Buzzing Stocks: McDowell Holdings, Olectra Greentech, Stove Kraft, and other stocks in news today

Maruti Suzuki August production falls 7.9% to 1.14 lakh units: Maruti Suzuki India share price was trading in the red after the company came out with its August production numbers. Maruti Suzuki in an exchange filing said that its August production was down 7.9 percent at 1.14 lakh units against 1.24 lakh units (YoY). Production volume of August was affected due to electronic components shortage, it said.

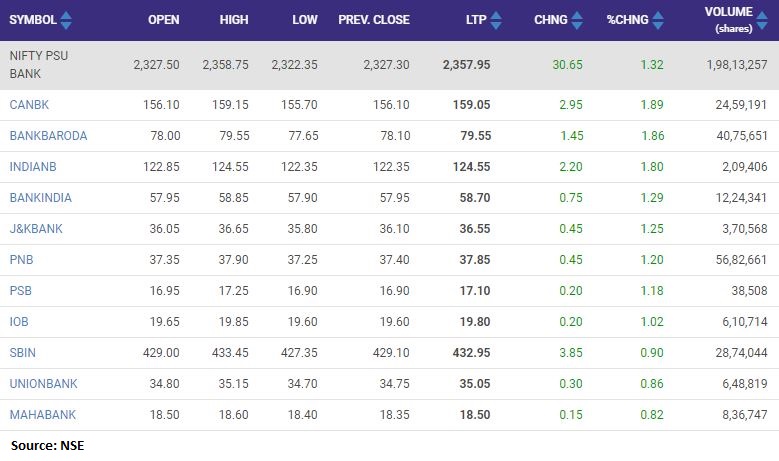

Nifty PSU Bank added over a percent led by Canara Bank, Bank of Baroda and Indian Bank

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services: Stock market experts are a confused lot now. By all matrixes of valuations markets are richly valued, even over valued, and ripe for a correction. But unmindful of valuation concerns, the market driven by liquidity and retail investor exuberance, is setting record after records. India is one of the best performing markets in the world. Consequently valuations have become excessive. MSCI India is at 80 percent premium to MSCI EM Index. In Warren Buffet’s famous words, “this is the time to be fearful” because greed is driving the market.

Corrections are imminent but we dont know when that will happen. The spike in the 10-year US bond yield to around 1.36% is an indication that inflation may not be transitory as the Fed assumes. Traders may consider lightning positions and investors can book some profits and increase cash component in the portfolio. There are rumors of relief to the telecom industry. This may impart resilience to telecom stocks.

Market at open: Sensex is up 9.12 points or 0.02% at 58288.60, and the Nifty shed 13.10 points or 0.08% at 17349.

Mohit Nigam, Head – PMS, Hem Securities: Benchmark Indices are expected to open on a positive note as suggested by trends on SGX Nifty. US stock indices mostly closed lower yesterday with solid gains seen in Apple, Facebook and other tech heavyweights’ companies. Asian markets off to a mixed start with Tokyo stock trading lower as investors sought to lock in profit after the recent rallies seen in the market.

We can see some movement in EID Parry today as the company board has approved the setting up of a 120 KLPD Grain/Sugar Syrup/Molasses-based Distillery at the Company’s Sankili unit in Andhra Pradesh. Overall Indian indices look on a positive territory with regular foreign capital inflows, strong domestic data.

On the technical front, 17450 may act as immediate resistance for Nifty 50 followed by 17,500 while 17,100 remains a crucial support for Nifty50.

Sansera Engineering IPO to open on September 14, price band fixed at Rs 734-744: Bengaluru-based auto-component maker Sansera Engineering will launch its initial public offering on September 14. The issue will close on September 16. The company, after consultation with merchant bankers, has fixed a price band at Rs 734-744 per equity share.

The initial public offer of 1,72,44,328 equity shares is a complete offer for sale by existing selling shareholders. The offer for sale comprises a selling of equity shares and 48,36,723 equity shares by investors Client Ebene and CVCIGP II Employee Ebene, respectively.

ICICI Direct on Indian stock market: Nifty witnessed a volatile day but closed almost flat. Sectorial buying was seen in FMCG stocks while realty and PSU banks witnessed selling pressure. As per option data, aggressive Call writing was seen at 17400 and 17500 levels, which should continue to act as resistance zone and limit upside gains. Nifty futures ended at a premium of 14 points while IV was down by 1.34%. The major Put base is at 17300 strike with 37 lakh shares while the major Call base is at the 17500 strike with 53 lakh shares.

Bank Nifty witnessed selling pressure but manage to rebound from lower levels. In banking stocks, PSU banks were under selling pressure. According to options data, 36500 and 36600 Call option witnessed significant OI addition, which should act as immediate resistance. If it sustains above that it would lead to a fresh up move.

SEBI introduces T+1 settlement cycle for stocks on optional basis

The Securities and Exchange Board of India (SEBI) on September 7 introduced T+1 (Trade plus 1 day) rolling settlement cycle for stocks on an optional basis. The new rule will come into force on January 1, 2022. The regulatory change has been adopted after the market regulator received requests from various stakeholders to further shorten the settlement cycle.

“Based on discussions with Market Infrastructure Institutions (Stock Exchanges, Clearing Corporations and Depositories), it has been decided to provide flexibility to Stock Exchanges to offer either T+1 or T+2 settlement cycle,” SEBI in its circular said.

Japan upgrades Q2 GDP on stronger business spending

Japan’s economy grew faster than the initially estimated in the April-June quarter, helped by solid capital expenditure, although a resurgence in COVID-19 is undermining service-sector consumption and clouding the outlook.

Revised gross domestic product (GDP) data by the Cabinet Office released on Wednesday showed the economy grew an annualised 1.9% in April-June, beating economists’ median forecast for a 1.6% gain and the initial estimate of a 1.3% expansion.