Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel One:

The technical structure provided encouragement for the bulls on the D-Street as Nifty showed an authoritative closure in the unfilled gap after three weeks of struggle.

With yesterday’s robust close, 15700 has once again become a sacrosanct support. Before this 15900 followed by 15800 are likely to provide cushion on the weekly expiry day. In case of any dip towards the mentioned supports, one can certainly look to add bullish bets.

We are now knocking on the doors of 16000 and if the global market supports, we are finally likely to traverse through this sturdy wall. This will certainly bolster the overall sentiments and in the process, 16125 – 16200 levels can be tested in the forthcoming session itself.

This development will open up the new gamut for the bulls, which augurs well considering recent cheerless action. Since we are not completely out of the woods yet, global development remains a caveat for the above mentioned view.

There have been contributions across the board, wherein the significant benefactors that boosted the bullish sentiments were from the FMCG and Auto space. Looking at the recent development, the undertone is likely to remain upbeat, and traders are advised to identify apt themes in order to find better trading opportunities.

Titan Company stock rallies on strong Q1 sales; brokerages retain ‘buy’

Foreign research firm Citi has maintained buy rating on the stock with a target at Rs 2,890 per share.

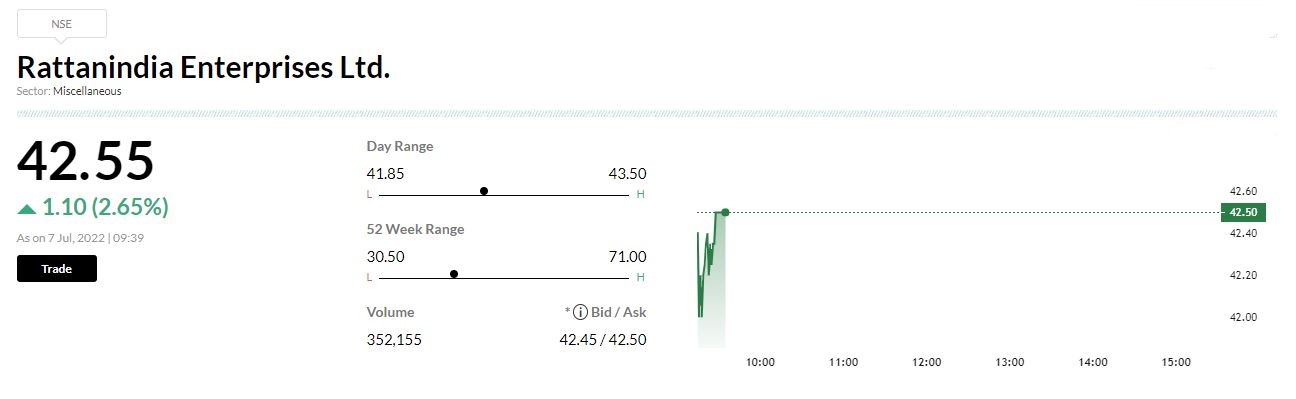

Buzzing:RattanIndia Enterprise is pleased to announce that Throttle Aerospace Systems Private Limited (TAS) has been shortlisted for the PLI (Production Linked Incentive) scheme for Drones and Drone components by Govt. of India.

BSE Auto index rose 1 percent supported by the Minda Industries, Tube Investments of India, M&M, Tata Motors:

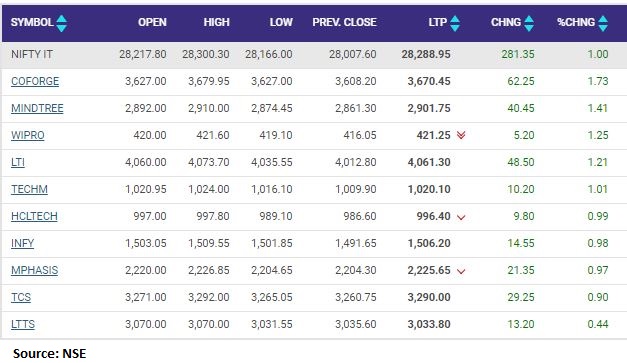

Nifty Information Technology index added 1 percent led by the Coforge, Mindtree, Wipro

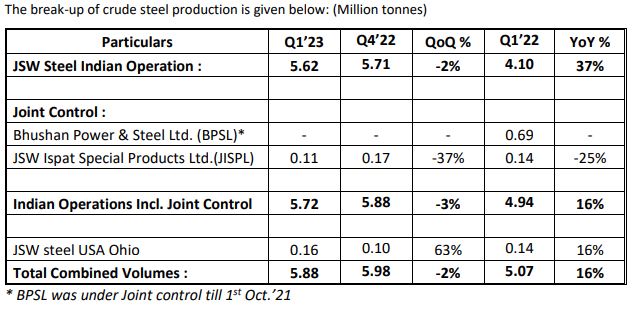

JSW Steel Q1 Update:JSW Steel was quoting at Rs 561.15, up Rs 6.00, or 1.08 percent.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The sharp correction in crude, commodities like metals, and the declining trend in edible oil indicate that inflation will come under control soon. Taking cues from these indicators the bulls have again turned buyers and the near-term structure of the market has turned clearly bullish now.

