It was a shocker for Rajiv, a 25-year-old engineering student in Chennai, when he received back-to-back calls from family members and friends last month seeking details of his loan default and offering monetary assistance to come out of the debt-trap.

Rajiv had drawn a Rs 50,000 loan from one of the digital lending apps for purchasing his bike. He couldn’t return the money within the stipulated period. Rajiv found that the app company had tracked down his contact details stored on the phone and started contacting them to flag the default. He managed to get some funds and pay back to the lender in the next two days.

Rajiv refused to divulge his identity or other details citing the sensitivity of the issue.

Not everyone is as lucky as Rajiv.

A few recent cases where borrowers allegedly ended lives following harassment from app-based loan financiers have put the focus back on tech-based loan sharks.

New-age loan sharks

These entities are no different from illegal moneylenders who have been operating in India for ages and typically lend against land or gold ornaments to low-income groups. They too, like typical moneylenders, engage in coercive lending practices to get their money back. Naming and shaming the borrower among his/her contacts is common.

The only difference is that the new crop of money lenders use technology to canvass loans especially to the young customer segment for consumption-related purposes. Unfortunately, there are no regulations in place now for digital lenders.

“Right now, there are no regulations to govern digital lending apps with respect to their structure and existence. These are fly-by-night operators. From the apps per se it is not clear as to what is their structure,” said Raman Aggarwal, Chair-NBFCs at Council for International Economic Understanding (CIEU).

According to industry observers, there are many Chinese apps which are active in the digital lending space allegedly leaking personal data and often harass their borrowers and family members at the first sign of loan default.

How do illegal app-based financiers work?

Here is how the illegal financial apps work.

These entities source money from somewhere (mostly unknown individuals) to on-lend to borrowers at usurious rates of interest for a very short tenure starting from 7 days to 15 days.

The average loan amount varies from Rs 3,000 to Rs 50,000.

The interest rate charged can vary from 60 percent to 100 percent as against a regular microfinance loan where lending rate is typically in the range of 22-25 percent and a bank loan with 7-12 percent lending rate.

How do these firms reach out to prospective borrowers?

“They use a variety of ways starting from advertising in market places to sending bulk messages and emails,” said an industry official who didn’t want to be named.

“The lure of quick money with no documentation traps gullible people easily,” said the person.

As against the regular documentation and KYC process, illegal-loan apps offer ‘hassle-free’ quick loans with practically no checks–an offer that many can’t refuse. You get the money in a few minutes in cash once you download the app and apply for the loan.

There will be no background checks and no income verification. The understanding will be that the money is returned in a week’s time with the interest component. The story, however, changes when you default on the loan amount.

The moment loan payment is defaulted, the representatives of the loan agency will start calling the defaulter over phone and even get in touch with the family members and other contacts in the customer’s phone list.

Google removed five digital lending apps from Playstore, the Times of India reported in November this year. These include OK Cash, Go Cash, Flip Cash, E Cash and SnapItLoan, the report said. Moneycontrol couldn’t immediately reach out to these apps for a response to this story.

‘Good ones’ & ‘bad ones’

There is no clear definition of what is an illegal digital lender or an app-based financier.

App-based digital lenders have been in business for a long time. There are many which work with leading banks and NBFCs following proper KYC norms, said Anuj Kacker, Co-founder and COO of Moneytap and Executive Committee member of Digital Lenders’ Association of India (DLAI), a body of digital lenders and fintech companies.

Among the 80 members of the association, around 50 are pure digital lenders while the remaining consists of tech companies and others like law firms.

“Digital lending apps like ours work with only big banks and NBFCs. The loan agreement is signed between the customer and the bank,” said Kacker.

These digital lenders typically charge a commission of 1-3 percent from banks which originate the loan. The interest rate charged to the borrower can range up to 25 percent for a tenure of three months to up to five years.

As against this, the ‘bad ones’ source money from dubious sources and offer loans for a very shorter tenure. The loan agreement is often signed between the borrower and the loan agency (not with the lender).

“We have formulated a code of conduct for our members to strictly adhere to the guidelines on sourcing of funds and KYC/ documentation processes. While digital lenders are a facilitator or interface between customers and lenders, the bad ones are akin to illegal moneylenders or loan sharks,” said Gaurav Chopra, Founder of IndiaLends and Executive Committee member of DLAI. Gaurav said IndiaLends doesn’t involve in the collection process.

According to the website of DLAI, the body was formed in the year 2016 by a clutch of companies – Capital Float, NeoGrowth, Zest Money, LendingKart, KredX , Indifi, IndiaLends, MoneyView and UPF Limited “with the primary objective of bringing together digital lenders to create a platform for sharing best practices and work with regulators.”

So how does one differentiate between good digital lenders from the bad ones?

“Make sure proper KYC norms are followed and loan agreement is between the bank and the borrower. Be careful when the loan is offered with no documents for too short a tenure,” said Kacker.

