Follow our LIVE blog for the latest updates on the new Omicron variant of COVID-19 and its impact

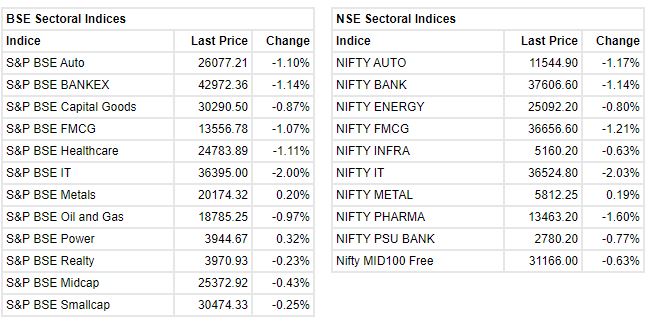

Market at 3 PMBenchmark indices erased some of the intraday losses but still down over 1 percent amid selling seen across the sectors.The Sensex was down 721.69 points or 1.20% at 59377.13, and the Nifty was down 207.10 points or 1.15% at 17731.30. About 1493 shares have advanced, 1685 shares declined, and 69 shares are unchanged.

Bank of Maharashtra Q3 earnings:

Bank of Maharashtra has reported net profit at Rs 324.6 crore versus Rs 154.1 crore and net interest income (NII) was up 16.9 percent at Rs 1,527 crore versus Rs 1,306 crore, YoY.

The Gross NPA was at 4.73 percent versus 5.56 percent and net NPA was at 1.24 percent versus 1.73 percent, QoQ.

Bank of Maharashtra was quoting at Rs 21.00, down Rs 0.50, or 2.33 percent on the BSE.

Puneet Maheshwari- Director, Upstox:

In the past year, digital brokerages offered investors easy and convenient access to a range of products and services. In a welcome development, SEBI announced a shorter settlement cycle, called T+1, as an incentive to the investor community.

Government may consider relieving traders of the securities transaction tax (STT). By doing so, new investors would be encouraged to start trading. There needs to be more participation in indexes or exchange-traded funds. By offering a lock-in and tax incentives on the lines of equity-linked tax savings schemes, the government can encourage long-term savings in Nifty or Sensex. A greater allocation by the government-owned provident funds and pension funds into equity markets could also help.

Given the enormous increase in medical expenses due to Covid-19, we urge the government to hike the standard deduction from the current Rs 50,000 to Rs 1,00,000. This will further lower the tax burden and put more money in the hands of the salaried class.

The government should remove the concept of speculative income and restrict income classification arising from capital market transactions to business income, long-term capital gains and short-term capital gains. We hope that the Government considers tax exemption up to Rs 1,00,000 on short-term capital gains tax as well as tax exemption on dividends up to Rs 50,000 for senior citizens.

The budget 2022 should help build momentum in the equity markets and every possible avenue must be considered by the government to make this happen.

Sensex Down 2,000 Points In 3 Days; What’s Driving The Losses On Dalal Street?

The Sensex and the Nifty were trading sharply lower for the third session in a row despite Asian markets led by China clocking gains

HCL Tech bags order from Austrian company AMS: HCL Technologies has expanded its strategic transformation partnership with ams OSRAM to digitize one of the optical solutions leader’s key business processes and drive enterprise resource planning and customer relationship management systems standardization across the organization. HCL will also continue to lead IT infrastructure operations integration for the client, the company said in an exchange filing. The stock was trading at Rs 1,173.30, down Rs 25.85, or 2.16 percent. It has touched an intraday high of Rs 1,204.90 and an intraday low of Rs 1,172.

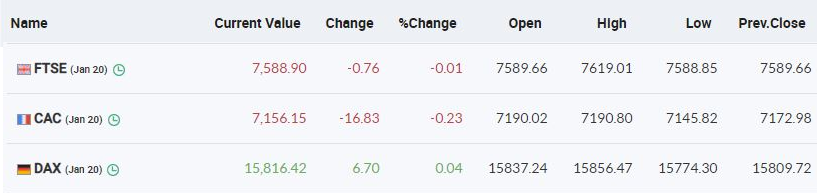

European Markets Updates:

Phillips Carbon Q3: Net profit was down 11.2% at Rs 111.4 crore against Rs 125.4 crore (YoY). Revenue jumped 50.3% at Rs 1,156 crore against Rs 769.4 crore (YoY). EBITDA slipped 10.7% at Rs 168 crore against Rs 188 crore (YoY). Margin at 14.5% against 24.5% (YoY).

AGS Transact Technologies IPO updates: AGS Transact Technologies’ initial public offering (IPO) has got a good response, with the Rs 680-crore issue being subscribed 1.26 times by the afternoon of January 20, the second day of bidding.

Investors have bid for 3.61 crore equity shares against an offer size of 2.86 crore equity shares. The portion set aside for retail investors has been subscribed 1.79 times and that of non-institutional investors 1.08 times. Qualified institutional buyers have put in bids for 38.28 lakh shares against the allocated number of 81,92,770 shares, or 47 percent of the offer.

Navneet Damani, VP – Commodity & Currency Research, Motilal Oswal Financial Services on Gold:

Bullions started 2021 year with some buzz over vaccine reports from major pharma companies, political tiff between US President Biden and Former President Trump along with rising cases and concerns regarding the Covid-19 and its variants, stimulus packages and liquidity measure to support the economy, lower interest rate scenario continued to support the prices at lower levels. They become more relevant especially in the year 2021, with some baggage from 2020. Bullions did have a few phases of struggle, although that did not create a deep dent on prices amidst the strong fundamentals creating a floor for the prices and triggering high volatility.

Looking ahead, quarterly target of $1915 followed by $1965 could be seen, with a meaningful base around $1800 and $1745 zone. Correction from short term hurdles could be used as a buying opportunity although over the course of next 12-15 months an extended rally could be seen over $2000 with a potential to make new life time highs.

Asian Paints Q3: Asian Paints Ltd on January 20 reported a consolidated profit after tax (PAT) of Rs 1,016 crore for the quarter ended December 2021, down 18 percent from Rs 1,238 crore in the year-ago quarter. The profit grew 70 percent from Rs 596 crore in the previous quarter.

Consolidated revenue of India’s largest player in the decorative paints segment was 26 percent higher at Rs 8,527 crore from Rs 6,788 crore in Q3FY21. Revenue in the September quarter was Rs 7,096 crore.

Market update at 2 PM: Sensex is down 916.12 points or 1.52% at 59182.70, and the Nifty tumbled 258.90 points or 1.44% at 17679.50.