May Aviation Data

The domestic air passenger traffic stood at 1.2 crore, up 11 percent, MoM

IndiGo May passenger load factor was at 81 percent versus 78.7 percent and SpiceJet passenger load factor was at 89.1 percent against 85.9 percent, MoM.

IndiGo May market share was at 57.9 percent versus 58.3 percent and SpiceJet May market share was at 9.5 percent versus 9.1 percent, MoM.

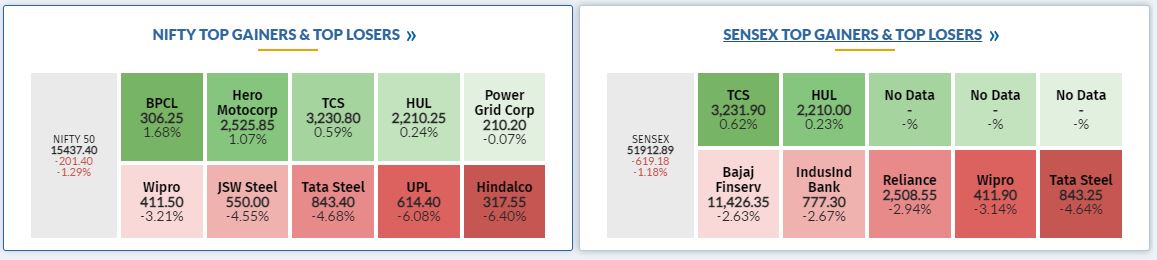

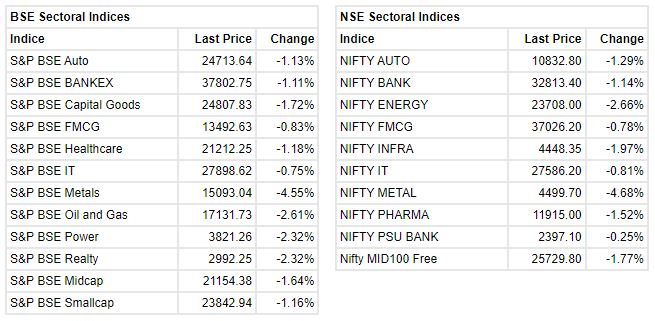

Market at 3 PMBenchmark indices were trading lower in the final hour of the trading with Nifty below 15500.The Sensex was down 581.42 points or 1.11% at 51950.65, and the Nifty was down 186.90 points or 1.20% at 15451.90. About 1113 shares have advanced, 2000 shares declined, and 105 shares are unchanged.

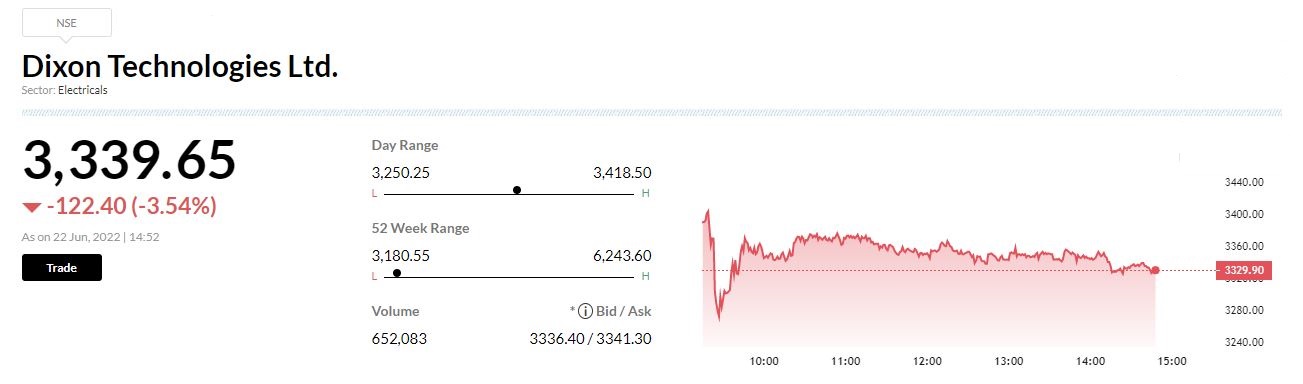

Morgan Stanley View On Dixon TechnologiesMorgan Stanley has kept underweight on Dixon Technologies and also cut target price to Rs 2,634 from Rs 2,879 per share as the growth concerns remained.It lower earnings estimates by 2-5% over FY23-26.The multiple risks are being ignored, including competition, margin & RoE contraction. Rising commodity prices pose a risk to ODM business margin, reported CNBC-TV18.

