Follow our LIVE blog for the latest updates on RBI Meeting

Follow our LIVE blog for the latest updates on LIC IPO Issue

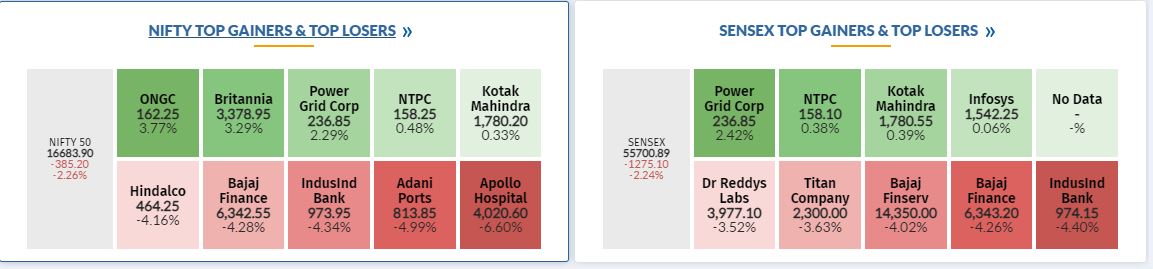

Today’s Stock Market Action

Market at 3 PMBenchmark indices extended the losses and trading near day’s low after RBI hiked repo rate and CRR rate.At 15:02 IST, the Sensex was down 1,267.22 points or 2.22% at 55708.77, and the Nifty was down 383.10 points or 2.24% at 16686. About 679 shares have advanced, 2487 shares declined, and 87 shares are unchanged.

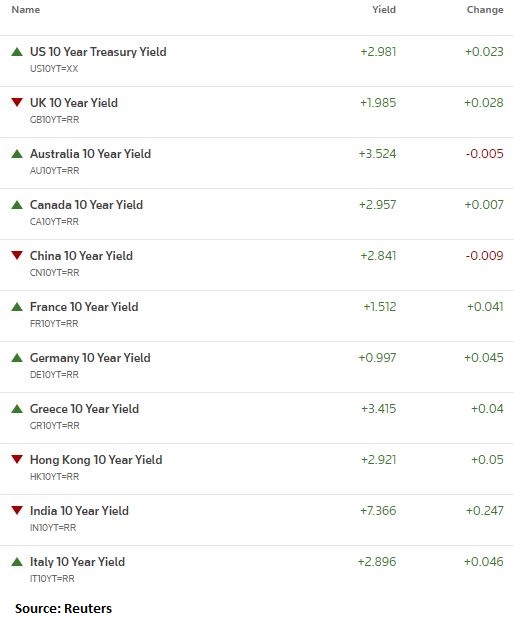

Bond Yields Update:

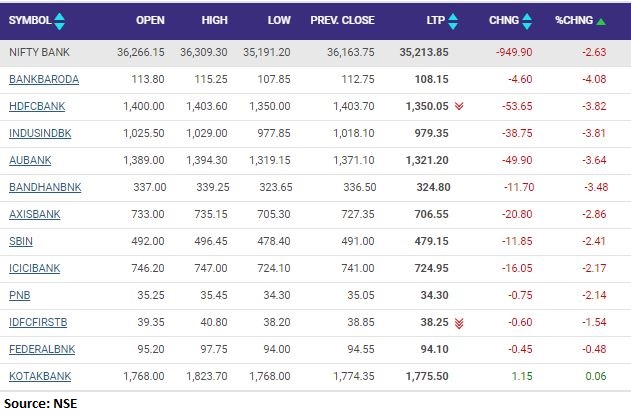

Nifty Bank index shed 2 percent dragged by the Bank of Baroda, HDFC Bank, IndusInd Bank

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The MPC’s decision, in an unscheduled meeting, to raise the repo rate by 40bp and CRR by 50 bp is a surprise since it came on the LIC IPO opening date.

MPC’s proactive move is justified from the perspective of inflation management, but the timing leaves a lot to be desired.

The above 1000 point crash in Sensex has soured the sentiments on the opening day of India’s largest IPO. The 10-year bond yield has spiked to above 7.39% indicating an imminent rise in the cost of funds.

RBI hikes repo rate by 40bps to 4.40%, CRR by 50bps, cites inflation worries

Reserve Bank of India (RBI) Governor Shaktikanta Das announced a 40-basis-point hike in the key lending rate and raised the cash reserve ratio by 50 basis points in an unscheduled announcement on May 4.

One basis point is one hundredth of a percentage point.

The revised repo rate stands at 4.40 percent and the CRR is increased to 4.5 percent. Click to Read More

RBI Governor Shaktikanta Das | Recent GDP releases suggest global economy is losing pace. By remaining accommodative, monetray policy continues to foster congenial financial conditions.

Binod Modi, Portfolio Manager – PMS, Sharekhan by BNP Paribas

Kotak Mahindra Bank (KMB) reported healthy performance on all counts. Sharp improvement in NIM at 4.78% was quite encouraging and was supported by lower funding cost and higher CASA proportion. Additionally, sustained decline in slippages (0.27% of advances) and higher recovering & upgrade aided asset quality with GNPA improving to 2.34% (vs. 2.71% in 3QFY22). Advances growth of 21% YoY to Rs2.71 trillion was quite encouraging. In our view, business momentum should continue with control on credit costs/ slippages and higher share of low cost deposits, though high opex could be a key headwind in the near to medium term perspective.

RBI withdraws its ‘accommodative’ stance

RBI is not to be bound by any rule book, said RBI Governor as it withdrew from its ‘accommodative’ stance, citing inflation pressures becoming more acute. He beleived that the Indian economy has managed to weather the economic shock while citing a quote that “The trials you encounter will introduce you to your strengths”.

LIC IPO Live Updates:

43% issue booked; policyholders portion subscribed 1.47 times, staff 75%, retail investors 46%