Ramkrishna Forgings Q3 Earnings:

Ramkrishna Forgings has reported 34.6 percent jump in its Q3 net profit at Rs 61 crore versus Rs 45.3 crore and revenue was up 29.3 percent at Rs 777.5 crore versus Rs 601.3 crore, YoY.

Ramkrishna Forgings was quoting at Rs 265.30, down Rs 12.65, or 4.55 percent on the BSE.

Jubilant FoodWorks plans to add 3,000 Domino’s stores in next 12-18 months

Jubilant FoodWorks plans to add 3,000 Domino’s stores in next 12-18 months, and 40-50 stores for Popeyes India in next 12-18 months.

Under capex plan, Rs 900 crore will be funded entirely through internal accruals over a period for 12-18 months.

Jubilant Foodworks was quoting at Rs 511.85, up Rs 1.15, or 0.23 percent.

Buzzing

IndiaMART InterMESH clocked a massive 61% year-on-year growth in profit at Rs 113 crore for quarter ended December FY23, backed by other income that jumped 367% to Rs 102 crore for the quarter.

Revenue from operations grew by 34% YoY to Rs 251 crore driven by 24% increase in number of paying subscription suppliers and addition of Rs 10 crore revenue from accounting software services.

However, EBITDA declined 11% to Rs 70 crore and margin contracted 14 percentage points to 28% for the quarter compared to year-ago period.

Indiamart Intermesh was quoting at Rs 4,523, up Rs 46.30, or 1.03 percent on the BSE.

CLSA view on PVR

-Buy rating, target at Rs 2,430 per share

-PVR collections for top movies up 75 percent QoQ; PVR-Inox merger ahead

-Q3 revenue and EBITDA ahead of estimates

-Resurgence of top movies box office collections

-Strong content line-up in 2023; screen expansions, reported CNBC-TV18.

PVR was quoting at Rs 1,620.20, down Rs 58.50, or 3.48 percent on the BSE.

Hiren Ved of Alchemy Capital Management shares his Budget wish list

Speaking to CNBC-TV18

-Tax regime stability will send a signal to international investor community

-Rate change will be problematic, tenure change will be received better

-Market is a mechanism that discounts good & bad news

-Any tax rate change will be digested by the market

-We need a stable tax regime

-Deficit number is important, there will be a glide path to fiscal consolidation

HDFC Life Q3-Annual premium equivalent up 39.6 percent at Rs 3,625 crore vs Rs 2,597 crore YoY

-Value of new business up 30.4 percent at Rs 905 crore vs Rs 694 crore YoY

-VNB Margin at 25 percent vs 26.7 percent YoY

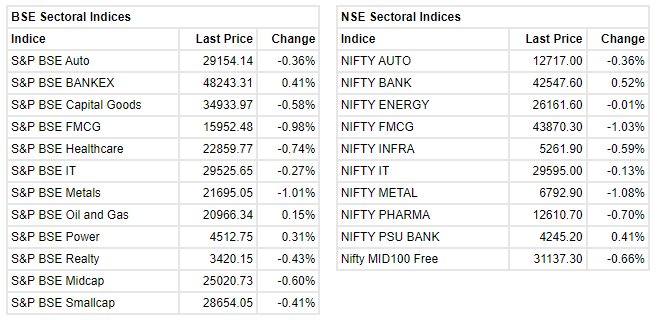

Markets at 2 PMSensex is down 160.55 points or 0.26 percent at 60697.88, and the Nifty down 56.80 points or 0.31 percent at 18051. About 1474 shares have advanced, 1744 shares declined, and 134 shares are unchanged.

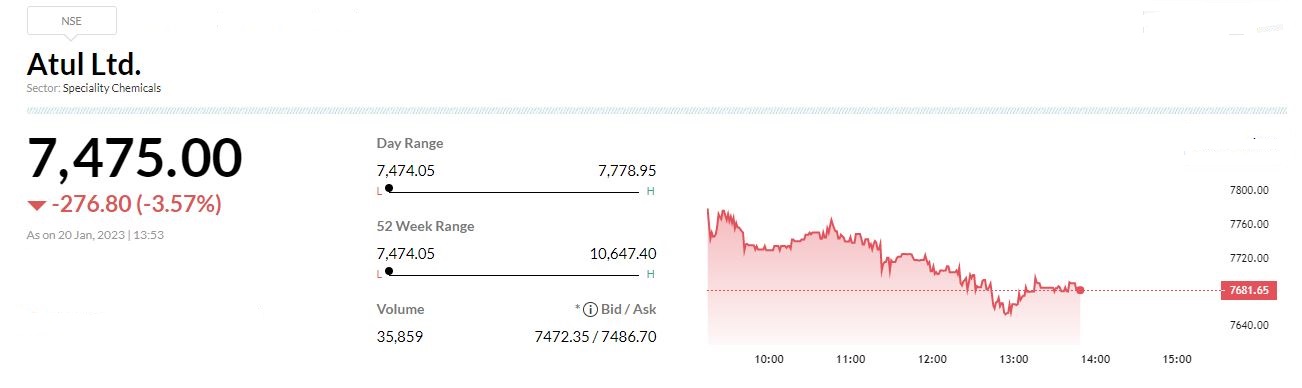

Atul Q3 Results:Atul has posted 32.2 percent fall in its Q3 net profit at Rs 105.1 crore versus Rs 155 crore while revenue is down 8 percent at Rs 1,268.2 crore versus Rs 1,380.3 crore, YoY.

Request to Hon’ble FM @nsitharaman ji. தயவுசெய்து கேளுங்கள். @nsitharamanoffc pic.twitter.com/X0CxRoeYjJ

— Vijay Kedia (@VijayKedia1) January 20, 2023

Anup Rau, MD & CEO, Future Generali India Insurance:

With the 2024 Lok Sabha elections on the horizon, the expectations from this budget are high. The strategy of focusing on infrastructure development, capital expenditure, and making India a manufacturing hub, will continue to spur growth and recovery. The Centre should continue on this path, while focusing on fiscal consolidation.

As far as the insurance sector is concerned, we look forward to major changes this year. The much-awaited proposal to increase FDI limit to 100% in insurance could be taken up during the Budget ’23, which would augur well for insurers who will get fresh capital. With the uptick in healthcare costs, there is a strong case for increasing deduction limits for health insurance in the coming budget.

DCM Shriram Q3 Results:

DCM Shriram has posted net profit at Rs 342.1 crore versus Rs 349.6 crore YoY and revenue is up 21.2% at Rs 3,383.7 crore versus Rs 2,790.8 crore, YoY.