Kotak Mahindra Bank share price jumped almost 6 percent in the morning trade on June 2 after billionaire banker and Managing Director Uday Kotak reportedly agreed to sell stake worth around Rs 6,000 crore in the private sector lender.

The aim is to comply with a settlement agreement struck with the Reserve Bank of India (RBI) in January on promoter stake dilution, sources told Moneycontrol.

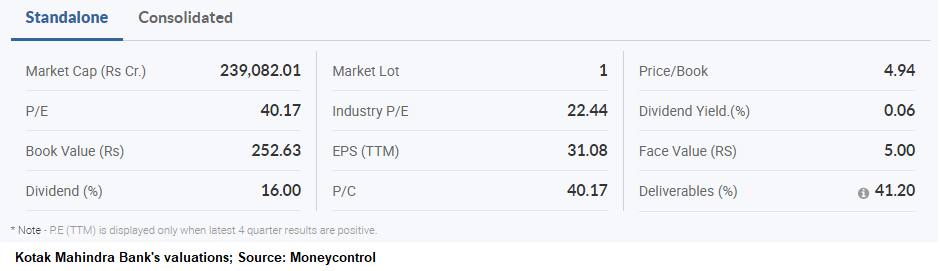

The stock price is the top index gainer and has witnessed a spurt in volume by more than 212.23 times. It was quoting at Rs 1,307.15, up Rs 57.90, or 4.63 percent. It has touched an intraday high of Rs 1,327.50 and an intraday low of Rs 1,299.40.

The scrip was trading with volumes of 56,178,355 shares, compared to its five day average of 356,918 shares, an increase of 15,639.85 percent.

The move to sell stake will bring the curtains down on an extended standoff between the regulator and the bank over the reduction in promoter shareholding.

“The promoter stake sale will happen via a block, which is likely to be launched shortly. Kotak Mahindra Bank has already issued shares as part of the recent Rs 7,000 crore qualified institutional placement (QIP), so Kotak may not have to sell 4 percent stake to meet the 26 percent promoter stake requirement, which was the case earlier,” a person familiar with the stake sale plans said.

“Morgan Stanley, Goldman Sachs and Kotak Securities are the advisors to the block deal,” a third person added.

With this settlement agreement, the bank has decided to withdraw the writ petition filed in the High Court of Bombay after RBI struck down its proposal to issue perpetual non-convertible preference shares to comply with promoter shareholding norms. On February 18, RBI granted final approval to the settlement between both parties.

For more details on the origin of the Kotak-RBI battle, the rules of the game and the reason behind the regulator’s objection to the bank’s stake dilution strategy, please read this Moneycontrol explainer dated December 14, 2018.

The Uday Kotak-led private sector lender Kotak Mahindra Bank on May 13 reported standalone profit of Rs 1,266.6 crore for the quarter ended March 2020, registering a 10 percent fall due to a significant jump in COVID-19 related provisions.

Provisions and contingencies shot up 6-fold to Rs 1,047.47 crore in Q4FY20 against Rs 171.26 crore in the same period last year, while the sequential rise was 135.9 percent. Net interest income, the difference between interest earned and expended, grew by 17.2 percent year-on-year to Rs 3,559.65 crore for March quarter, with net interest margin improving 26 basis points YoY to 4.72 percent in Q4.

Moneycontrol Ready Reckoner

Now that payment deadlines have been relaxed due to COVID-19, the Moneycontrol Ready Reckoner will help keep your date with insurance premiums, tax-saving investments and EMIs, among others.