Milind Muchhala, Executive Director, Julius Baer India

The Indian equity markets have begun the new year on a slightly cautious note, in line with the global markets, continuing the trend visible in December 2022. While expectations remain of softer rate tightening by the global central banks from hereon, concerns remain on the overall economic environment amidst the high interest rates and sticky core inflation. 2023 is expected to be ‘the year of cool down’; both growth and inflation rates globally are likely to slow down, as monetary policy normalisation takes its toll and some of the pandemic-related constraints ease.

Overall, the inflation rate is expected to fall more than the growth rates. Indian markets have been one of the best performing markets globally in CY22, aided by its relatively strong growth – both GDP and corporate earnings – and resilient domestic liquidity, a trend likely to continue in CY23 as well. However, in the near term, the markets seem to be running into a few headwinds – record high valuation premium to EMs (although the valuations are only slightly above its own historical averages) which may attract some tactical shifts to other EMs, potential slowdown in exports on the back of global slowdown, and Fixed Income emerging as a viable investment option. Hence, while we continue to remain constructive on the markets, we believe there could be several interim opportunities in the near term as the markets adjust to the headwinds.

Precision Wire India Board approves preferential issue of 52 lakh shares (3 percent equity) at Rs 73.3:

Earnings preview: Q3 to bring PAT, margin growth for banks

Early updates of select private sector banks show that the low-cost current and savings account deposits have remained stagnant during Q3FY2023, an indication of a shift to term deposits by customers… Read More

Earnings preview: Q3 to bring PAT, margin growth for banks” title=”

Earnings preview: Q3 to bring PAT, margin growth for banks” title=”Earnings preview: Q3 to bring PAT, margin growth for banks

“>

European Markets Updates

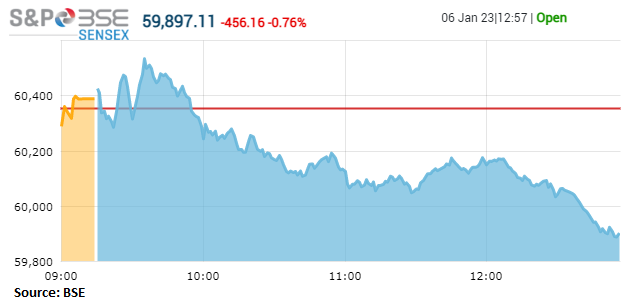

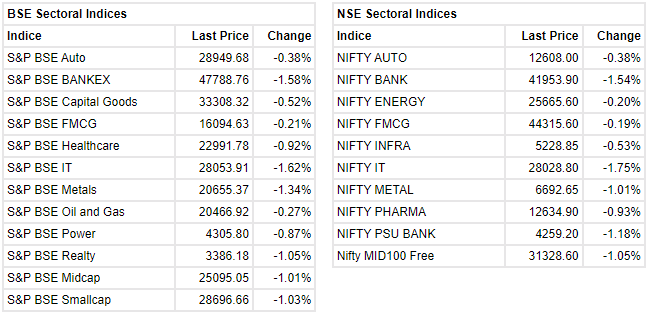

Market update at 2 PM: Sensex is down 493.62 points or 0.82% at 59859.65, and the Nifty shed 141 points or 0.78% at 17851.20.

DB Realty | CFO Asif Balwa resigns; Atul Bhatnagar re-designated As CFOThe company said in an exchange filing that Asif Balwa has resigned from the position of Chief Financial Officer with effect from the closing of business hours on 5th January, 2023.Atul Bhatnagar, who has been acting as Joint Chief Financial Officer, has been redesignated as CFO with effect from 6th January, 2023.

