Santosh Meena, Head of Research, Swastika Investmart:

The record-high inflation numbers announced in the USA on Friday have created a huge sell-off in the global equity markets. The markets expect Fed to become more aggressive to tame the entrenched inflation; this will lead to huge outflows of FII’s and FPI’s money and further depreciation of INR.

To be honest, today’s fall is nothing new; it’s just a reality check as the majority of stock prices had moved far away from their fundamentals or intrinsic values. Markets often need trigger events to comply with the universal law of mean reversion and the Russia-Ukraine War is that event this time. Markets often get confused between risk and uncertainty, risk is the permanent loss of capital whereas uncertainty means situations involving imperfect or unknown information.

Uncertainty often leads to correction and once it subsides, the markets normalize. In short, we recommend investors to see the big picture, it is true that inflation is going to stay for a while and affect the profits of corporate India, but in the medium to long term, there are many companies with good fundamentals, robust financials, and competitive advantages that are going to perform well. Further, India is better placed than its peers with respect to growth factors and the ability to fight the current inflation. Thus, the current uncertain times are best to lap up such quality stocks and investors can use the buy on dips strategy, however, in the near term, the markets are going to be volatile.

Vedanta ventures into international iron ore mining operations in Liberia, West AfricaVedanta’s iron & steel sector has ventured into international iron ore mining operations in Liberia, West Africa through its subsidiary Western Cluster (WCL) with the ground-breaking ceremony that was held at the Bomi iron ore mine on June 8. WCL is a wholly owned subsidiary of Bloom Fountain (BFL) which is in turn a wholly owned subsidiary of Vedanta. WCL had signed a Mineral Development Agreement with the Government of Liberia (GoL) for three iron ore mining concessions in Liberia namely Bomi, Bea, and Mano in 2011. However, the operations could not be started due to outbreak of Ebola epidemic.

BSE Metal index declined nearly 3 percent dragged by the Hindalco Industries, NMDC, Vedanta

Daily Voice | See some more downside risk to Nifty earnings growth estimates for FY23, says Sampath Reddy of Bajaj Allianz Life

Reddy says he is positive on some of the large private sector banks as well as metal, pharma, quick service restaurant and EV segments

Anindya Banerjee, VP, Currency Derivatives & Interest Rate Derivatives at Kotak Securities:

USDINR touched a fresh all time high at 78.27 and now trading at 78.14. RBI intervention is suspected, both in spot as well as forwards.

Till US Fed meeting on Wednesday, there can be significant upward pressure on USDINR. Odds for a 75 bps hike is rising and that is positive for USD. However, we expect RBI to cap the upside. We are looking at a range of 77.90 to 78.40 on spot over the near term.

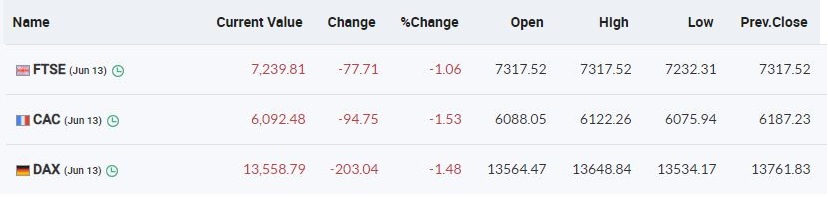

European indices down 1 percent each

Prashanth Tapse, Vice President (Research), Mehta Equities:

Gap-down markets as inflation jitters continue to haunt global markets. We suspect, Nifty will lack direction in the afternoon session as the key driver of sentiment hinges now on:

a) The FOMC policy Outcome (June 15th)

b) U.S 10-year Treasury spiked to 3.157%. The street now expects it to flirt with 4% by the end of 2022.

c) India’s CPI inflation data on June 13 and WPI inflation to trickle in on June 14.

A hot inflation reading is bolstering expectations that the Federal Reserve will continue to aggressively hike rates in the second half of this year, even with signs of economic slowdown.

Honestly speaking bear holds grip on markets very tight hence, we advise investors to have “Wait and watch strategy “and not get into the trap. Once the above economic data is out and market discounts that then, we can enter markets in a phase wise manner.

On the downside, the line in the sand is at Nifty’s support at 15793 mark.

