25 on higher volumes and EBITDA/T assumption. Upgrade Ambuja to buy (Target Rs 620) and also retain buy to ACC (Target Rs 3,030).

Indus Towers | CMP: Rs 197.75 | The share price fell 3 percent after Bimal Dayal resigned as the managing director and CEO of the company and as a director of the board. Till the time the vacancy is filled, Tejinder Kalra, the Chief Operating Officer and Vikas Poddar, the Chief Financial Officer, will be jointly responsible for the functioning of the company under the guidance of the board and the chairman.

Mafatlal Industries | CMP: Rs 377 | The company share price added 5 percent after its Board of Directors gave approval for the sub-division of existing equity shares from one equity share (face value Rs 10 each) into five shares (face value Rs 2 each). The record date for the split will be intimated in due course.

SAL Steel | CMP: Rs 11.34 | The share price rose 5 percent after the company said it will supply ferro chrome to AIA Engineering. It has entered into a supply agreement for three years with AIA Engineering on a non-exclusive basis, while AIA Engineering also agreed to provide a secured inter -corporate deposit of Rs 125 crore to the company, which will be used to repay its loan or for working capital requirements.

Bajaj Finance | CMP: Rs 7,493.10 | The share price rose nearly 3 percent on September 19 after broking firm Jefferies kept a “hold” rating on Bajaj Finance and raised the target price to Rs 8,000 from Rs 7,300 a share. “The company has a shot at being the first NBFC to launch credit card if RBI approves. The credit card will enable the company to take the product to deeper markets, the brokerage house said.

Delta Corp | CMP: Rs 215.15 | The share price slipped 4.5 percent after the company clarified that it had not received a licence for a casino in Daman. In an exchange filing dated September 16, the company said “We have been made aware that there are various online articles and social media posts claiming that the UT Administration of Daman and Diu has granted casino licenses inter alia to Deltin Hotel, Daman. Please note that neither the Company nor its subsidiaries has received any communication from the U.T. Administration of Daman and Diu regarding grant of any such license and we cannot verify the authenticity of such claims.”

Welspun Corp| CMP: Rs 266.75 | The share price touched a 52-week high of Rs 271.95, rising nearly 8 percent after the company secured an order for a carbon capture pipeline project in the United States. This order is for the supply of 785 miles (1,256 KM) or 100,000 MT (approximately) of high- frequency induction welding (HFIW) pipes and would be used for transporting captured carbon dioxide. “The pipes for this order will be produced from Welspun’s Little Rock plant in the US and the same will be executed in FY 23‐24,” the company said.

Indo-National | CMP: Rs 409.95 | The share price surged 20 percent on September 19 after the company subsidiary Kineco bagged a Rs 113 crore order for the supply and installation of modular interiors for Vande Bharat semi-high speed trains (originally called Train 18), from its esteemed customer, Integral Coach Factory, Chennai.

Rakesh Patil