Purely looking at the operational performance, Vodafone Idea’s EBITDA stood at close to Rs 4,400 crore while the interest and finance charge stood over Rs 4,600 crore.

Aditya Birla Group’s telecom arm Vodafone Idea is crumbling under a mountain of liabilities with net debt at Rs 1.8 lakh crore at the end of FY21. The company has stated that its inability to raise funds and the present financial condition has put a question mark on their ability to service debt and pay AGR & spectrum dues. The company in a statement has admitted to this situation as “Material Uncertainty Related to Going Concern.”

Vodafone Idea as part of its statement with the Q4FY21 results states, “The Company’s financial performance has impacted its ability to generate the cash flow that it needs to settle/ refinance its liabilities and guarantees as they fall due, which along with its financial condition is resulting in material uncertainty that casts significant doubt on the Company’s ability to make the payments mentioned therein and continue as a going concern.”

In September 2020, the company had announced plans to raise Rs 25,000 crore and reached out to several investors but has not been successful in their endeavours. Vodafone Idea states, “The said assumption of going concern is essentially dependent on its ability to raise additional funds…”

No Investor In Sight

Moneycontrol had sent a detailed questionnaire to Vodafone Idea on their ability to raise funds and service the liabilities ahead of the result announcement. Several sources told Moneycontrol that the investors needed comfort on two aspects, government’s support to the company to stay afloat and promoters infusing equity capital. Both conditions being uncertain the investors we spoke to shied away from any investment of either equity funding or debt refinancing at Vodafone Idea.

Vodafone Idea’s Ballooning Liabilities

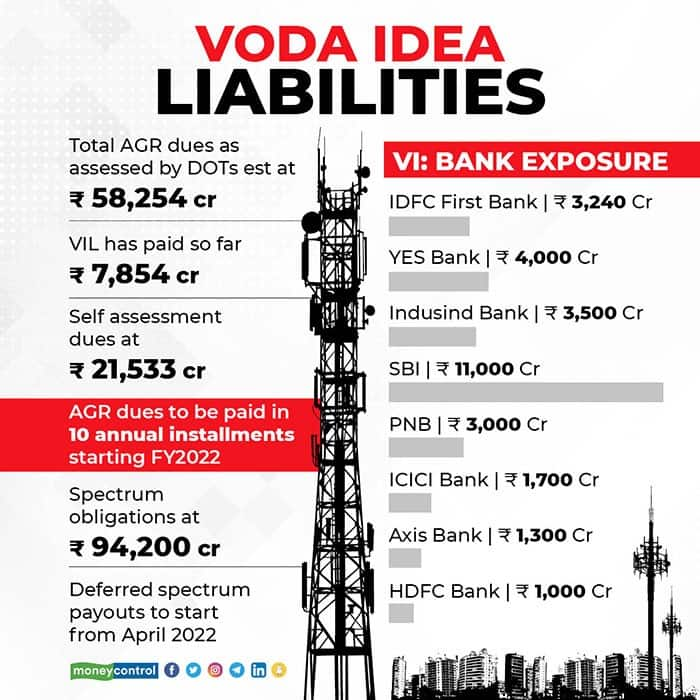

Vodafone Idea’s liabilities are three part, exposure to banks of close to Rs 30,000 crore, spectrum dues of Rs 94,200 crore and deferred payouts start from April 2022 and AGR dues which is conflicted in its actual quantum. Total AGR dues as assessed by DOT is estimated at Rs 58,254 crore. VIL has paid so far Rs 7,854 crore and the company’s self assessment of dues stand at Rs 21,533 crore. AGR dues are to be paid in 10 annual installments starting FY22.

Bank Exposure A Concern

Eight top banks led by SBI have large exposure to Vodafone Idea. In terms of percentage to book, IDFC First Bank, YES Bank, IndusInd Bank top the list. On September 4, 2020 the company said that it had “successful negotiations with lenders on continued support, refinancing of debts, monetisation of certain assets” and then embarked on the fund raising exercise for sustainability of business.

Sources told Moneycontrol that SBI has represented the lenders of Vodafone Idea and written to the Ministry of Finance for a “reconsideration of AGR computation issue.”

A senior banker on condition of anonymity told Moneycontrol, “It is required to be addressed by the government or else the banks will not be in a position to support the telecom sector with 5G spectrum auctions also in the pipeline.”

He also shared, “If AGR issue is solved then Vodafone Idea will be viable to service its debt.”

Duopoly In Telecom Sector?

Not just the lenders, pressure has been mounting on the government from the promoters of Vodafone Idea for a while, Aditya Birla Group Chairman Kumar Mangalam Birla had said that the company would not put good money after bad and shut shop if the government did not give relief to Vodafone Idea.

He echoed Vodafone Global CEO Nick Read who had said Vodafone Idea would head for liquidation if the government did not offer relief to the telcos.

Aditya Birla Group holds 27.66 percent stake in the telco, while Vodafone holds 44.39 percent.

Arch rival of Birla, Sunil Bharti Mittal of Airtel recently said in Qatar Economic Forum that duopoly will be “tragic” and a large country like India needed 3 players.

Is AGR The Only Issue?

Vodafone Idea has seen a sharp decline in its overall performance on almost all metrics in the recent past. Shrinking market share, subscriber base and with the lack of ability to scale up 4G, 5G may even question its relevance in the near future.

Company statement says, “We continue to invest in 4G to increase our coverage and capacity. We have also started to actively upgrade our 3G network to 4G.”

“Struggling to service liabilities the company may not be able to even spare 10% of sales for capex which is an industry standard,” an analyst pointed out. While the rest of the sector gears up for 5G spectrum auctions, Vodafone Idea is pointing to the ability to be a going concern given the present financial condition.

Vodafone Idea on June 30 reported a consolidated net loss of Rs 7,022.8 crore for the quarter ended March 31, 2021. It had posted a loss of Rs 11,643.5 crore in the corresponding quarter of the previous fiscal. In the December quarter, the company’s loss stood at Rs 4,532.1 crore.

For the full financial year 2020-21, the debt-ridden telecom firm’s net loss came in at Rs 44,233.1 crore against Rs 73,878.1 crore in the previous financial year.

Purely looking at the operational performance, Vodafone Idea’s EBITDA stood at close to Rs 4,400 crore while the interest and finance charge stood over Rs 4,600 crore.

Equity analyst, Prakash Diwan says, “In the absence of any price hikes in the quarter gone by and widening losses from its operations, VI will get further pushed into a state of uncertainty that can only make the task of convincing investors to participate in its fund raising program even more difficult.”

The subscriber base of Vodafone Idea has been consistently declining since more than a year. Present subscriber base stands at 267.8 million in Q4FY21, a QoQ decline of 2.0 million. ARPU for Q4FY21 declined to Rs 107 vs Rs 121 in Q3FY21, on account of removal of IUC, adjusting for which ARPU was broadly flat this quarter, Vodafone Idea said.

Vodafone and Idea announced a merger worth $23 billion telecom behemoth in 2017 to become the largest player in India in terms of subscriber base.