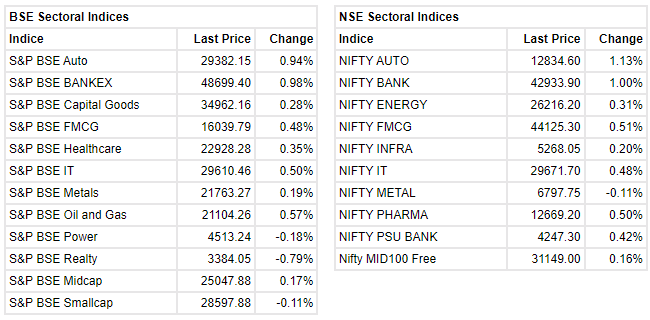

Market at 12 PMBenchmark indices were trading higher with Nifty above 18100.The Sensex was up 358.42 points or 0.59% at 60980.19, and the Nifty was up 100.40 points or 0.56% at 18128.10. About 1685 shares have advanced, 1577 shares declined, and 160 shares are unchanged.

Amar Ambani, Group President and Head, Institutional Equities, Yes Securities

Even though expenditure for FY23 will likely surpass the budgeted numbers, the math will be under control due to the buoyancy in tax collections.

After the pandemic-induced spurt in spending, FY24 Budget expansion is likely to be a moderate one, with the economy having stabilized. From looking at the budget data of the last two decades, it is amply evident that the NDA tends to be less expansionary on the fiscal.

The government will continue to focus on Capex and also persist with its intent to swell the share of Indirect Taxes, as is evident from the widening net of formalisation. We see subsidy bills moving back to pre-Covid levels in terms of GDP size. Notwithstanding the fact that government’s Debt servicing is a cause for concern – given interest payments significantly eating into revenue receipts – a decisive tilt towards small saving schemes should reduce the dependence on market borrowings and ease the pressure on sovereign yields.

This time round, the government is likely to be modest in its asset monetization targets, unlike the lofty projections of the prior budgets. In all probability, India’s GDP growth target would be a low double-digit affair amid a challenging global backdrop, and the government would not stray from its fiscal prudence roadmap.

Euro clears 9-month peak

The euro scaled a nine-month high on the dollar on Monday as more hawkish comments on European interest rates contrasted with market pricing for a less aggressive Federal Reserve.

The euro reached as far as $1.0903, breaking the recent peak of $1.08875 and opening the way to a spike top from last April at $1.0936.

It was aided by European Central Bank (ECB) governing council member Klaas Knot, who said interest rates would rise by 50 basis points in both February and March and continue climbing in the months after.

RBL Bank Q3 profit grows 34%

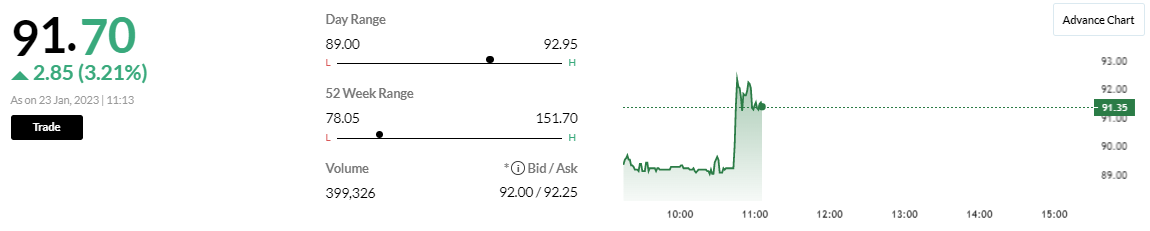

RBL Bank has clocked a 34% year-on-year increase in profit at Rs 209 crore for quarter ended December FY23, on fall in provisions with improvement in asset quality.

Net interest income at Rs 1,148 crore for the quarter rose by 13.6% compared to year-ago period, with net interest margin expanding 40 bps YoY to 4.74%.

Advances for the quarter at Rs 66,684 crore increased by 15%, and deposits grew by 11% with CASA deposits rising 18%.

RBL Bank was quoting at Rs 167.95, down Rs 1.95, or 1.15 percent.

Jefferies View on Reliance Industries

Brokerage house has kept ‘buy’ rating on the stock with a target at Rs 3,110 per share with EBITDA beat in O2C and Jio, while retail was in-line.

Strong store additions and improving footfalls paint a strong growth outlook in FY24. However, Jio’s sub additions were a tad lower, but rapid 5G Roll-out should drive strong growth.

O2C benefited from strong diesel spreads and cheap crude blending and Chinese demand recovery can lead to earnings upside in FY24.

