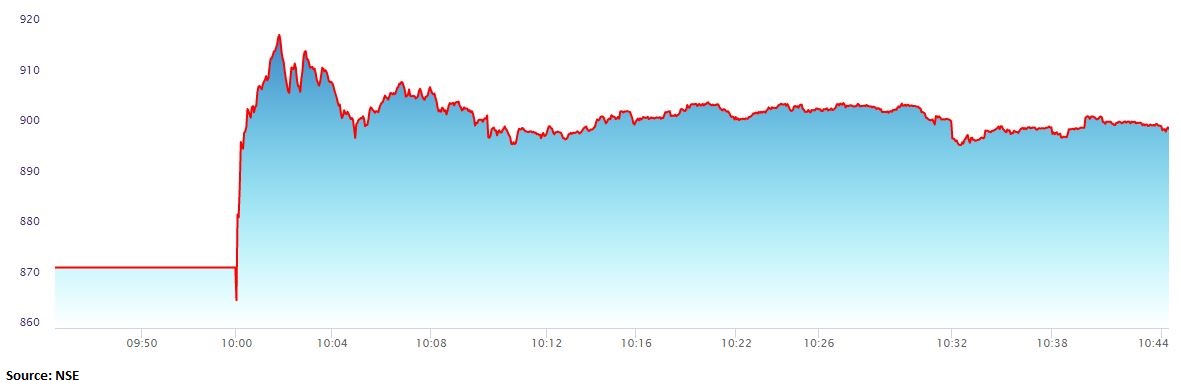

Life Insurance Corporation of India was quoting at Rs 887.35, down Rs 61.65, or 6.50 percent. It has touched an intraday high of Rs 920.00 and an intraday low of Rs 860.10.

Mohit Ralhan, Managing Partner, TIW Capital Group, on the LIC IPO being listed on the stock exchanges:

The 8% lower debut of LIC shares is a commentary on the current state of global markets rather than the company itself. In terms of subscription, the LIC IPO was extremely successful given the fact that it was the biggest IPO of India. LIC has a solid business, trusted brand, and market leadership in an underpenetrated insurance market. In FY-21, LIC’s market share was about 75% for individual policies and 81% for group policies. It is the top life insurance company by a wide margin. The insurance industry in India is growing at an annual rate of about 15% and the growth is expected to sustain over a long period of time given that insurance penetration in India is a meagre 3.2% which tends to be more than 8% for developed economies and it is about 5% in China. LIC is a typical blue-chip company which is expected to give steady returns over a long period of time and therefore returns over a day is not relevant. It is expected to remain quite attractive for investors.

Macquarie’s Suresh Ganapathy starts coverage on LIC with ‘neutral’ rating

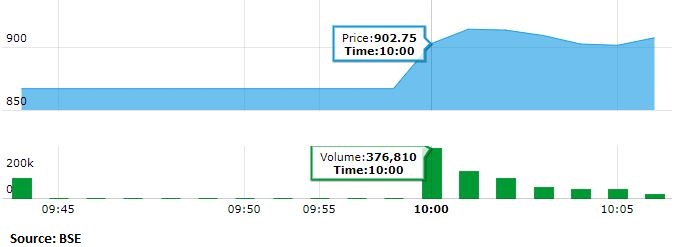

LIC is expected to see a muted listed on the bourses after the country’s biggest IPO raised Rs 21,000 crore from the public earlier this month

