Stocks in the news | Axis Bank, Hindustan Unilever, Tata Coffee, JK Paper, SBI, NCL Industries

Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments: The level of 14,200-14,250 was a key support which the market disrespected in a jiffy. The fall thereafter has happened on the back of very high volumes. We could slide further to test 13,600. If we are unable to hold that level, we could fall more towards 13,100-13,200. As of right now, any up move can be utilised to short the Nifty. The resistance on the upside is at 14,400-14,500.

Buzzing:

JK Paper share price was down over 3 percent on January 28 after the company reported a decline of 51 percent in its consolidated net profit at Rs 64.59 crore for the third quarter ended December. The company had posted a net profit of Rs 131.85 crore in the October-December quarter a year ago.

Its total income was down 9.28 percent to Rs 770.45 crore during the period under review as against Rs 849.25 crore in the corresponding period of the last fiscal.

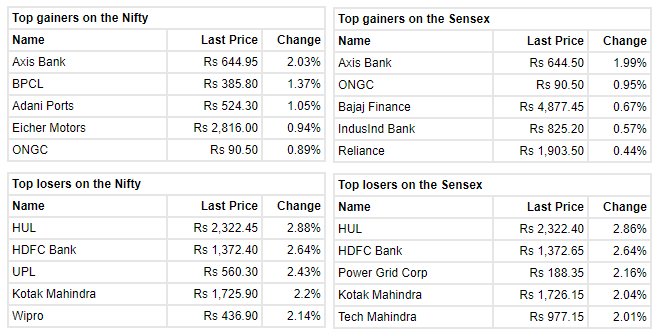

Market Updates: Benchmark indices are trading lower with Nifty below 13,850.At 10:29 IST, the Sensex was down 467.44 points or 0.99% at 46,942.49, and the Nifty was down 134.90 points or 0.97% at 13,832.60. About 1178 shares have advanced, 1113 shares declined, and 101 shares are unchanged.

Ravindra Rao, VP- Head Commodity Research at Kotak Securities.

Comex gold was trading 0.5 percent lower at $1,835 after declining 0.3 percent the previous day. Gold weakened as the Fed painted a downbeat outlook for the US economy but did not hint towards additional measures.

The Fed’s downbeat growth outlook and ECB’s willingness to cut rates pushed the US dollar higher, putting pressure on gold. ETF outflows also showed weaker investor interest.

Lower bond yields, mixed economic data from major economies, and rising virus cases supported prices. Gold has come under pressure but was unlikely to see a sustained decline as the US economic outlook and stimulus expectations may limit upside in the dollar.

With infrastructure push, Railways to see highest-ever capex in 2021-22

With the country’s railways infrastructure set for a massive revamp, the Indian Railways is likely to see its highest ever capital expenditure (capex) for 2021-22 in the upcoming Budget 2021. During the current financial year, the capex by the Indian Railways was pegged at Rs 161,042 crore, which is likely to grow in double-digits in 2021-22, if the finance ministry meets the Railway Board’s expectation.

“A lot of infrastructure projects are lined up. This includes new lines, doubling, tripling and electrification, overhauling of the existing signalling and telecommunication system, freight corridors, station redevelopment and introduction of modernized rolling stock,” said R Sivadasan, former finance commissioner with the Railways. The railways is expected to raise its market share in overall freight, from around 30 per cent now to 45 per cent in 2030.

Over 20 Stocks From Top 5 PMS Schemes Outperformed Nifty In December; Worth A Look?

Small & midcaps captured the limelight after two straight years of underperformance, and if we look at the PMS schemes which outperformed the index are mostly from the broader market space.

Rupee Opens: Indian rupee fell in the early trade on Thursday. It opened 21 paise lower at 73.13 per dollar against previous close of 72.92, amid selling seen in the domestic equity market.

On January 27, the rupee erased most of the intraday gains and ended near the day’s low level at 72.92 per dollar against Monday’s close of 72.95.

India likely to announce sale of IDBI Bank, stake in LIC: Sources

India’s government plans to announce the sale of a 10 percent to 15 percent stake in state-run Life Insurance Corp, the country’s biggest insurer, in next week’s federal budget, as part of a privatisation push to improve public finances, two government sources said.

Finance Minister Nirmala Sitharaman’s plans to divest government control of large companies such as Air India and Bharat Petroleum Corp Ltd failed to make much headway in the current fiscal year because of the pandemic. Read More

Dollar Updates:

The dollar extended gains against most currencies on Thursday as a stock market rout due to concerns about excessive valuations boosted safe-harbour demand for the U.S. currency.

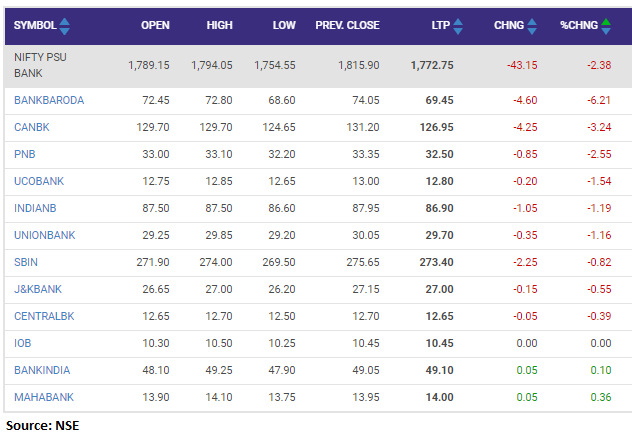

Nifty PSU Bank index shed 2 percent dragged by the Bank of Baroda, Canara Bank, PNB: