Moneycontrol launches Analysts’ Call Tracker. A monthly special page that tells you which way analysts are leaning; the stock they are most bullish or bearish on, what they are upgrading or downgrades, and where they are betting against the market. Ignore this at your own risk!

Ravindra Rao, VP- Head Commodity Research at Kotak Securities:

COMEX gold trades marginally lower near $1707/oz as US dollar index stalled after two days of losses. The US dollar fell in last few sessions amid debate about pace of Fed’s rate hike but continues to remain supported by safe haven buying amid global growth worries and expectations that Fed may lead other central banks in monetary tightening. ETF outflows also shows lack of investor interest despite lower prices. Gold has stalled near $1700/oz level after the sharp sell-off in last few days however a sustained rise is still difficult as outlook for US dollar still remains firm.

#OnCNBCTV18 | RBI would want Rupee to stay within a range. Market dynamics for Rupee is that there could be some overshooting, says Samiran Chakraborty of CITI India pic.twitter.com/M8acNRJeeK

— CNBC-TV18 (@CNBCTV18Live) July 19, 2022

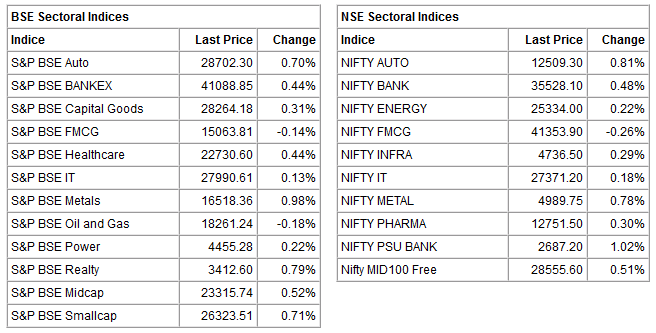

Market update at 11 AM: Sensex is up 123.12 points or 0.23% at 54644.27, and the Nifty added 36.40 points or 0.22% at 16314.90.

M&M Financial Services partners with Credgenics for digital services:

Results on July 19

Hindustan Unilever, HDFC Life Insurance Company, ICICI Lombard General Insurance Company, Ambuja Cements, L&T Finance Holdings, Network18 Media & Investments, TV18 Broadcast, Polycab India, AU Small Finance Bank, DCM Shriram, Garware Synthetics, Hatsun Agro Product, Kirloskar Pneumatic, Ponni Sugars (Erode), Rallis India, Shemaroo Entertainment, and Steel Strips Wheels will be in focus ahead of quarterly earnings on July 19.

BSE Realty index added 0.5 percent supported by the Phoenix Mills, Macrotech Developers, Sobha

Buzzing:

Shares of Surya Roshni jumped four percent on July 19 after the company bagged a contract to supply pipes to a public sector undertaking.

“The company has obtained orders amounting to Rs 91.27 crore (including GST) for supply of API- SL 3LPE-coated line pipes from Bharat Gas Resources, a a wholly owned subsidiary of Bharat Petroleum Corp Ltd (BPCL) that handles natural gas business,” said the firm.

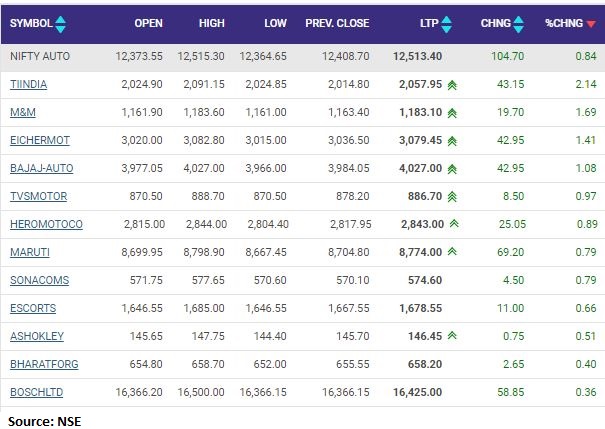

Nifty Auto index rose nearly 1 percent led by the Tube Investments Of India, M&M, Eicher Motor

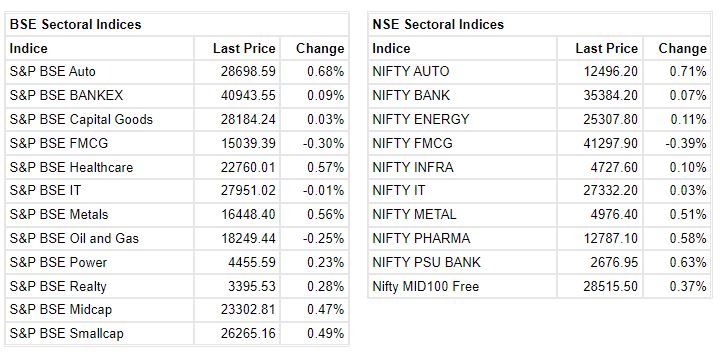

Market at 10 AMBenchmark indices erases opening losses and trading flat in the volatile session.The Sensex was down 11.77 points or 0.02% at 54509.38, and the Nifty was down 6.40 points or 0.04% at 16272.10. About 1824 shares have advanced, 887 shares declined, and 150 shares are unchanged.

Motilal Oswal View on Tube Investments

Tube Investments offers diversified revenue streams, with strong growth in its core business (~25% CAGR), ramp-up in CGPOWER, and optionality of new businesses incubated under the TI-2 strategy.

At the consolidated level, we estimate a revenue/EBITDA/PAT CAGR of ~16%/21%/22% over FY22-25 on a high base of FY22, where CGPOWER delivered a robust performance.

We expect consolidated RoCE to improve by 560bp to 38% by FY25. We are not building in any benefit from new ventures under TI-2 (except the Lens business, which is part of others) in our consolidated performance.

We maintain our Buy rating with a Target Price of Rs 2,230 per share (premised on Sep’24E SoTP, based on 30x for the standalone business and valuing listed subsidiaries at a 20% holding company discount).

BSE Metal index added 0.5 percent led by the Tata Steel, SAIL, NMDC