New Business Premium of top 6 life insurance companies

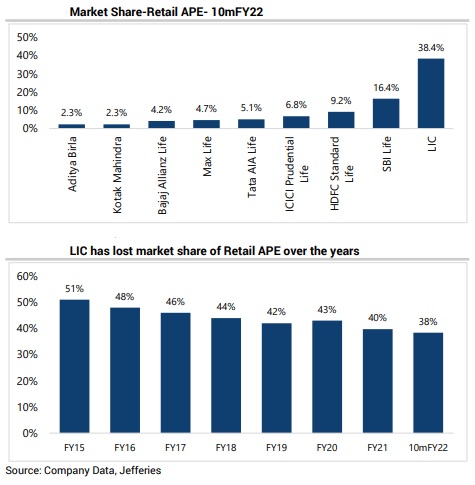

LIC has lost its market share of retail annual premium equivalent over the years, but still overall retail APE remains much higher than peers.

Interest rate fluctuations is one of the risks, says BOBCAPs

A sustained decline in interest rates may result in a reduction of rate assumptions used to calculate statutory policy liabilities, which could have a material adverse effect on the company’s financial condition and results of operations. This, in turn, could require the company to take actions, such as realigning of discretionary benefits to policyholders or capital funding from shareholders, or a combination of both.

Similarly, any increase in interest rates could lead to higher levels of surrenders and withdrawals of existing policies as policyholders seek to buy products with perceived higher returns – this may require LIC to sell the invested assets and make cash payments to policyholders at a time when prices of those assets are declining, leading to losses.

LIC IPO Day 4: Issue subscribed 1.63 times

Country’s largest life insurance company Life Insurance Corporation of India has opened its Rs 21,000-crore public issue for subscription for fourth day. The offer, so far, has subscribed 1.63 times, garnering bids for 26.35 crore equity shares against IPO size of 16.2 crore shares.

The portion set aside for retail investors has been subscribed 1.43 times, employees 3.49 times and policyholders 4.58 times, while qualified institutional buyers bid 67 percent shares of allotted quota and non-institutional investors 106 percent.

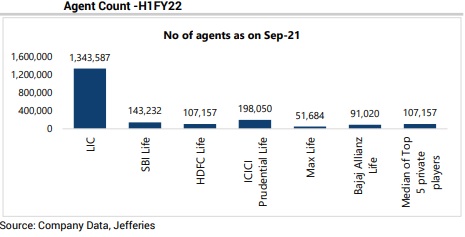

LIC had 13.43 lakh agents as of September 2021

LIC IPO Day 4: Issue subscribed 1.6 times

Country’s largest life insurance company Life Insurance Corporation of India has opened its Rs 21,000-crore public issue for subscription for fourth day. The offer, so far, has subscribed 1.6 times, garnering bids for 25.88 crore equity shares against IPO size of 16.2 crore shares.

The portion set aside for retail investors has been subscribed 1.39 times, employees 3.47 times and policyholders 4.5 times, while qualified institutional buyers bid 67 percent shares of allotted quota and non-institutional investors 105 percent.

LIC IPO Valuations

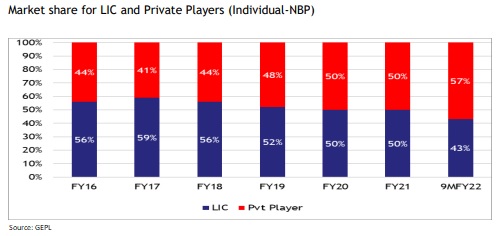

With over 60 percent market share, LIC remains the undisputed leader in India’s life insurance industry, backed by a robust distribution network and strong brand. It is also the largest asset manager with AUM of over Rs 40 trillion at end-9MFY22 (3.2x that of private insurers combined).

The company realises the need for product diversification and hence is focused on non-par and protection products that can provide a fillip to VNB (value of new business) margins. Persistency ratios are improving and solvency margins remain healthy.

At the upper IPO price band of Rs 949 per share, LIC is valued at ~1.1x based on September 2021 Embedded Value, which is at a steep discount to the 2.5-4.1x multiples commanded by major listed private players, says BOBCAPs which finds valuations attractive given the company’s strong fundamentals and hence recommend that investors subscribe to the IPO.

LIC IPO Day 4: Issue subscribed 1.59 times

Country’s largest life insurance company Life Insurance Corporation of India has opened its Rs 21,000-crore public issue for subscription for fourth day. The offer, so far, has subscribed 1.59 times, garnering bids for 25.74 crore equity shares against IPO size of 16.2 crore shares.

The portion set aside for retail investors has been subscribed 1.39 times, employees 3.46 times and policyholders 4.46 times, while qualified institutional buyers bid 67 percent shares of allotted quota and non-institutional investors 104 percent.

Market share for LIC and Private Players (Individual-NBP)

LIC IPO Day 4: Issue subscribed 1.58 times

Country’s largest life insurance company Life Insurance Corporation of India has opened its Rs 21,000-crore public issue for subscription for fourth day. The offer, so far, has subscribed 1.58 times, garnering bids for 25.53 crore equity shares against IPO size of 16.2 crore shares.

The portion set aside for retail investors has been subscribed 1.37 times, employees 3.42 times and policyholders 4.42 times, while qualified institutional buyers bid 67 percent shares of allotted quota and non-institutional investors 103 percent.

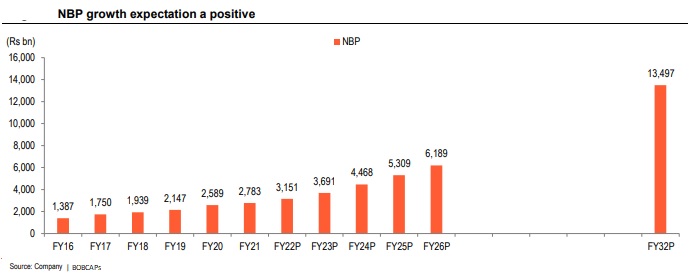

Life insurance industry size to double to Rs 12 trillion by FY26,says CRISILIndia’s life insurance industry is forecast to reach Rs 12.4 trillion by FY26, growing at a CAGR of 14-15 percent during FY21-FY26. New business premium (NBP) is expected to grow at 17-18 percent CAGR during the same period to cross Rs 6 trillion. Long term, NBP is forecast to cross Rs 13 trillion by FY32.

LIC IPO Day 4: Issue subscribed 1.57 times

Country’s largest life insurance company Life Insurance Corporation of India has opened its Rs 21,000-crore public issue for subscription for fourth day. The offer, so far, has subscribed 1.57 times, garnering bids for 25.39 crore equity shares against IPO size of 16.2 crore shares.

The portion set aside for retail investors has been subscribed 1.37 times, employees 3.42 times and policyholders 4.41 times, while qualified institutional buyers bid 67 percent shares of allotted quota and non-institutional investors 101 percent.