The crash in commodities and RBI’s latest initiatives to increase foreign currency inflows have the potential to arrest further depreciation in rupee. This means FIIs are unlikely to sell more. This is positive for markets.

Leading indicators like demand for housing, autos particularly passenger and commercial vehicles, certain discretionary items like jewellery etc. reflect robust economic recovery in India.

Daily Voice | Recession in US likely but no wide-spread dislocation on cards, says Unmesh Sharma of HDFC Securities

We believe rising cost of capital impacts the longest end of the duration curve. For example, high PE (price-to-earnings) stocks especially without a clear path to profitability. We therefore do not…

Motilal Oswal View on Titan Company:

Titan remains our top pick in the largecap consumption space in India, with strong earnings growth visibility and compounding by ~20% for an elongated period of time.

In the Jewelry industry, which is organizing at a rapid space, Titan is clearly at the vanguard among organized players in leading this growth. Its runway for growth is long, with a market share of ~6%.

Unlike other high-growth categories, the competitive intensity from organized and unorganized peers in Jewelry is considerably weaker. The structural investment case for Titan is intact.

We maintain our buy rating with a target price of Rs 2,900 per share, premised on 75x Mar’24E EPS.

Prabhudas Lilladher View on Titan Company

We are increasing FY23/24 EPS estimates by 16.6% and 13.4% following strong performance by company in 1Q23, first normal 1Q after FY20.

The company’s growth strategy is playing out in Jewellery with 1) aggressive store expansion (19 in 1Q) 2) Increased focus on wedding segment 3) focus on lighter Jewellery and 4) designs and campaigns to cater to regional tastes and preferences.

Eyewear business is gaining scale and growth prospects in this large but highly organized segment look encouraging. Watches and wearables growth will be led by significant revamp of WOT distribution and emerging wearables segment.

We believe new businesses like Wearables, Taneria (Distribution and product range led), Carat lane will continue to gain traction.

We estimate 1Q sales and PAT growth of 166% and 1137% although these numbers can’t be extrapolated. We estimate 34.4% PAT CAGR over FY22-24 and arrive at a DCF based target price of Rs 2520 (Rs 2701 earlier, impacted by higher Risk free rate). Although structural story remains intact, expect back ended returns given rich valuations of 59.8xFY24 EPS. Retain Buy

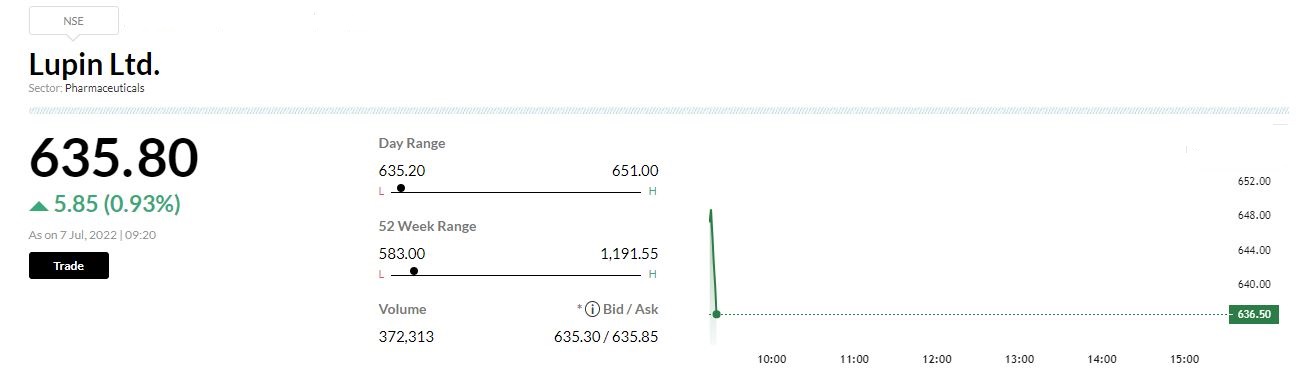

Lupin’s Somerset manufacturing plant gets EIR from USFDALupin has received the Establishment Inspection Report (EIR) from United States Food and Drug Administration (US FDA) for its Somerset, NJ manufacturing facility, after the inspection of the facility in March 2022. The US FDA has determined that the inspection classification of the facility is Voluntary Action Indicated (VAI).

Gainers and Losers on the BSE Sensex in the early trade: