Vanguard Total Stock Market Index Fund ETF is one of the largest passively managed US-based ETFs and also among the cheapest funds

Last month, Navi mutual fund filed a draft offer document with SEBI for a new mutual fund scheme. Called the ‘Vanguard Total Stock Market ETF FoF,’ this fund of fund will invest in Vanguard Total Stock Market Index Fund ETF (VTI). VTI is one of the largest passively managed US-based ETFs and also among the cheapest funds.

Vanguard, founded by John C. Bogle, was the pioneer of low-cost index funds. This ETF’s expense ratio is just 0.03 percent. Navi’s FOF would, therefore, be among the cheapest (with charges of up to 0.09 percent). VTI, the underlying fund, is the third largest ETF in the world. VTI tracks the CRSP US Total Market Index which represents nearly the entire investable equity US market.

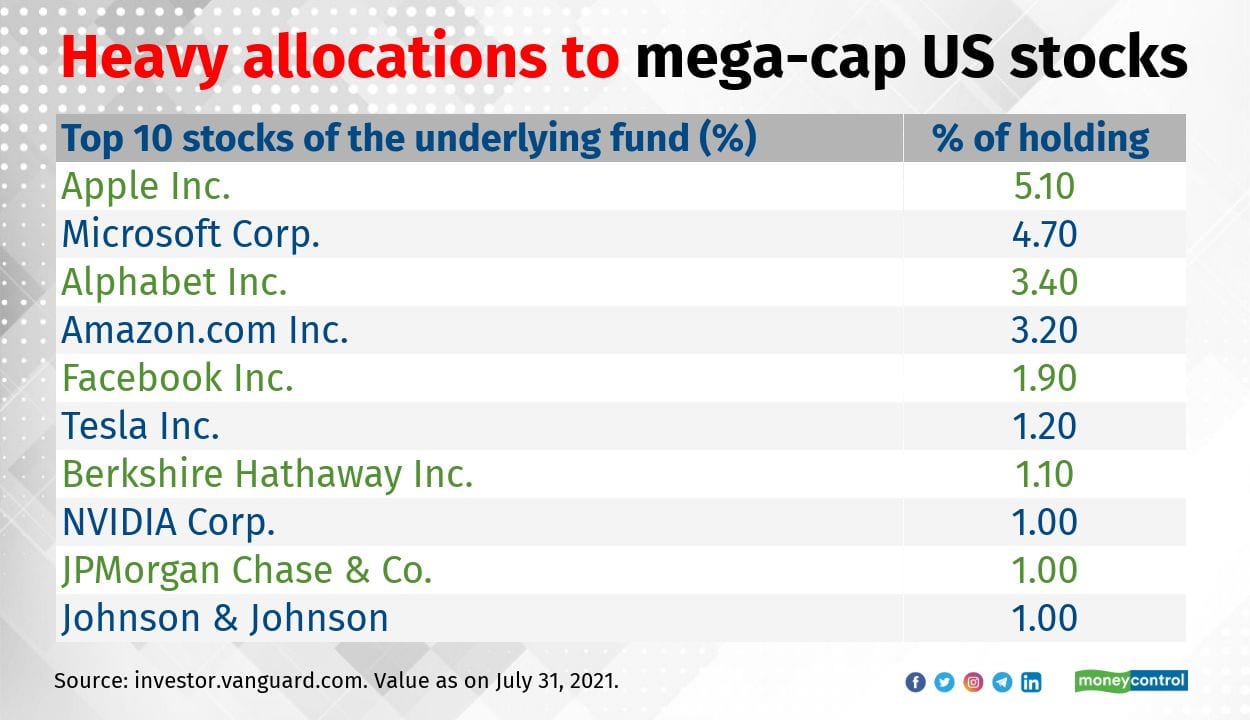

Though VTI invests in US equities of all sizes, including mid, small, and micro capitalization companies, it has heavy allocations to the most popular names such as Apple, Microsoft and Alphabet. Its top 10 holdings account for 23.6 percent of the total assets.

