Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Nippon Life India enters into strategic collaboration with Cathay SITE:

Cathay SITE (Securities Investment Trust) the largest Asset Manager in Taiwan, signed a Letter of Intent (LOI) for an exclusive strategic collaboration with Nippon Life India Asset Management Limited (NAM India), a subsidiary of Nippon Life Insurance, as per the press release.

Nippon Life India Asset Management was quoting at Rs 331.80, up Rs 2.50, or 0.76 percent on the BSE.

Gaurav Garg, Head of Research, CapitalVia Global Research:

The market opened with a gap up but with increased concerns over rise in Covid cases, the market could not maintain the higher levels and corrected till the level of 14400. The US market closed with a mixed sentiment in the market. Asian markets were trading mixed, after Singapore’s central bank retained its monetary policy stance as the policymakers viewed it appropriate amid weak outlook for core inflation and continuing economic recovery.

Market continues to trade in a range between 14250-14800 with 14200 being a major support in the short period of time. On the sectoral front, Metal and Health Care have shown some strength while Auto and IT sector being the top losing sectors each shredding nearly 2 percent. Cipla and ONGC are the top gainers while Grasim and Eicher Motor are the top losers.

Rupee Updates:

Indian rupee has erased early losses and trading at day’s high at 75.00 per dollar, amid selling seen on the domestic equity market.

It opened 14 paise lower at 75.19 per dollar against Monday’s close of 75.05.

NMDC revises lump ore and fines prices:

The company has fixed the prices of Lump Ore (65.53, 6-40mm) at Rs 6,950/- per ton and Fines prices (643, -10mm) at Rs 5,060/- per ton w.e.f. 14-04-2021, company said in press release.

NMDC was quoting at Rs 141.10, up Rs 3.00, or 2.17 percent on the BSE.

Coinbase Makes Its Nasdaq Debut; Here’s How Indian Investors Can Invest: Vinay Bharathwaj Of Stockal

We are seeing investors go beyond FAANG companies, it was popular initially when we launched and when investors just wanted to get some global exposure, says Bharathwaj.

ICRA upgrades rating of bank facilities of Jindal Steel & Power:

Credit rating agency, ICRA, has upgraded its rating from [ICRA] BBB + with “Stable” outlook to [ICRA] A with “Stable” outlook on the Long Term Bank Facilities and from [ICRA]A2 to [ICRA]A1 for short term facilities of Jindal Steel & Power, company said in its release.

Jindal Steel & Power was quoting at Rs 415.15, up Rs 5.65, or 1.38 percent on the BSE.

Sensex, Nifty Volatile; 5 Factors That Are Weighing On The Market

The market failed to extend the gains of the previous session and succumbed to profit-taking after opening higher.

JUST IN | March WPI inflation was at 7.39% versus 4.17%. Food inflation stood at 5.28% versus 3.31% and manufactured products inflation was at 7.34% versus 5.81%, MoM.

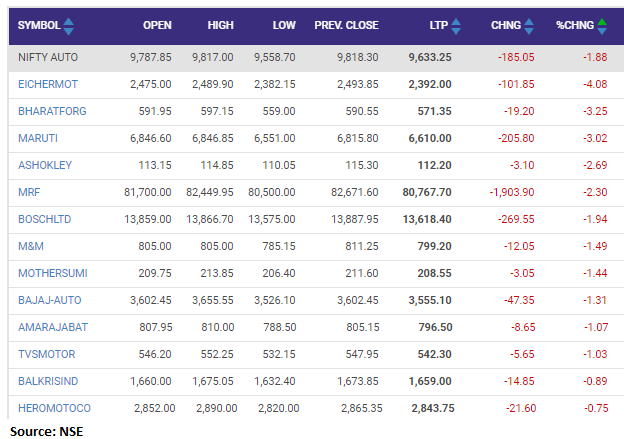

Nifty Auto index slipped 1 percent dragged by the Eicher Motors, Bharat Forge, Maruti Suzuki

L&T bags contracts across various verticals:

The heavy engineering arm of Larsen and Toubro has won significant contracts for its various business segments in Q4 of FY21, company said in the release.

L&T Heavy Engineering has secured order for 12 Steam Generators (SGs) from NPCIL for the prestigious 3 x 700 MWe Pressurized Heavy Water Reactor (PHWR).

Also, L&T Heavy Engineering also won a Critical Reactor system package order for IOCL’s Petrochemical Project against stiff international competition

Other notable orders include Hydroprocessing Reactors for the Renewable diesel & Biofuel Project for prestigious refinery majors from USA & Europe.

Larsen & Toubro was quoting at Rs 1,360.50, down Rs 13, or 0.95 percent on the BSE.

Yes Securities on Infosys:

While the revenue performance was less than expected in the quarter, but robust deal booking and deal pipeline in digital, cloud and data offers strong revenue growth visibility for FY22 and ahead. It should be able to achieve stable operating margin for FY22, supported by positive operating leverage, even though, it faces headwind in terms of increased cost such as salary hikes and increased travel expense. Share buyback would restrict downside risk in the near term. The stock trades at 22.8x on FY23 earnings. Initiate coverage on the stock with buy rating. Target Rs 1,560.