Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Gold Updates:

Gold slipped on Thursday as investors flocked to the safety of the dollar after an equity sell-off, while the U.S. Federal Reserve flagging concerns around the pace of the recovery in the world’s largest economy lent further support to the greenback.

Stove Kraft IPO subscribed 3.7 times:

The Rs 413-crore maiden public issue of Stove Kraft has been subscribed 3.7 times on January 28, the final day of bidding.

Investors have put in total bids for 2.17 crore equity shares against the IPO size of 58.94 lakh equity shares (excluding anchor book), the subscription data available on exchanges showed.

The portion set aside for qualified institutional buyers has seen a subscription of 47 percent, while the reserved portion of non-institutional investors has been subscribed 2.13 times, and that of retail investors, 15.7 times.

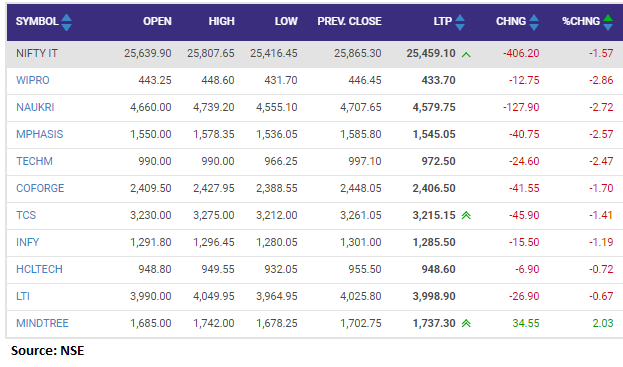

Nifty IT index shed 1 percent dragged by the Wipro, Info Edge, Mphasis:

Crude Updates: Oil slid in Asia morning trade on Thursday despite a huge drop in U.S. crude stock, as the strength in the U.S. dollar and fresh fuel demand worries due to travel curbs and delays with coronavirus vaccines weighed on prices.

ICICIdirect on United Spirits:

United Spirits reported a continued reduction in its overall debt by selling its non-core assets and improved its WC position. While in the short to medium term, uncertainty continues to remain over the evolving situation in the on-trade channels and pickup in the home consumption, the longer term growth aspiration and continued premiumisation trends remain key positives for the liquor sector.

USL continues to invest in increasing its brand strength and propel its Premium brands to higher share of its revenues (currently at 70%). We value the stock at ~39x FY23 EPS and revise our target price to Rs 710 (earlier target price Rs 650). We maintain our buy rating.

Rupee trades lower: Indian rupee has recovered some early losses but still trading 16 paise lower at 73.08 per dollar, amid selling seen in the domestic equity market. It opened 21 paise lower at 73.13 per dollar against previous close of 72.92.

These 12 Stocks Are On Sharekhan’s Radar For Up To 37% Upside

Titan Company, HCL Tech, HPCL and Repco Home Finance are among the stocks that the brokerage is bullish on.

Emami gains on post Q3 results:

Emami share price was trading higher after the company declared its Q3 results. Company on January 27 reported 44.67 percent rise in consolidated net profit at Rs 208.96 crore for December quarter 2020 helped by sales growth and cost control measures. The company had posted a profit after tax of Rs 144.44 crore for the year-ago period, Emami said in a regulatory filing.

Revenue from operations was up 14.89 percent at Rs 933.61 crore in the quarter under review as against Rs 812.64 crore in the same period a year ago.

Way2Wealth Research on Larsen & Toubro: During Q3FY21, the company recorded highest ever order inflow of Rs 73,200 crore, +76 percent YoY led by large order wins in infra and hydrocarbon segment in the domestic market. With labour availability at full strength in Q3FY21, we expect sustained execution pick-up and improved productivity in 2HFY21. Also timely payments from Central/State governments provide comfort on working capital front. The management is clear to give preference to cash over revenue and will prefer to execute projects with timely cash payments from customers.

We believe that L&T is well-placed to emerge stronger given its financial, technical and managerial capability to sustain and gain market share. Taking into account high ticket size order wins and improving economic growth, we continue to remain positive with fair value of Rs 1,550-1,600.

Budget 2021 | Govt Likely To Increase Allocation For Infra Projects; L&T, KNR Constructions, Sadbhav Engineering To Benefit

There are expectations that railways will get higher allocation as the COVID-19 pandemic dealt a severe blow to the sector’s revenue in the current financial year.

Nitin Aggarwal, CEO, Religare Broking: While there are lot of expectations that FY22 Union Budget will take number of measures to ensure that the post COVID rebound in Indian economy is robust and sustainable, there are also hopes for market focused announcements that will cheer the sentiment on the street.

Among the key expectations, investors will look forward to the abolition of long-term capital gains tax or redefining long-term to two years and reducing the taxation to nil, while further allow indexation benefits to equity mutual funds and some relief on dividend distribution tax in hands of investors.