Stocks to Watch Today | Sun Pharma, IRCTC, LIC, Wockhardt and others in news today

#OnCNBCTV18 | The e-commerce segment has grown by 35% for the company. Will be profitable at a PAT level by end of FY23 & FY24, says Sahil Barua of @delhivery pic.twitter.com/YGAIT29rw4

— CNBC-TV18 (@CNBCTV18Live) May 31, 2022

Market update at 10 AM: Sensex is down 363.71 points or 0.65% at 55562.03, and the Nifty down 90.70 points or 0.54% at 16570.70

Adani Power large trade | 136.5 lakh shares (0.37% equity) worth Rs 441.3 crore change hands

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The pullback in the market has been sharply assisted by smart bounce in large-caps across sectors. The recovery in beaten down IT stood out. A significant development in the market is the selling exhaustion by FPIs of recent days turning into FPI buying of Rs 502 crores. It remains to be seen whether this trend will sustain.

The dominant factor determining the market direction, going forward, would be the trend in the US market, which, in turn, would be determined by the inflation in the US and the Fed’s response to it. The recent rally has been supported by expectations that inflation is peaking out and, therefore, the Fed wouldn’t have to hike rates as aggressively as the market feared.

A major headwind for the Indian economy and markets is crude spiking above $120 on EU sanctions on Russian oil. Financials can remain resilient even in a choppy market.

#COVID19 India Update | India adds 2,338 cases in last 24 hours vs 2,706 cases the previous day

Active cases rise by 185, recoveries rise by 2,134 & deaths by 19

Positivity rate at 0.64%, recovery 98.74% & mortality 1.22% pic.twitter.com/3ebVPyrrGk

— CNBC-TV18 (@CNBCTV18Live) May 31, 2022

Market at Open: Sensex is down 306.20 points or 0.55% at 55619.54, and the Nifty shed 84.30 points or 0.51% at 16577.10.

Prashanth Tapse, Vice President (Research), Mehta Equities:

Local gauges may start on a cautious note amid steady weakness in SGX Nifty, but gains in other Asian gauges could help revive sentiment. The markets, however, will be keenly awaiting India’s GDP numbers for the March quarter that will trickle in later in the day. The biggest concerns about the inflation, economy and earnings is that WTI Oil has again firmed up above $116 a barrel. However, helping sentiments are key positive catalysts like Nifty is building ‘bullish double bottom pattern’, early arrival of monsoon, fresh stimulus in China, easing China covid curbs and the US Dollar index dropping from a multi-decade high.

Japan’s April factory output slumps in worrying sign for economy:

Japan’s factories posted a sharp fall in output in April as China’s COVID-19 lockdowns and wider supply disruptions took a heavy toll on manufacturers, clouding the outlook for the trade-reliant economy.

Factory output dropped 1.3% in April from the previous month, official data showed on Tuesday, on sharp falls in the production of items such as electronic parts and production machinery. It was the first fall in three months and much weaker than a 0.2% decline expected by economists in a Reuters poll.

India’s January-March GDP growth seen at one-year low on weak consumption

Soaring prices and the subsequent hit to consumer spending and investments are likely to further dampen India’s economy, as the central bank faces a finely balanced struggle to tame inflation via rate hikes without hurting economic growth, economists said.

Asia’s third-largest economy probably grew 4.0% in the January-March quarter from a year earlier, a Reuters poll showed last week. That would be the slowest pace in a year, following 5.4% growth in the previous quarter. Forecasts for the data, due at 1200 GMT on Tuesday, ranged from 2.8% to 5.5% in the May 23-26 survey of 46 economists.

Deepak Jasani, Head of Retail Research, HDFC Securities

Indian markets could open flat to mildly lower in line with range-bound Asian markets. Stocks in Asia fell on Tuesday amid concerns on the impact on growth due to interest rate hikes by central banks and the surge in crude oil prices to $118 per barrel after the European Union backed a push to ban some Russian oil.

Nifty rose for the third consecutive session on May 30 following positive global cues due to China easing Covid curbs and sharp Friday gains on the Wall street. Some local factors helping the mood include early arrival of monsoon in Kerala raising hopes of a favourable impact on agri crops. At close, Nifty was up 1.89% or 308.9 points at 16661.4.

Indian stocks were anyway due for a bounce after continuously underperforming since early April 2022. 16800-16850 level on the Nifty could be tough to breach in the near term.

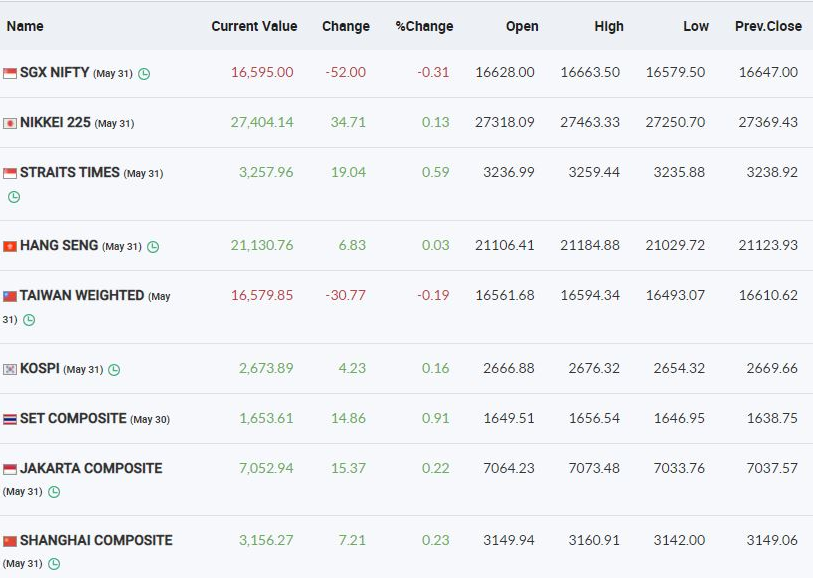

Asian Markets Updates