#CNBCTV18Exclusive | US FDA begins inspection of Glenmark’s Baddi plant today, sources to CNBC-TV18

Alert: Glenmark’s Baddi plant was issued a warning letter in October 2019. Baddi facility manufactures solid & liquid oral drugs pic.twitter.com/tKPIfZqlhB

— CNBC-TV18 (@CNBCTV18Live) June 13, 2022

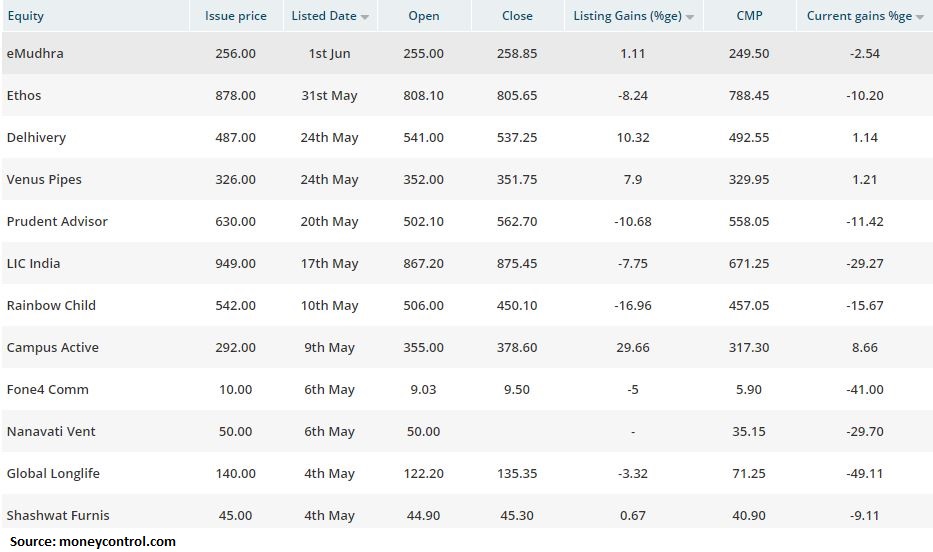

Performance of the recently listed IPOs

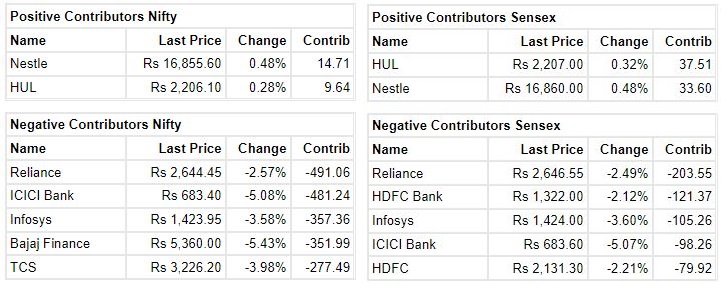

Market at 1 PMBenchmark indices extended the losses and trading at day’s low in the afternoon session.The Sensex was down 1,524.24 points or 2.81% at 52779.20, and the Nifty was down 440.90 points or 2.72% at 15760.90. About 581 shares have advanced, 2606 shares declined, and 115 shares are unchanged.

BSE Midcap index fell 1 percent dragged by the RBL Bank, Mahindra & Mahindra Financial Services, L&T Finance Holdings:

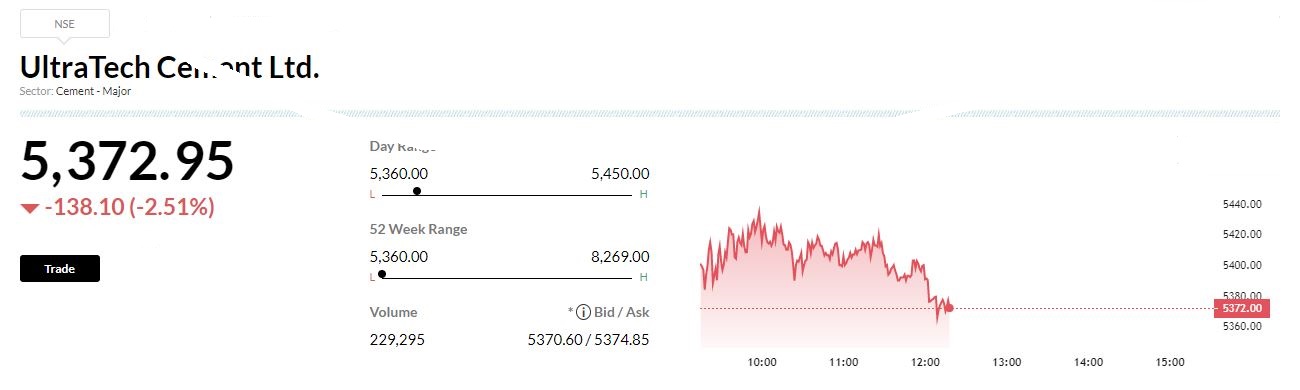

Jefferies view on UltraTech Cement:Research firm Jefferies has maintained buy rating on UltraTech Cement but cut the target price to Rs 6,550 from Rs 7,275 per share.The most expansions announced 10 days back are targeted to commence in FY25. The full impact of fuel price increase is likely to reflect in Q2FY23.Jefferies expect volume growth trend to continue, supported by new expansions, reported CNBC-TV18.