Top Gainers and Losers on the BSE Sensex and Nifty50:

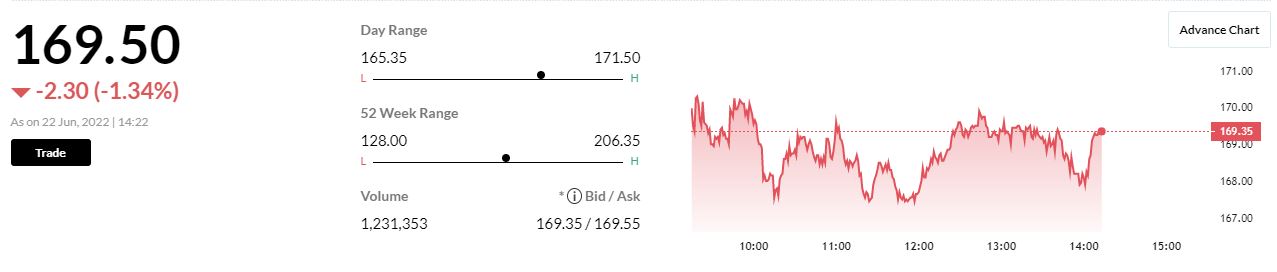

CARE revises credit rating on Filatex India

CARE revised its credit rating on Filatex India’s long term bank facilities to A+, from ‘A’, with stable outlook.

Filatex India was quoting at Rs 94.60, up Rs 0.50, or 0.53 percent.

The #Telecom Department notifies an order on #SUC (Spectrum Usage Charge).@AshmitTejKumar reports. pic.twitter.com/B9O347Xb39

— CNBC-TV18 (@CNBCTV18Live) June 22, 2022

Gaurang Somaiya, Forex & Bullion Analyst, Motilal Oswal Financial Services:

Rupee fell towards fresh all time lows especially as the dollar rose against its major crosses. The greenback rose ahead of the Fed Chairman’s testimony. Expectation is that the commentary could be hawkish and that could support the dollar at lower levels. Pound fell sharply after UK CPI in May came in line with estimates. We expect the USD-INR to trade sideways but with a positive bias quote in the range of 77.70 and 78.50.

M&M Financial Services partners with BigHaat to offer health & motor insurance

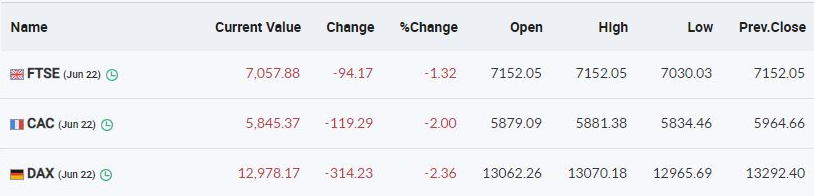

European markets updates

Tapan Patel, Senior Analyst (Commodities), HDFC Securities:

Crude oil prices traded lower with benchmark NYMEX WTI crude oil prices fell by 4.58% near $104.56 per barrel. Crude oil prices plunged amid a push by US President Joe Biden to bring down soaring fuel costs, including pressure on major US firms to help ease the pain for drivers during the country’s peak summer demand. US President Joe Biden is expected on Wednesday to call for temporarily suspending the 18.4-cents a gallon federal tax on gasoline, a source briefed on the plan told Reuters.

We expect crude oil prices to trade lower with resistance at $108 per barrel with support at $102 per barrel. MCX Crude oil July contract has important support at Rs 8010 and resistance at Rs 8350 per barrel.

Market update at 2 PM: Sensex is down 708.57 points or 1.35% at 51823.50, and the Nifty shed 231 points or 1.48% at 15407.80.

BofA Securities remain cautious on Indian market; Nifty target at 14,500

We are cautious on markets despite the recent market correction. In addition to globally tightening monetary conditions and a slowing economic outlook, including fears of a recession in the US, we see other risks: (1) likely earnings cut for Nifty in 2Q/3Q FY23 as effects of cheaper inventory buffers fade; (2) headwinds from higher crude likely sustaining; (3) Nifty valuation, though corrected, still appears vulnerable close to its 10yr average.

We maintain a cautious stance with defensive sectoral skew & a revised year-end Nifty target of 14.5k. Potential clarity on macro & monetary policy outlook in the US/India could lead markets to bottom by Aug/Sept 2022.