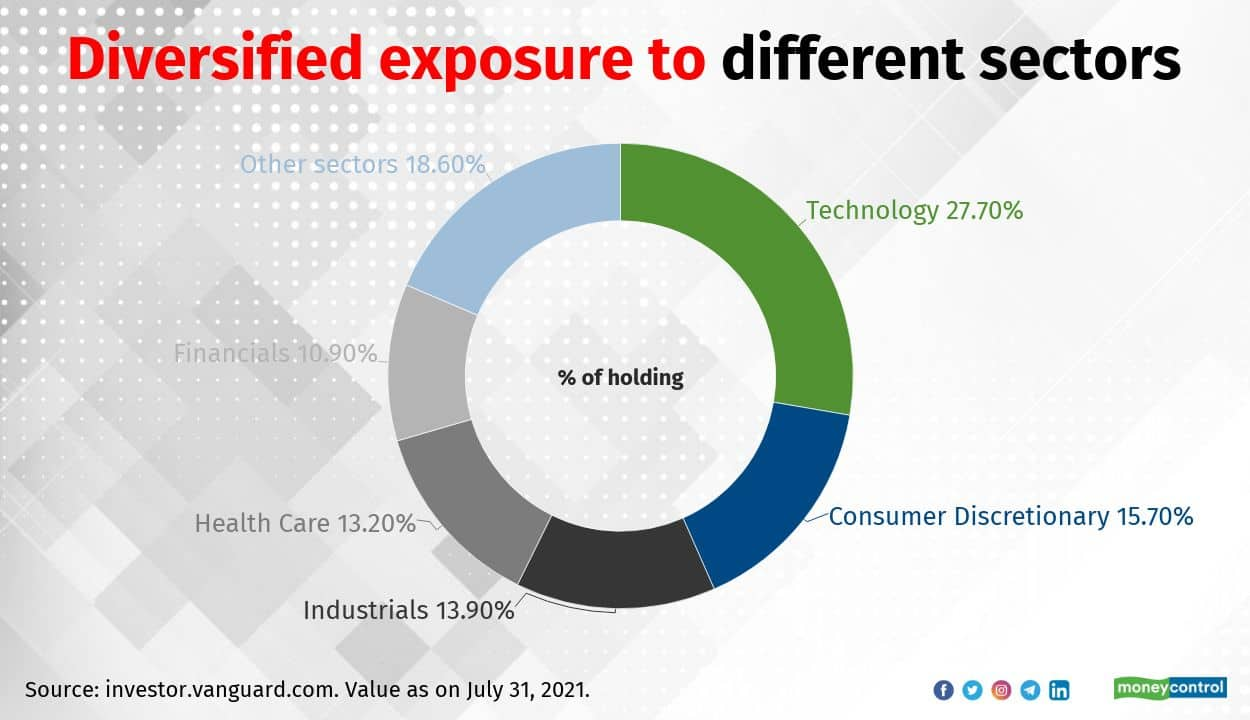

CRSP US Total Market Index, the benchmark for the Vanguard ETF, is a diversified, comprehensive and broader index having exposure to different sectors. On the contrary, most of the US-focused funds offered by domestic mutual funds in India are investing majorly in technology stocks.