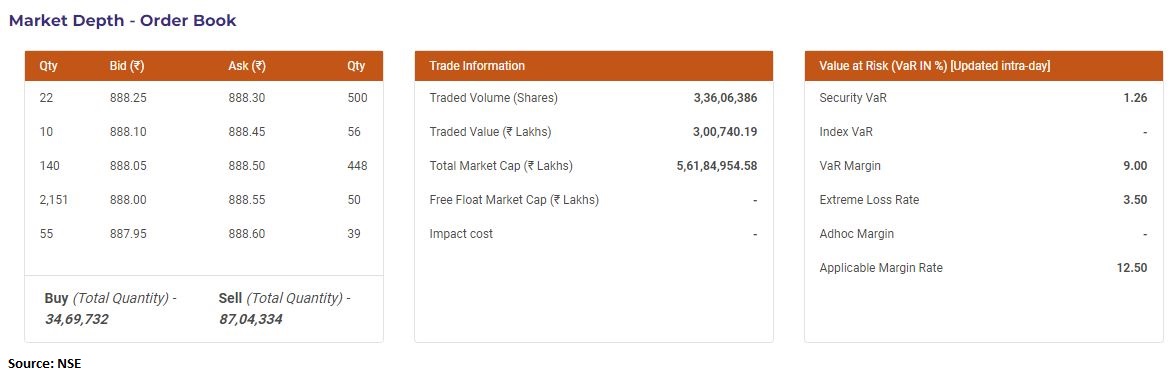

LIC market depth – order book

⚡️ @LICIndiaForever makes debut on stock exchanges at ₹865/share, a discount of 9% against the issue price of ₹949/share#LICListing #LIC #IPO #LICIPO #stockmarket #IPOCornerhttps://t.co/89WtjM0wyu

— CNBC-TV18 (@CNBCTV18News) May 17, 2022

Mohit Nigam, Head – PMS, Hem Securities on LIC listing:

As observed, the majority of big IPOs have not given a strong listing debut gains. Considering previous trends, LIC has continued to take the same path with listing at a discount of 8.8% from 949 to 872 at NSE on its listing day and is currently trading at Rs 900-905 levels. We believe that personal savings and awareness regarding insurance will increase enabling the sector to outperform in the long run and will indirectly benefit LIC as it is the market leader in this sector. We feel long term investors should continue to hold the scrip while short-term investors can wait to enter at a lower price.

LIC was trading at Rs 900.55, down Rs 48.45, or 5.11 percent. It has touched an intraday high of Rs 920 and an intraday low of Rs 860.10.

Parth Nyati, Founder, Tradingo on LIC lisiting:

The company’s weak listing can be attributed to high volatility in the markets and negative market sentiments. The company is synonymous with insurance in India and enjoys a phenomenal brand recall. We believe India’s highly underpenetrated life insurance space is still at a nascent stage and is attractively positioned to capture the huge growth opportunity. LIC enjoys many competitive advantages like strong brand value, extremely large scale of operations, a huge network of agents, and an envious distribution network, further, the company’s issue was priced at a Price to Embedded value of 1.1x, providing a valuation comfort, so we suggest investors to stay with the company for the long term despite the negative listing. Those who applied for listing gains can maintain a stop loss of Rs. 800. New investors can take advantage of the dips to accumulate this share for the long term. We would like to add that the company’s further downside will be limited due to low float post listing.

Hemang Jani, Head – Equity Strategy, Broking and Distribution, Motilal Oswal Financial Services:

Though LIC listing has been below the issue price of Rs 949, given the attractive valuations and stability in the markets, we expect some buying interest in the stock both from retail and intuitional investors. Since large amount of money has been released post listing of LIC, part of this money could get diverted into equity markets.

Santosh Meena, Head of Research, Swastika Investmart:

The current market is not conducive for primary issues and LIC being the largest IPO has witnessed a negative listing, the current market volatility has weighed down on the insurance titan’s listing. However, the prospects for the insurance industry in India are good due to the under penetration of insurance and a long runway of growth; hence LIC being the largest player will be the beneficiary in the long term. Insurance is a business of scale, and there is no company to match the scale of LIC, so we suggest investors not be bothered about the negative listing and stay with the company for the long term. Those who applied for listing gains can maintain a stop loss of Rs 800. New investors can take advantage of the dips to accumulate this share for the long term. Another point to note has that, LIC didn’t pay any dividends in the last financial year, so there are high chances that the company might declare a good dividend this year, thus making it a good dividend play.

#OnCNBCTV18 | Competition landscape makes it difficult for LIC & there is also a supply overhang. Would advise investors to stay away from MNCs & have more belief on strong Indian promoters rather than MNCs, says Ajay Srivastava of Dimensions Corporate Finance Services pic.twitter.com/QD4YrRpDWb

— CNBC-TV18 (@CNBCTV18Live) May 17, 2022

LIC stock price movement as it starts trading on exchanges