Moneycontrol launches Analysts’ Call Tracker. A monthly special page that tells you which way analysts are leaning; the stock they are most bullish or bearish on, what they are upgrading or downgrades, and where they are betting against the market. Ignore this at your own risk!

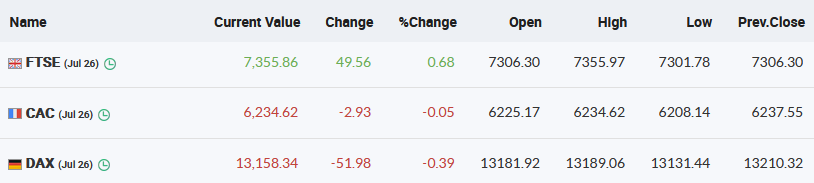

European Markets Updates

EIH Associated Hotels Q1: The company reported net profit of Rs 5.68 crore against loss of Rs 9.7 crore (YoY). Revenue was up at Rs 60.1 crore against Rs 12.7 crore (YoY). EBITDA at Rs 11 crore against loss of Rs 13.2 crore (YoY).

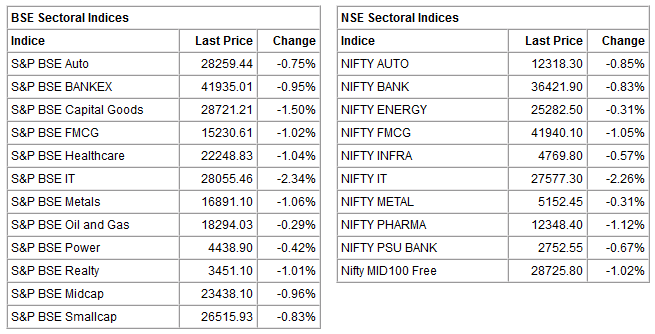

Market update at 2 PM: Sensex is down 399.93 points or 0.72% at 55366.29, and the Nifty shed 121 points or 0.73% at 16510.

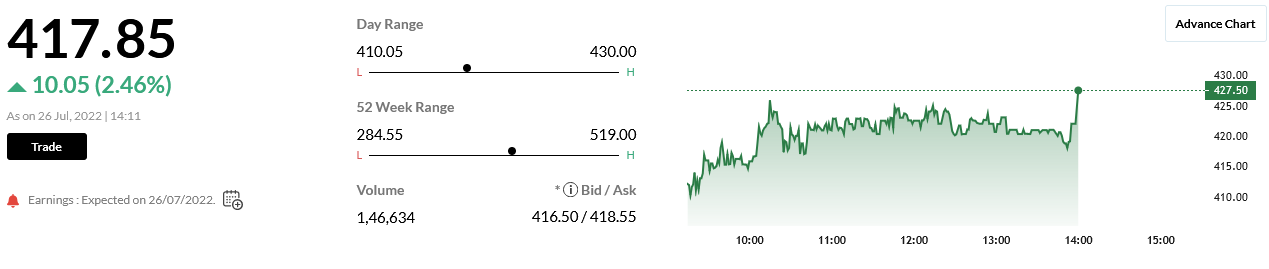

Bajaj Auto Q1: Net profit grew 10.6% at Rs 1,173 crore against Rs 1,061 crore (YoY). Revenue was up 8.4% at Rs 8,005 crore against Rs 7,386 crore (YoY). EBITDA rose15.9% at Rs 1,297 crore against Rs 1,119 crore (YoY) while EBITDA margin came in at 16.2% against 15.2% (YoY). The stock was trading at Rs 3,986.40, down Rs 31.10, or 0.77 percent. It has touched an intraday high of Rs 4,028.95 and an intraday low of Rs 3,945.

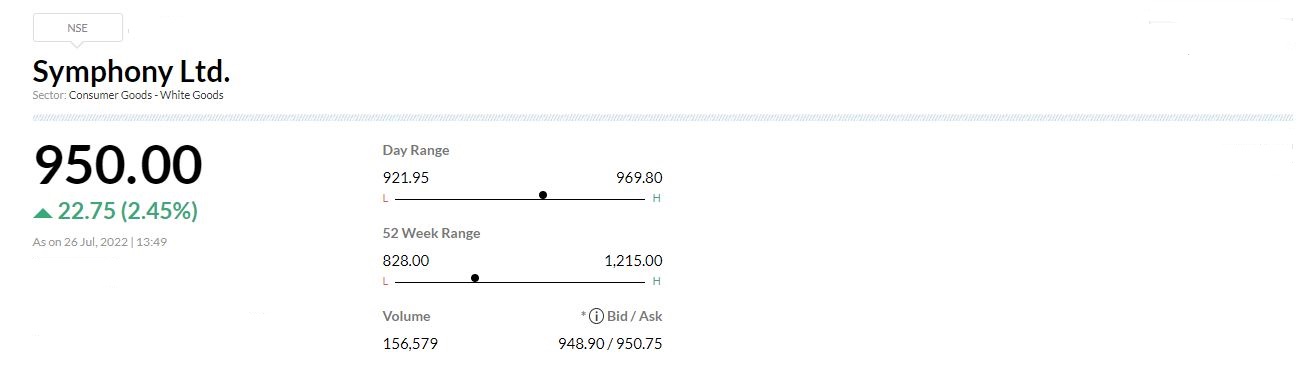

Symphony Q1 Symphony has posted consolidated net profit at Rs 29 crore versus Rs 6 crore and revenue rose 43 percent at Rs 329 crore versus Rs 230 crore, YoY.

