Recent public issues from the defence sector seem to be simmering with overwhelming subscription by retail, high networth and qualified institutional investors with blockbuster returns.

Investors are now awaiting Kaynes Technology India Ltd, which provides manufacturing and life-cycle support for players in the automotive, industrial, aerospace and defence, outer-space, nuclear, medical, railways, internet of things (IoT), IT and other segments, share issue that will hit the markets on November 22.

The Rs 858-crore issue has seen subscription over 34 times on the last day of bidding. Grey market premium of the Kaynes Technology trading massive 40 percent higher or at Rs 235 a share. The IPO has set an issue price at Rs 587 a share.

Many brokerages have given subscribe ratings to the issue. Based on the FY22 earnings, Kaynes is valued at 82x P/E, 38x EV/EBITDA and 5x EV/Sales. “The valuation which we believe is fairly priced considering its decent historical growth, strong revenue visibility and growing demand of automation across underlying industries,” Anand Rathi said in its report.

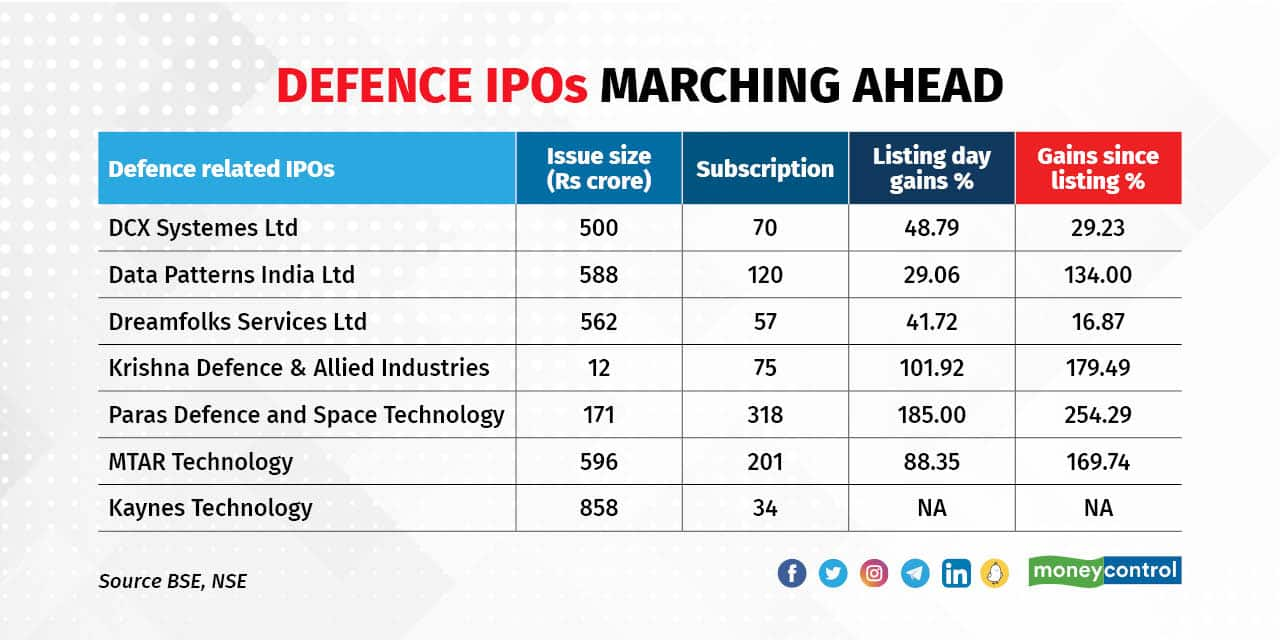

Companies such as DCX Systems Ltd, Data Patterns India Ltd, Dreamfolks Services Ltd, Krishna Defence & Allied Industries Ltd, Paras Defence and Space Technology Ltd and MTAR Technology that came out with IPOs in recent times saw huge response. All these firms gave bumper returns on the listing day and so far.

DCX Systems Ltd, a defence system integration company, raised around Rs 500 crore through IPO which got subscription nearly 70 times. The stock jumped 49 percent on the listing day and till date have over 29 percent premium from its issue price. Data Patterns India Ltd which supplies electronic systems to defence and aerospace sector, listed with 30 percent gains and currently trades 134 percent higher from its issue price.

Dreamfolks Services Ltd, airport service aggregator, trades 17 percent higher from its issue price while on listing day it jumped nearly 42 percent. The issue got subscribed over 57 times. Krishna Defence & Allied Industries jumped over 100 percent on listing and now trading nearly 180% from its issue price.

Paras Defence and Space Technology, the biggest subscribed IPO of 2021, advanced nearly 185 percent on the listing day and is over 254 percent higher from its issue price. MTAR Technology Ltd got subscription over 200 times and advanced 88 percent on the listing day. It is trading nearly 169 percent from its issue price.

The other defence-related stocks are also doing excellent in this volatile market. Among the lot, shares of Mazagon Dock Shipbuilders Ltd, Garden Reach Shipbuilders & Engineers Ltd, Cochin Shipyard Ltd, Bharat Dynamics Ltd, Hindustan Aeronautics Ltd soared between 69 percent and 241 percent since April 1. Bharat Forge Ltd, Bharat Electronics Ltd and Larsen & Toubro Ltd jumped 14-50 percent. The benchmark Sensex and Nifty rose 4.4 percent each in this period.

All the defence stocks came into the limelight after Budget 2022 when the finance minister said in her speech that the prioritisation given to the domestic defence industry and the need to strengthen research and development. The defence ministry allotted Rs 5.25 trillion, up 10 percent from its Rs 4.78 trillion allocated last year. This has been the sharpest increase in the defence budget in recent years.

After this allocation, the Defence Ministry has decided to earmark around 64 percent of its modernisation funds under the capital acquisition budget for 2021-22 — a sum of over Rs 70,000 crore — for purchases from the domestic sector. Analysts had welcomed the step towards encouraging Atmanirbhar Bharat and Make in India and said it will have a positive impact post this earmark. It will have a multiplier effect on many industries including MSME and startups and will also increase employment in the defence sector, they added.

“Defence sector has been in full glory since the GOI has announced its list of defense related material/equipment to be manufactured in house. That has brought cheers to the sector as it has provided visibility of volumes and cost savings impacting profitability positively,” said Ashwin Patil, Senior Research Analyst at LKP Securities.