The company’s Capex remains elevated, reported CNBC-TV18.

Reliance Industries was quoting at Rs 2,445.00, up Rs 2.30, or 0.09 percent on the BSE.

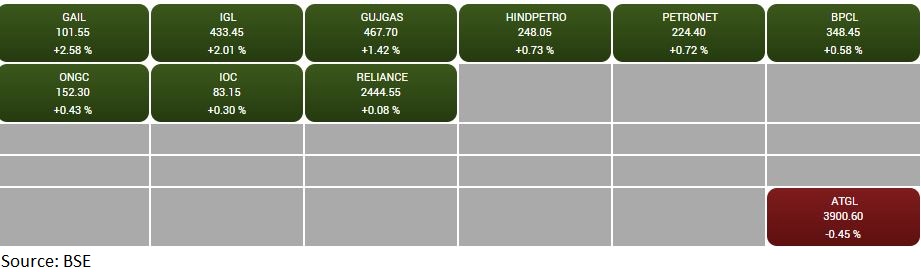

Oil & Gas index added 0.5 percent led by Gail, Indraprastha Gas, Gujarat Gas

Prabhudas Lilladhar View on Kotak Mahindra Bank

Changed rating to ‘buy’ from ‘accumulate’ and kept the target price unchanged at Rs 2,100.

The bank saw a strong quarter as core earnings at Rs 26 billion, beating broking house estimates by 6 percent driven by higher NIM at 5.43 percent (PLe 5.2 percent) which was a function of lower cost of funds that came in at 3.83 percent (PLe 4.1 percent).

Credit growth was a tad higher at 5.7 percent QoQ driven by corporate (+6.8 percent) and retail (+6.0 percent).

With continued traction in PL/CC and MFI, bank expects unsecured share to increase from 9.3 percent to early-mid teens in FY24 which would also protect margins.

TCS BaNCS gets deal from Bitcoin Suisse AG for support of digital assets

Tata Consultancy Services announced on January 23 that it has helped Bitcoin Suisse AG (BTCS) create a next-generation crypto-financial technology platform.

BTCS selected TCS BaNCS for its native support for digital assets and Swiss and global market readiness. “The secure and scalable cloud-based solution covers all core functions like brokerage, custody, payments for crypto assets, including risk,” the press release stated.

TCS is trading flat at Rs 3375 on the NSE, higher by 0.37 percent from Friday’s close

Puravankara Q3 Update-Volumes up 3 percent at 1.02 msf vs 0.99 msf YoY

-Sales up 20 percent at Rs 796 crore vs Rs 666 crore YoY

-Realisations up 15 percent at Rs 7,767/sqft vs Rs 6,727/sqft YoY

Markets At 11 AMSensex is up 428.84 points or 0.71 percent at 61,050. Nifty is up 114.60 points or 0.64 percent at 18,142.30. About 1669 shares have advanced, 1484 shares declined, and 169 shares are unchanged.

L&T Construction bags orders in the range of Rs 1,000-2,500 crore

The construction arm of Larsen & Toubro has secured orders for its Power Transmission & Distribution and Buildings & Factories businesses, said the company in an exchange filing on 23 January.

The renewables arm of the Power Transmission & Distribution (PT&D) business has received a turnkey EPC order to establish a 112.5 MW solar power plant in south-western part of West Bengal.

The Buildings & Factories Business has secured an order from Nanavati Max Super Specialty Hospital to construct a state-of-the-art 600-bed super specialty hospital at Vile Parle, Mumbai.

The stock is trading flat at Rs 2261 per share on the NSE

Manu Rishi Guptha, Founder and CEO of MRG Capital

Considering this budget is the last before the general elections in 2024, we expect the budget to be a bit populist. Support to MSME and Agri sectors to continue while some moderation in capex spends (from 7.5 lakh crore in FY23) is expected. Buoyant direct and indirect tax collections will be offset by sticky food, farm subsidy bills and lower disinvestment targets. So, we need to see the path FM takes to get to the fiscal deficit target of 4.5% by FY26 from 6.4% currently.

Government ECLGS scheme to support Covid hit MSME sector has seen 71 percent (of total Rs 5 lakh crore allocated) disbursals and set to end in March 2023. Not availing of full credit available indicates better health of the sector but considering the inflationary trends and falling exports amid global recessionary trends, we expect Government to extend the validity of the scheme.

Government hasn’t tweaked income tax slabs since February 2020 budget wherein tax rates were reduced albeit on the clause of not claiming any exemptions. With inflationary trends and in view of FY24 elections, Government might offer some relief to the salaried class to increase the exemption limit from the current 2.5 lakh.