Follow our LIVE blog for the latest updates on the new Omicron variant of COVID-19 and its impact

Kotak Pre-IPO Opportunities Fund raises Rs 2,000 crore

Kotak Investment Advisors Limited (KIAL) today announced that it has successfully closed its maiden Kotak Pre-IPO Opportunities Fund, raising Rs 2,000 crore.

The Pre-IPO Fund will invest in a range of India focused late-stage new-age businesses with a strong moat of technology.

Oil climbs to more than 7-year high

il prices rose more than $1 on Tuesday to a more than seven-year high on worries about possible supply disruptions after Yemen’s Houthi group attacked the United Arab Emirates, escalating hostilities between the Iran-aligned group and a Saudi Arabian-led coalition.

The “new geopolitical tension added to ongoing signs of tightness across the market,” ANZ Research analyst said in a note.

Brent crude futures rose $1.37, or 1.6%, to $87.85 a barrel by 0738 GMT, while U.S. West Texas Intermediate (WTI) crude futures jumped $1.71, or 2%, from Friday’s settlement to $85.53 a barrel. Trade on Monday was subdued as it was a U.S. public holiday.

Both benchmarks climbed to their highest levels since October 2014 on Tuesday.

TV18 Broadcast Q3: Operating revenue was up 15.1% at Rs 1,567.1 crore against Rs 1,361 crore (YoY). EBITDA was up 10.7% at Rs 355 crore against Rs 320.7 crore (YoY). EBITDA margin at 22.7% against 23.6% (YoY). News business saw sharp improvement in margin to 27.2%; revenue was up 13% YoY. Entertainment business margin at 21.4%; revenue gained 16% YoY.

ICICI Securities Q3: Consolidated net profit jumped 42.4% at Rs 380.3 crore against Rs 267 crore (YoY). Consolidated Revenue was up 51.8% at Rs 941.6 crore against Rs 620.1 crore (YoY). Consolidated EBITDA gained 53.2% at Rs 608.3 crore against Rs 397 crore (YoY). Consolidated EBITDA margin at 64.6% against 64% (YoY).

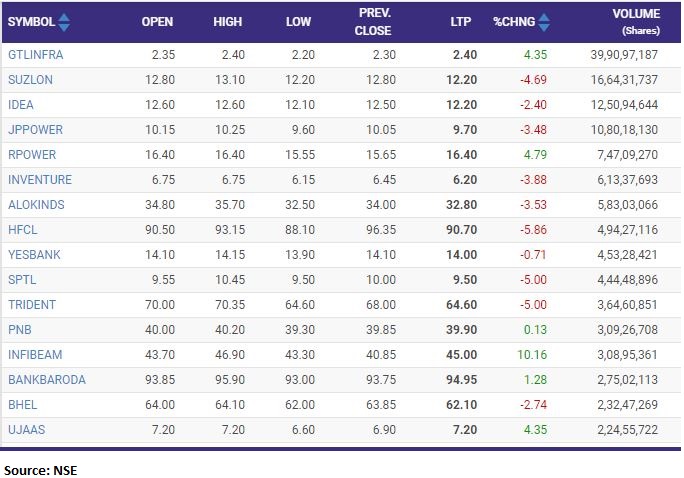

Most active stocks on NSE in terms of volumes

FM Nirmala Sitharaman Press Conference Today: What To Expect

Finance Minister Nirmala Sitharaman will hold the press conference to discuss an “important economic issue”.

Nitin Sharma, Director, Research & India Site Head, Fidelity International

Budget 2022 will be all about a balancing act between boosting demand on one hand and strengthening the investment cycle on the other. The Finance Minister (FM) does have some leeway on this front owing to the buoyant tax receipts and early signs of a credit pick-up. However, even with relatively healthy corporate and bank balance sheets, onus will be on public spending on both fronts, given the pandemic-induced uncertainty and disruptions. At the same time, we hope that the FM will look beyond Covid19 and leverage this budget as an opportunity to systematically enhance India’s potential real growth rate.

Expect continued focus on supporting urbanisation through a sustained high spend on public infrastructure and housing, social spending to help mitigate the impact on incomes across a broad spectrum, higher education and healthcare allocation, asset monetisation and tax simplification. In a busy political year, measures to support demand could flow through some income tax relief, rationalisation of select non-GST indirect taxes, and higher farm income support.

Some supportive measures for services sectors that have been hardest hit in the latest Covid19 wave would also be expected. Production-linked Incentives (PLI)/Make in India schemes have generated quite a buzz and there has been good traction across sectors. Expect the government to expand it to cover still more manufacturing industries. The start-up ecosystem in India has had a pretty good year. Hopefully the coming budget will encourage new businesses through various measures such as better capital availability and improved ease of doing businesses. Finally, reduced friction costs in capital markets and further easing capital flow restrictions will remain on the wish list.

Market update at 2 PM: Sensex is down 75.90 points or 0.12% at 61233.01, and the Nifty shed 46.20 points or 0.25% at 18261.90.

Fabindia likely to file DRHP for IPO with SEBI this week

Fabindia is likely to file DRHP for IPO with SEBI this week. The company is going to raise over Rs 4,000 crore via combination of fresh issue & OFS. The fresh issue to be over Rs 500 crore, while offer for sale (OFS) to be Rs 3,500 crore, reported CNBC-TV18.

KRChoksey on HDFC Bank

Q3FY22 performance of HDFC Bank remained strong on all the metrics, which we expect to continue in coming quarters, resulting in market share gain compared to its peers.

We expect robust growth in advances led by improved demand from the retail segment and strong growth coming from the commercial & rural banking segment. The bank is expected to remain well capitalised.

We expect a steady improvement in NIMs in the medium to long term on the back of improved yields and lower cost of funds. Strong growth in loan book led by retail & commercial segment, healthy NII, decent growth in fee income with pick up in credit card business, improving operating efficiencies with new digital initiatives, and improving asset quality will boost the profitability for HDFCB in the long term.

We maintain our target price at Rs 1,997 per share, implying a P/ABV of 3.7x to FY24E adjusted book value of Rs 540 per share, giving an upside of 31.3% over the CMP. Accordingly, we reiterate our buy rating on the shares of HDFC Bank.

We expect the bank to outperform the industry as we are optimistic about its overall prospects, owing to its robust operating performance, strong parentage, and asset quality improvement.

AGS Transact Technologies IPO opens for subscription on January 19

AGS Transact Technologies, omni-channel payment solutions provider, will open its initial public offering for subscription on January 19, 2022 and will close on January 21.

The total IPO size is Rs 680 crore with a price bank of Rs 166-175.