Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

CLSA on Reliance Industries post AGM

Broking house kept outperform rating with a target of Rs 2,250. The company exhibited hopes of closing the O2C stake sale with Aramco this year. The clarity on the new energy foray is useful. Any big take-up of new smartphones to be an important trigger, while progress in omni-channel retail will also be an important trigger.

Small & Midcap Mantra | A Stock With M-cap Of Less Than Rs 1,000 Crore Triples In 1 Year. Is It On Your Watch List?

So far this year, Sanghvi Movers has outperformed the benchmark index, advancing about 80 percent compared with an over 12 percent gain in the Nifty and a 37 percent increase in the BSE Smallcap Index

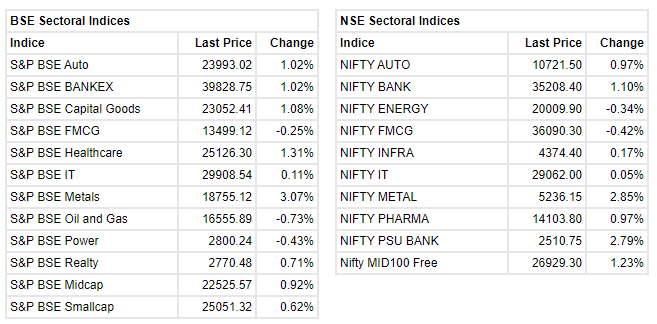

Market at 12 PMIndian benchmark indices were trading with marginal gains amid volatility with Nifty above 15800.The Sensex was up 80.04 points or 0.15% at 52779.04, and the Nifty was up 34.90 points or 0.22% at 15825.40. About 1632 shares have advanced, 1190 shares declined, and 106 shares are unchanged.Reliance Industries, HUL, Asian Paints, UPL and Titan Company were among major losers on the Nifty, while gainers included Tata Steel, JSW Steel, Hindalco, SBI and Axis Bank.

Dollar Updates:

The dollar drifted lower in Asia on Friday as an agreement on U.S. infrastructure spending underpinned appetite for riskier currencies, but caution ahead of key U.S. inflation data kept losses to a minimum.

Satia Industries bags order of Rs 700 million from Maharashtra govt

Satia Industries has been awarded an order worth Rs 700 million from Maharashtra state textbook bureau for supply of 7000 MT paper at a very good realization. The said order execution has already started and will be completed in Q2FY22, company said in the release.

Satia Industries was quoting at Rs 91.45, down Rs 1.40, or 1.51 percent on the BSE.

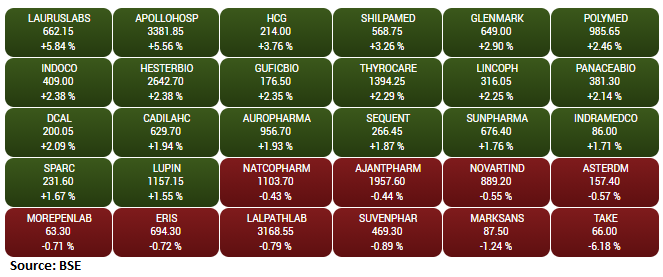

BSE Healthcare index added over 1 percent supported by the Laurus Labs, Apollo Hospitals, Thyrocare Technologies

Zydus Cadila receives tentative USFDA approval:

Zydus Cadila has received tentative approval from the USFDA to market Pemetrexed for Injection in the strengths of 100mg/vial, 500 mg/vial, and 1000 mg/vial, single-dose vials (US RLD: Alimta). Pemetrexed is used to treat certain types of cancers such as lung cancer, mesothelioma. It is a chemotherapy drug that works by slowing or stopping the growth of cancer cells, company said in the release.

At 11:24 hrs Cadila Healthcare was quoting at Rs 629.80, up Rs 12.10, or 1.96 percent on the BSE.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

During normal times markets would be subject to sharp corrections when valuations are high. Such corrections remove excesses and make markets healthy. Therefore, periodic corrections in a bull market are desirable. But corrections need not happen when they are desirable. Market springs surprises. This resilient bullish trend has surprised even the market gurus. So, investors should remain invested, particularly in quality large-caps which are attracting investment even at high valuations.

RIL’s big push for a transformational clean energy ecosystem that will “transform India from a major importer of fossil fuels to an exporter of clean energy” is a potential game-changing strategy. RIL’s vision to make clean energy a truly global business is good news not only for the planet but for shareholders too.

Rupee Updates:

Indian rupee is trading flat at 74.17 per dollar, amid volatility seen in the domestic equity market. It opened flat at 74.14 per dollar against Thursday’s close of 74.16.

Buzzing:

Ashok Leyland share price added 9 percent on June 25 after the company turned profitable in Q4FY21. The company posted standalone net profit at Rs 241.1 crore in the fourth quarter of FY21 against a loss of Rs 57.3 crore in the year-ago period.

Its standalone revenue was up 82 percent at Rs 7,000.5 crore versus Rs 3,838.5 crore in the year-ago quarter.

Earnings before interest, tax, depreciation and amortization (EBITDA) were at Rs 533.7 crore and the margin expanded to 7.6 percent from 4.7 percent (YoY)

Milan Desai, Lead Equity Analyst, Angel Broking

Ashok Leyland has reported a good set of numbers for Q4FY21. The top-tine grew by 82%/45% YoY/QoQ to Rs 7,000 crore against estimates of Rs 6,200 crore. EBITDA grew by 192%/110% YoY/QoQ to Rs 534 crore ahead of our estimate of Rs 380 crore and EBITDA margins expanded by 286bps/236bps YoY/QoQ despite negative RM pressures (up 581bps/248bps YoY/QoQ) owing to operating leverage benefits.

Adjusted PAT came in at Rs 213 crore against our estimate of Rs 115 crore. We maintain our positive view on the stock considering rebound in CV sales due to full opening up of the economy.