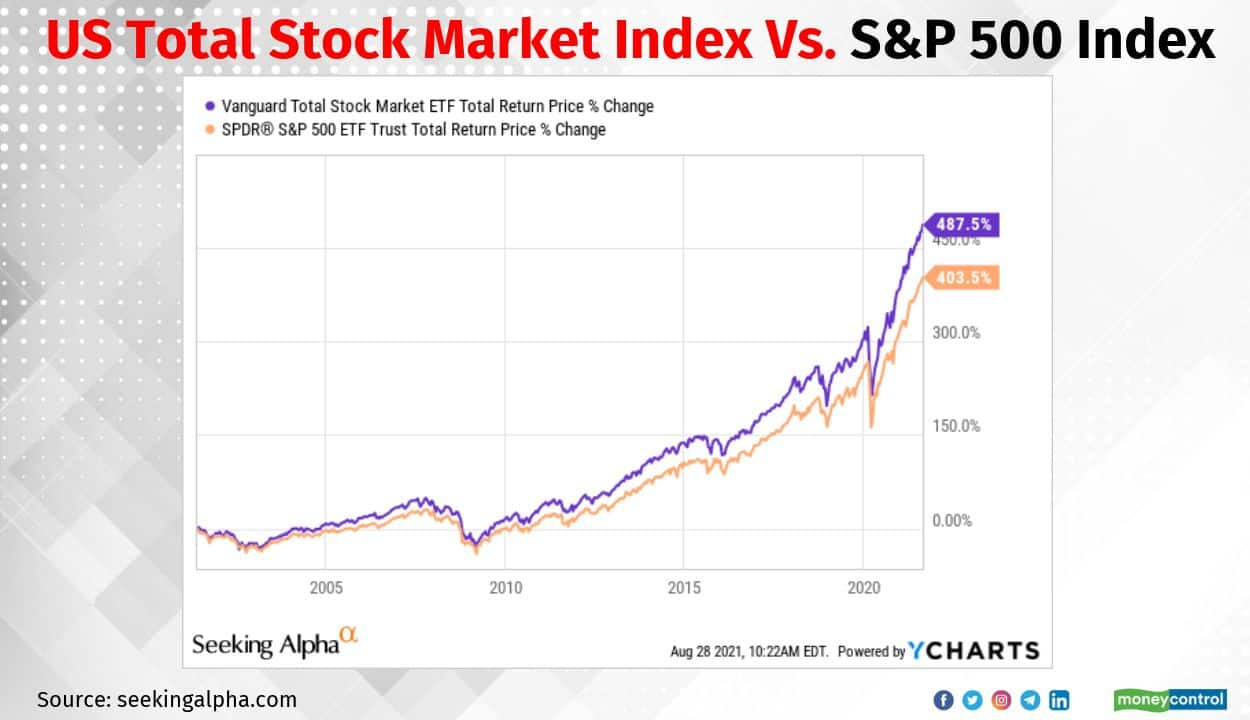

According to a recent report published in the seekingalpha.com, VTI has outperformed its closest peer ETFs that track the S&P 500 index over long run. Unlike most other broad-based US indices, the underlying benchmark index for this fund invests in companies across market capitalisation, including small-cap stocks. That is one reason behind its strong performance. But that also makes it slightly more volatile than other broad-based indices.

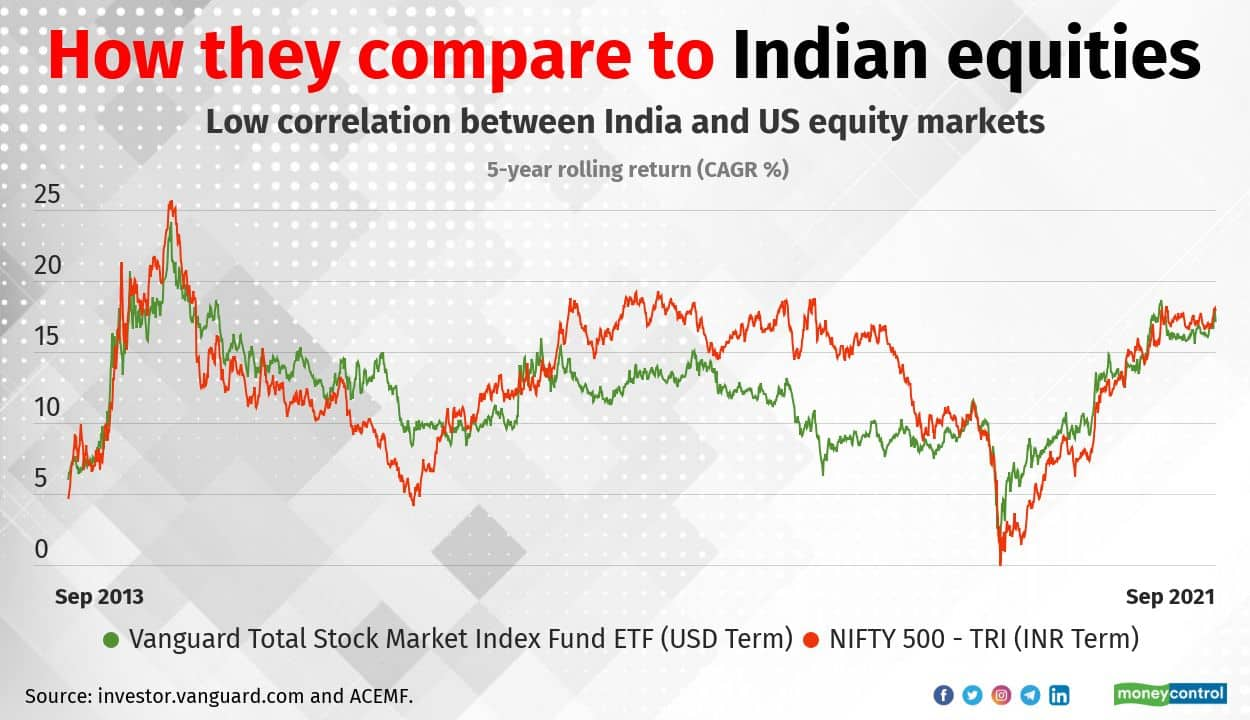

US Equity markets have been one of the most developed in the world. This fund will help Indian investors participate in stocks and sectors that are otherwise not available in India. A low correlation between the equity market of US and India certainly makes the case for Indian investors taking the US route.

International funds, including US-focused ones, are taxed as debt funds. Long-term capital gains tax is applicable at 20 percent with indexation on the profit, if you sell units after 36 months. Capital gains are added to your income and taxed if the holding period is less than 36 months.

Dhuraivel Gunasekaran