KPIT Technologies Q1 results:

KPIT Technologies has reported 8.3 percent jump in its consolidated net profit at Rs 85.4 crore versus Rs 78.9 crore and revenue was up 5.2 percent at Rs 692 crore versus Rs 658 crore, QoQ.

KPIT Technologies was quoting at Rs 523.75, down Rs 6.85, or 1.29 percent.

Union Bank of India Q1

Union Bank of India has posted 32 percent jump in its Q1 net profit at Rs 1,558.5 crore versus Rs 1,181 crore.

The banks gross NPA stood at 10.22 percent versus 11.11 percent and net NPA was at 3.31 percent versus 3.68 percent, QoQ

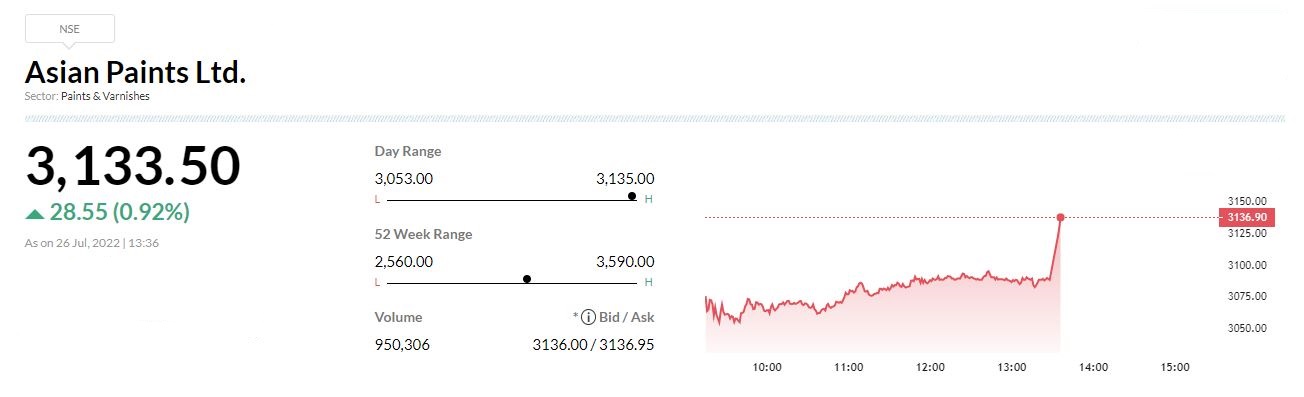

Asian Paints Q1 EarningsAsian Paints has posted consolidated net profit at Rs 1,036 crore and revenue at Rs 8,607 crore in the quarter ended June 2022.

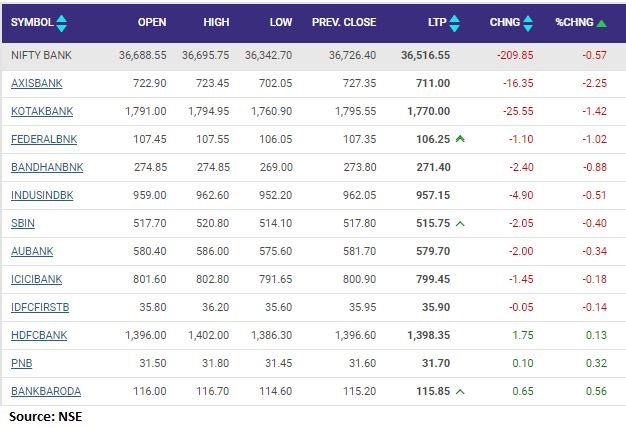

Nifty Bank index shed 0.5 percent dragged by the Axis Bank, Kotak Mahindra Bank, Federal Bank

Prabhudas Lilladher View on Larsen and Toubro

We believe Larsen and Toubro (L&T) is well placed to gain from its focus on international markets, healthy order prospect pipeline, continued execution momentum and focus on divestment of non-core assets.

The stock is currently trading at PE of 23.5x/21.2x FY23/FY24E. We have ‘Buy’ rating on stock with Target Price of Rs 2,091.

Larsen & Toubro was quoting at Rs 1,760.60, down Rs 21.30, or 1.20 percent on the BSE.

Gaurang Somaiya, Forex & Bullion Analyst, Motilal Oswal Financial Services:

Market participants will be keenly keeping an eye on the advance reading of second quarter of GDP and a negative number could reaffirm expectation of a slowdown in the US economy. GDP has contracted in the last quarter and another quarter of contraction could put the economy on the brink of recession. The Fed could consider raising rates thrice this year; with one at the July meeting and the other two in the next couple of meetings after that. But the rates hike after the July meeting could be smaller than the one we have seen in the recent ones.

Recent data has shown signs of an economic slowdown while inflation remains stubbornly high, with claims for jobless benefits rising to its highest in eight months last week. Market participants at this point of time have discounted a 75bps rate hike with a hawkish stance and a 100bps rate hike could strengthen the dollar against its major crosses.