Regulator takes note

On December 23, the RBI issued a caution against unauthorised digital lending platforms and mobile apps saying there have been reports about individuals/small businesses falling prey to a growing number of unauthorised digital lending platforms/mobile apps on promises of getting loans in a quick and hassle-free manner.

“Members of public are hereby cautioned not to fall prey to such unscrupulous activities and verify the antecedents of the company/ firm offering loans online or through mobile apps. Moreover, consumers should never share copies of KYC documents with unidentified persons, unverified/unauthorized Apps and should report such Apps/Bank Account information associated with the Apps to concerned law enforcement agencies or use Sachet portal (https://sachet.rbi.org.in) to file an on-line complaint,” the RBI said.

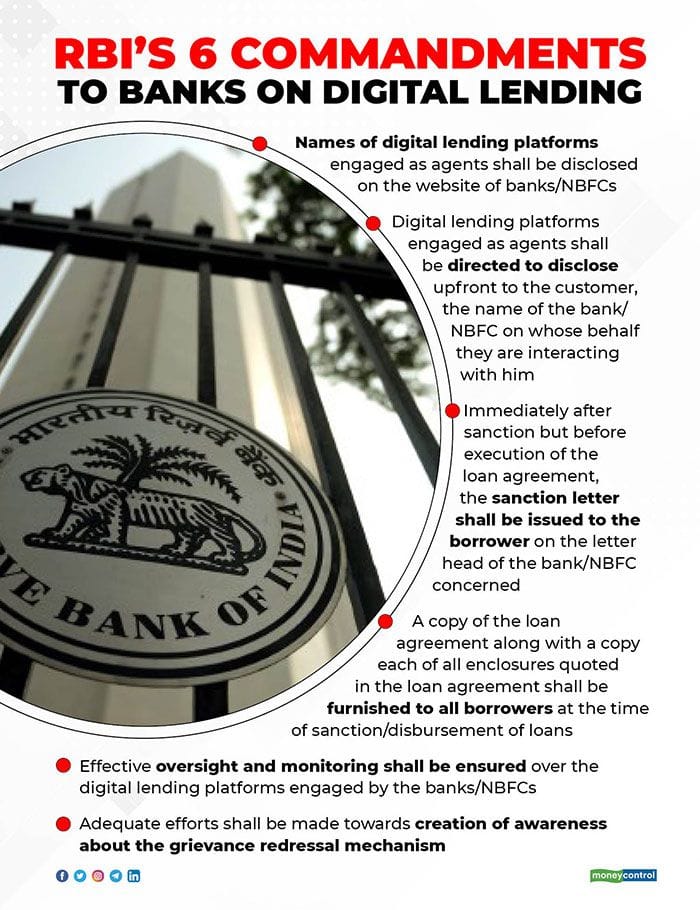

Presently, there are no strong RBI regulations to control digital lending apps. But the rampant increase of shoddy digital lenders has alerted the RBI. On June 24, the RBI asked banks and non-banking financial companies (NBFCs) to make sure they adhere to the fair practices code guidelines in letter and spirit while lending through digital platforms.

This is irrespective of whether they lend through their own digital lending platform or through an outsourced lending platform, the regulator said.

The RBI said this after observing that lending platforms tend to portray themselves as lenders without disclosing the name of the bank/NBFC at the backend, as a consequence of which, customers are not able to access grievance redressal avenues available under the regulatory framework. “Of late, there are several complaints against the lending platforms which primarily relate to exorbitant interest rates, non-transparent methods to calculate interest, harsh recovery measures, unauthorised use of personal data and bad behaviour,” it stated.

Many digital platforms have emerged in the financial sector claiming to offer hassle-free loans to retail individuals, small traders and other borrowers, the RBI said, adding banks and NBFCs are also seen to be engaging digital platforms to provide loans to their customers. In addition, some NBFCs have been registered with the RBI as ‘digital-only’ lending entities while some NBFCs are registered to work both on digital and brick-mortar channels of credit delivery, the regulator said.

What lies ahead?

According to Aggarwal of CIEU, there is a dearth of regulations to govern digital lenders. “Currently, lending done by individuals is not regulated under any statutes as long as they do not access public deposits. Recent incidents should be a wake-up call for the regulator to draw the line,” Aggarwal said.

While agencies acting as mediators between banks and borrowers on a commission basis is fine, the issue arises when apps source money from dubious sources and lend from their books staying out of regulation, Aggarwal said.

Till the time the regulatory gaps exist, the problem of illegal money apps will persist. The suicide cases associated with illegal lending apps are a reminder of the 2010 Andhra Pradesh microfinance crisis which happened after a series of borrower suicides by certain microlenders who resorted to coercive recovery practices and charged usurious rates. The crisis prompted the RBI to enact new laws to regulate NBFC-MFIs.