The market ended higher for the fourth straight week as global markets cheered better US inflation data, commodity prices softened and foreign investors kept on buying Indian equities. Strong earnings and better monsoon fuelled the rally on the home turf.

In the last week, the BSE Sensex gained 1,074.85 points (1.84 percent) to end at 59,462.78, while the Nifty50 added 300.7 points (1.72 percent) to close at 17,698.2 levels.

The benchmark BSE Sensex and the Nifty50 indices gained more than 3 percent since July.

On the sectoral front, the BSE Metal index added nearly 5 percent, BSE Capital Goods climbed 4 percent and the BSE Power index surged 3.6 percent. The BSE FMCG index, however, lost 1 percent.

In the last week, the large-cap index added nearly 2 percent, and the small-cap and mid-cap indices were up 1 percent each.

“The Nifty closed the week with a long green candle on the weekly time frame. This is a big push for the Nifty as it closed in the green for the fourth week in a row. The pace of the rally was slow but the Nifty moved in a strong sustainable uptrend,” said Manish Shah, Independent Technical Analyst.

“On the weekly time frame, MACD has crossed the zero line and this is a bullish quant development. The Nifty is below a falling trendline coming down from October 2021 highs and below 78.6 percent retracement of the entire 18,600-15,100 decline. The 78.6 retracement is at 17,850. The zone between 17,850-17,900 will prove to be a major barrier for the Nifty,” he added.

The Nifty is likely to move towards 17,850-17,900 where the bulls will face the true test. If the Nifty whistles past that level, it will see opportunities to surpass 18,600, according to Shah.

Foreign institutional investors (FIIs) picked up equities worth Rs 7,850.12 crore this week, while domestic institutional investors (DIIs) sold equities of Rs 2,478.19 crore. In August so far, the FIIs bought equities worth Rs 14,841.66 crore, while DIIs sold equities worth Rs 4,243.78 crore.

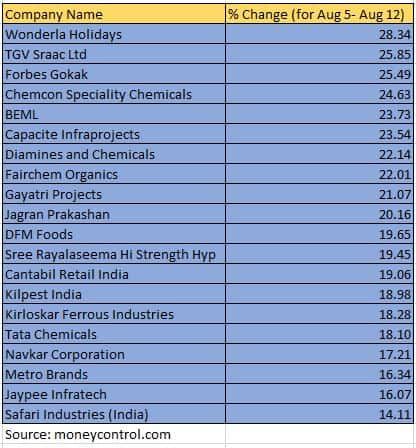

In the last week, 50 small-cap stocks rose 10-28 percent. Wonderla Holidays, TGV Sraac, Forbes Gokak, Chemcon Speciality Chemicals, BEML, Capacite Infraprojects, Diamines and Chemicals, Fairchem Organics, Gayatri Projects and Jagran Prakashan added over 20 percent each.

On the other hand, Everest Kanto Cylinder, Dynemic Products, Birla Tyres, Future Retail, Sandur Manganese and Iron Ores and Kirloskar Brothers lost 15-33 percent.

“The Nifty had started the week on a positive note and it surpassed the hurdle of 17,500 mark on Monday itself. After a mid-week holiday, the market continued its positive momentum and the positive reaction of the US markets on the inflation numbers led to further up-move in the global equity markets. The Nifty posted weekly gains of almost a couple of percent and ended around 17,700 mark,” said Ruchit Jain, Lead Research, 5paisa.com.

“In last couple of months, our markets have shown a significant up-move from the swing lows and we have not seen any meaningful price wise correction in this move. The momentum readings have now reached the overbought zone, but market is still continuing the momentum, although at a slower pace now.”

“The falling trendline resistance of the previous swing highs is around 17700-17800 and we have ended right around the resistance end. In case the market surpasses this hurdle, then the 78.6 percent retracement of the previous correction is around 17875.”

“So this entire 200 points range 0f 17700-17900 is a crucial hurdle for the index and the momentum readings are overbought. So it is quite possible that our markets would see a corrective phase again anytime soon, but sometimes the index continues to trade in overbought zone and hence, traders should wait for a confirmation of any reversal before taking any contra trades,” Jain added.

The BSE 500 index added 1.7 percent led by BEML, Indraprastha Gas, Tata Chemicals, Metro Brands, Hindustan Aeronautics, Zomato, Mahanagar Gas, KSB, Mazagon Dock Shipbuilders, JSW Energy and Bharat Forge.

Where is Nifty50 headed?

Amol Athawale, Deputy Vice President – Technical Research, Kotak Securities

Ahead of India’s retail inflation data, benchmark indices settled higher for the fourth straight week. Technically, Nifty is consistently forming higher high and higher low formation which is broadly positive. In addition, on weekly charts, it has formed a bullish candle that also supports a further uptrend from the current levels. However, 17900-18000/(BSE on 60000-60300) could act as the strong resistance level. Further, momentum indicators like Stochastic and RSI indicate a strong possibility of some profit booking at higher levels.

We believe that, due to the temporary overbought situation, we could see range-bound activity in the near future. On the higher side, the immediate hurdle would be 17900-18000/(60000-60300 on the BSE). On the downside, 17400-17300/(58500-58200 on BSE) could be the key supports level for the positional traders. For traders, buying on dips and sell on rallies could be the ideal strategy.

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty has posted fourth consecutive positive weekly close. On the way up, it crossed several short term hurdles & has reached a crucial trendline drawn from the October 2021 high. For the last couple of sessions the index is hovering near this trendline.

In terms of the levels, 17750-17800 is the crucial zone that will determine whether the Nifty continues with its northward journey. Thus staggered profit booking is recommended for the Nifty short term traders; while the positional traders can continue to ride the trend, they need to tighten the reversal level to 17500.

Ajit Mishra, VP – Research, Religare Broking:

Markets will react to the macroeconomic data viz. IIP and CPI and other global cues in early trade on Tuesday. The recent buoyancy on the global front combined with rotational buying across sectors are pointing towards the prevailing up move to extend further with intermediate pause participants should align their positions accordingly.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.