LIC IPO: Issue subscribed 2.91 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.91 times, receiving bids for 47.17 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 5.99 times, employees bid 4.32 times the allotted quota and retail investors 1.95 times, while the reserved portion of qualified institutional buyers has booked 2.83 times and that of non-institutional investors 2.88 times.

LIC has robust risk management framework, says Asit C Mehta

LIC has a risk management framework where risk identification, risk measurement and risk mitigation are undertaken through structured procedures and various Board-approved policies and controls. Their enterprise risk management (“ERM”) cell provides a framework for evaluating and managing risks inherent in LIC through risk and control self-assessment, incident management and top risk-key risk indicator analysis.

The ERM cell is working on the implementation of the IT solution package for monitoring various risks LIC encounters in its business processes.

LIC IPO: Issue subscribed 2.89 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.89 times, receiving bids for 46.77 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 5.97 times, employees bid 4.31 times the allotted quota and retail investors 1.94 times, while the reserved portion of qualified institutional buyers has booked 2.83 times and that of non-institutional investors 2.8 times.

Continued dominant position of LIC in group insurance driving NBP growth

In terms of business parameters LIC’s new business premium (NBP) has grown at a CAGR of 13.5 percent between FY2019-FY2021 while total premium has grown at a CAGR of 9.2 percent during the same period.

Total premium in India has grown at a CAGR of 9.3 percent while annualized premium equivalent (APE) has grown at a CAGR of 6.0 percent CAGR during the same period. (Source: Angel One)

LIC IPO: Issue subscribed 2.83 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.83 times, receiving bids for 45.84 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 5.93 times, employees bid 4.28 times the allotted quota and retail investors 1.92 times, while the reserved portion of qualified institutional buyers has booked 2.81 times and that of non-institutional investors 2.57 times.

Here are LIC’s risk and concerns highlighted by Motilal Oswal

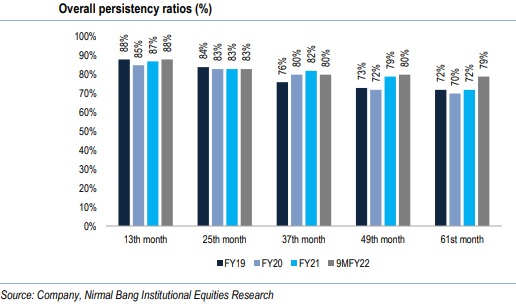

Adverse variation in persistency metrics could have a material effect on LIC’s financial performance

Change in regulations could adversely impact business

LIC is highly dependent on individual agents. If LIC is unable to retain and recruit individual agents on a timely basis and at reasonable cost, there could be a material adverse effect on its operations.

If actual claims experienced and other parameters are different from the assumptions used in pricing its products and setting reserves for its products, it could have a material adverse effect on LIC business.

A significant proportion of LIC’s total new business premiums are generated by participating products and single premium products, and any significant regulatory changes or market developments that adversely affect sales of such products could have a material adverse effect on its business.

Peer Comparison

LIC IPO: Issue subscribed 2.64 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.64 times, receiving bids for 43.3 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 5.86 times, employees bid 4.26 times the allotted quota and retail investors 1.89 times, while the reserved portion of qualified institutional buyers has booked 2.43 times and that of non-institutional investors 2.34 times.

LIC Persistency RatioPersistency ratio is the proportion of the business that is retained from the business underwritten earlier. It is calculated for each year’s policy renewal. For example, LIC has 79 percent persistency ratio for 13th month, which means 79 policies out of 100 are renewed after one-year of completion. The higher it is, the better it is for the company.

LIC IPO: Issue subscribed 2.55 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.55 times, receiving bids for 41.28 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 5.74 times, employees bid 4.21 times the allotted quota and retail investors 1.85 times, while the reserved portion of qualified institutional buyers has booked 2.22 times and that of non-institutional investors 2.13 times.

Robust pan India distribution network driven by individual agents

LIC has a robust pan India omni-channel distribution platform for individual products which comprises of (i) individual agents, (ii) bancassurance partners, (iii) alternate channels (iv) digital sales (v) Micro Insurance agents and (vi) Point of Sales Persons-Life Insurance scheme. LIC has the largest individual agent network among life insurance entities in India, comprising approximately 1.33 million individual agents as on 31st December 2021, which was 6.8 times the number of individual agents of the 2nd largest life insurer.

As on 31st December 2021, LIC had 2,048 branch offices and 1,559 satellite offices in India, covering 91 percent of all districts in India. LIC’s individual policies are primarily distributed by their individual agents who were responsible for sourcing 94.8%/96.2% of LIC’s NBP for their individual products in India, for FY2021/9MFY2022 respectively. (Source: Angel Broking)

LIC IPO: Issue subscribed 2.50 times on final day

The initial public offering of Life Insurance Corporation of India has received healthy response from investors as the offer has subscribed 2.5 times, receiving bids for 40.54 crore equity shares against IPO size of 16.2 crore equity shares.

The portion set aside for policyholders has been subscribed 5.70 times, employees bid 4.19 times the allotted quota and retail investors 1.84 times, while the reserved portion of qualified institutional buyers has booked 2.13 times and that of non-institutional investors 2.07 times.