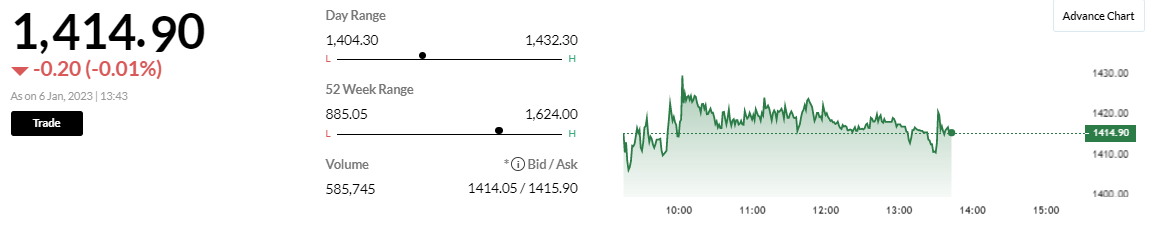

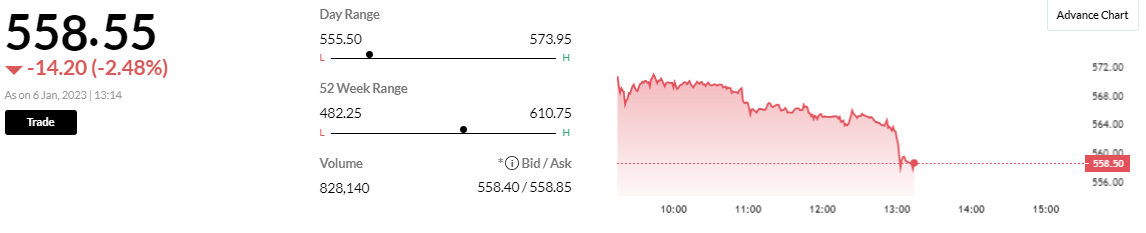

Phoenix Mills Large Trade | 4.60 lakh shares (0.27% equity) worth Rs 65 cr change hands at an avg of Rs 1,415.95 per share

Anant Goenka, MD and CEO, CEATIn an interview to LivemintOur vision will be to cross $2 billion in revenues in the near term by focusing on the passenger and off-highway tyre (OHT) segments. We are already at a leading position in the two-wheeler segment and are now expanding our growth in the passenger car and SUV (sport-utility vehicle) segments, where penetration in India is still low. Internationally, India is becoming the farm tyre manufacturer for the world, and we have made strong gains in the EU and US markets over the last five years.

Markets at 1:30 PMSensex is down 650 points or 1.07 percent at 59705. Nifty is down 183.80 points or 1.02 percent at 17,808.40. About 1077 shares have advanced, 2126 shares declined, and 122 shares are unchanged. All sectors are trading in the red.

Dabur Q3 Business Update-India business expected to report low to mid-single digit revenue growth

-Healthcare portfolio returned to positive growth trajectory

-Demand trends for the industry remained weak during Q3FY23

-Rural markets continue to remain under pressure

-Gross margin will be marginally better sequentially

-Rural markets showed early signs of recovery towards the end of the quarter

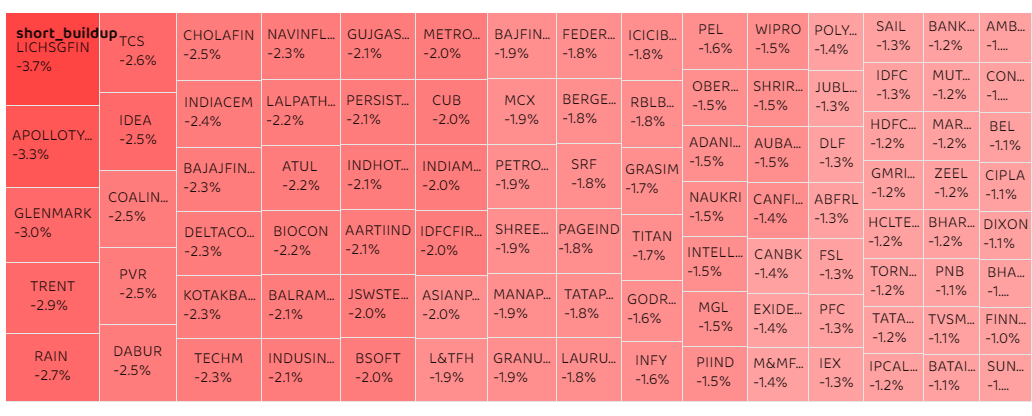

F&O Update-As market has moved downwards, more and more stocks are seeing bear pressure

-These are the stocks that have seen short build up – a scenario when price falls but open interest risePic source: MyF&O

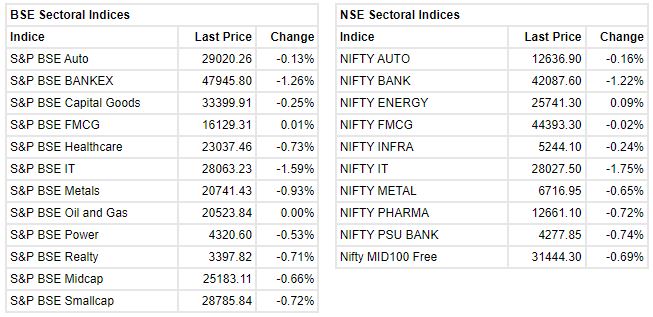

Sensex drops 400 points, Nifty below 17,900; all sectors in red except Nifty FMCG