#CNBCTV18Exclusive | International business doesn’t fit into our roadmap anymore. @zomato isn’t looking at any lay-offs or hiring freeze

Not looking at any acquisitions right now, not in talks with Zepto@deepigoyal, Co-Founder & CEO, Zomato tells CNBC-TV18 pic.twitter.com/VcgQAdX8B6

— CNBC-TV18 (@CNBCTV18Live) July 12, 2022

Debt mutual funds see Rs 92,248 crore outflow in June on uncertain macro environment

Mutual funds focused on investing in fixed-income securities witnessed a heavy outflow of Rs 92,248 crore in June on uncertain macro environment, driven by expectations around an increasing rate cycle, higher commodity prices and slowdown in growth. This comes following a net outflow of Rs 32,722 crore in May and an inflow of Rs 54,756 crore in April, data available with Association of Mutual Funds in India (Amfi) showed.Out of the 16 fixed-income or debt fund categories, 14 witnessed net outflows during the month under review. The only categories that witnessed inflows were the 10-year gilt funds and the long duration funds

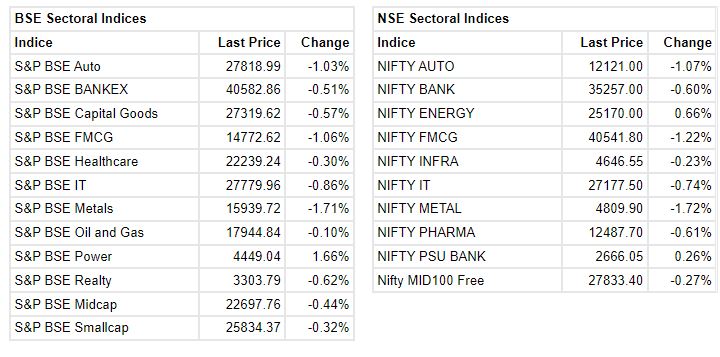

Nifty PSU Bank index, gains 0.81 percent aided by Indian Bank and Canara Bank. Other sectoral indices are under pressureSource: NSE

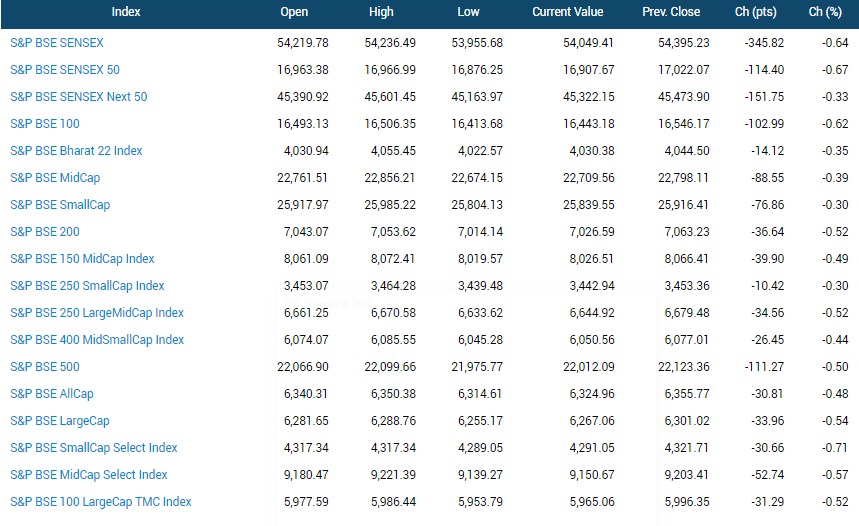

Market at 2.00 PM

Indices trade lower amid volatility, Nifty around 16,000

The Sensex was trading lower by 359.5 points or 0.66% at 54,035.17 and the Nifty was lower by 121.6 points or 0.75% at 16,094.25 About 1,490 shares have advanced, 1,721 shares declined, and 167 shares are unchanged.Source: BSE

Samir Arora of Helios Capital sees FIIs flooding back in six months

“Despite heavy selling by FIIs, the Indian market has outperformed its peers thanks to steady and continuously strong flows from domestic investors”

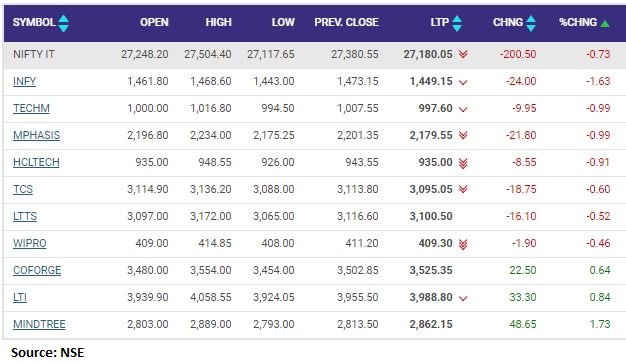

Nifty Information Technology index shed 0.7 percent dragged by the Infosys, Tech Mahindra, Mphasis

Dhruv Consultancy Services bags contract

I don’t believe the US will be going into a recession: JPMorgan’s Adrian Mowat

“I think India is continuing to be an outperformer. But whether you can make absolute returns depends on whether the Wall Street is able to make absolute returns.”

Chandan Taparia, Vice President, Equity Derivatives and Technical, Broking & Distribution, Motilal Oswal Financial Services:

Nifty opened gap down and is facing resistance at higher levels. The index is making lower lows since the last 3 trading sessions which is providing some discomfort at higher zones. Any rise towards 16161 can be utilised as a selling opportunity in the index.

India VIX is flat near 19 zones. However it needs to cool down below 18 for stability and a directional move in the market. Now till it holds below 16161, it can move down to 16061 and 15950 zones whereas bounce can be seen towards 16250. Market breadth is positive which indicates that there is buying interest in the market but pressure at higher zones.

Nifty is showing signs of weakness while Bank Nifty is holding at higher levels. In Nifty we can utilize any rise for selling opportunity while in Bank Nifty any dip should be utilised as a buying opportunity for higher levels. At current juncture, we are advising to be with selective stocks and one can look for buying opportunity in M&M Fin, Eicher Motors and Pidilite.

BSE Fast Moving Consumer Goods index fell 1 percent Associated Alcohols & Breweries, AVT Natural Products, Britannia Industries

Market at 1 PMBenchmark indices extended the losses and trading at day’s low with Nifty below 16100.The Sensex was down 401.93 points or 0.74% at 53993.30, and the Nifty was down 135.00 points or 0.83% at 16081. About 1398 shares have advanced, 1604 shares declined, and 145 shares are unchanged.

NMDC revises prices of Lump Ore & Fines

The company fixed prices of Lump Ore (65.5%, 6-40mm) at Rs 3,900/- per ton and Fines (64%, – 10mm) at Rs 2,810/- per ton.

NMDC was quoting at Rs 102.95, down Rs 6.05, or 5.55 percent on the BSE.