Expert’s Take on Bank Nifty

The Bank Nifty index formed a Bearish Engulfing candle on the last of the week indicating stiff resistance on the upside at the 36,000 level. The Bears took over the market and the index ended at a day’s low. The lower-end support zone stands at 35,000-34,800 levels and if fails to hold this level will trigger further selling pressure, Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities said.

Aether Industries Locked in 20% Upper Circuit on Debut

Technical View

Nifty index opened gap up by around 130 points and then headed towards 16,800 zones in the morning tick. However, it failed to hold at higher zones and then sharply drifted lower towards 16,567 mark in the last hour of the session by wiping out all the intra gains. It formed a Bearish candle on daily scale while a small bodied Bullish candle on weekly scale which indicates that absence of follow up buying and sustained supply pressure at higher levels. Now it has to hold above 16,550 for an up move towards 16,800 and 17,000 zone whereas supports are placed at 16,442 and 16,400 zones, Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

Market Closing Update

The benchmark indices ended moderately lower amid volatile session, while the broader space was under selling pressure. The BSE Sensex fell more than 600 points from day’s high to end with 49 points loss at 55,769.23, and the Nifty50 shed 44 points to 16,584.

The Nifty Midcap 100 and Smallcap 100 indices have fallen 1.6 percent and 0.86 percent respectively. About two shares declined for every share rising on the NSE.

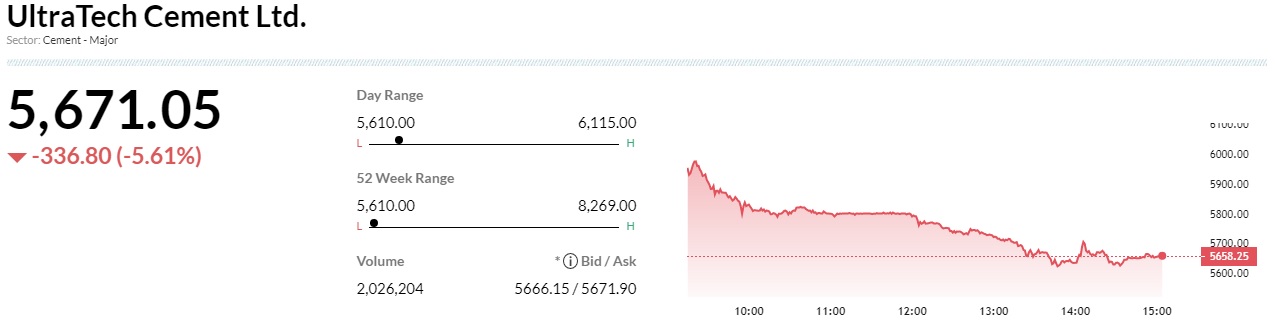

UltraTech Cement, Maruti Suzuki, NTPC, Bajaj Finserv, IndusInd Bank, and Axis Bank were top losers, whereas Reilance Industries extended gains on Friday as well, followed by Infosys, L&T, HCL Technologies and Sun Pharma.

Mobisafar Services Partners with Suryoday Small Finance Bank

Suryoday Small Finance bank, one of India’s leading small finance bank, today announced its partnership with Mobisafar to provide banking services through all Mobisafar’s franchisees and Business Correspondent networks across India. The partnership is aimed at strengthening financial inclusion by providing key banking services, digitally to the underbanked customers even at the remotest parts of the country, the small finance bank said in its release.

GST Council Agenda

CNBCTV18Exclusive | In the upcoming meet, GST Council is unlikely to correct inverted duty correction w.r.t. textiles. Also, Council may take up GoM’s report on onlinegaming, casinos & race courses.

#CNBCTV18Exclusive | In the upcoming meet, #GST Council is unlikely to correct inverted duty correction w.r.t. #textiles. Also, Council may take up GoM’s report on #onlinegaming, #casinos & race courses: Sources to @TimsyJaipuria #gstcouncil pic.twitter.com/fIdXzraVh4

— CNBC-TV18 (@CNBCTV18Live) June 3, 2022

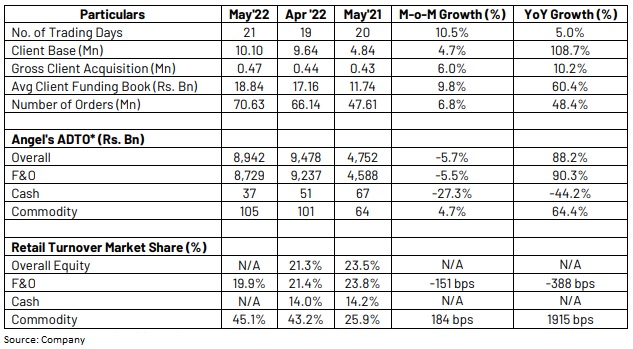

Angel One – Monthly Business Updates

Market Update

The benchmark indices turned lower in late trade, with the Nifty50 falling below 16,600 levels, pulled down by banking & financial services, auto, metal, FMCG and pharma stocks. The broader markets were also under pressure as the Nifty Midcap 100 index fell 1.7 percent and Smallcap 100 index declined nearly 1 percent.

UltraTech Cement Under Pressure Despite Capex AnnouncementThe cement major announced Rs 12,886 crore towards increasing capacity by 22.6 mtpa with a mix of brownfield and greenfield expansion. This would be achieved by setting-up integrated and grinding units as well as bulk terminals. The additional capacity will be created across the country. Commercial production from these new capacities is expected to go on stream in a phased manner, by FY25.

Commerce Minister Piyush Goyal on Wheat Export Ban

A committee is looking at demands from neighboring countries for #wheat, says Commerce Minister @PiyushGoyal pic.twitter.com/rO52XPWC8h

— CNBC-TV18 (@CNBCTV18Live) June 3, 2022

Markets Live with Santo & CJ | Will the chip shortage ever end? Plus, Wipro, Raymond, and ICRA in focus

#ICYMI Global semiconductor industry is facing fresh challenges. Know all about it at 3 PM LIVE. Also, get Santo & CJ’s takes on 5 stocks. Tune in to Moneycontrol Livestream

May Services PMI Review

India’s services PMI (seasonally adjusted) continued to improve, rising to 58.9 in May, the highest reading in 11 years. This suggest that the post-Omicron recovery in services activity remains solid and that concerns over higher input and transportation costs have had limited effects on activity so far. Indeed, services activity continues to outpace the recovery in manufacturing, which pushed the composite index in May to 58.3 , from 57.6 in April. Still, high inflation, tightening domestic financial conditions and risks to the global growth outlook could temper recovery in the coming months, Barclays said.